Member LoginDividend CushionValue Trap |

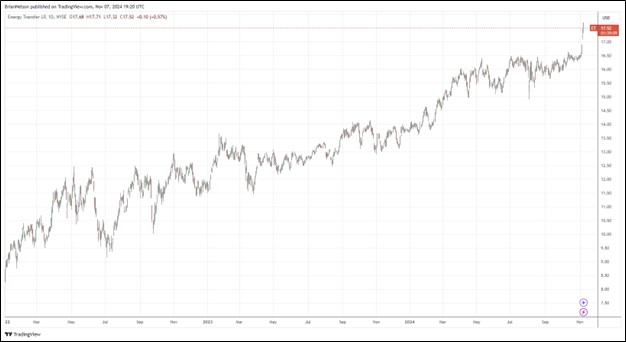

Energy Transfer Now Covers Distributions with Traditional Free Cash Flow

To gain access to the members only content, click here to subscribe. You will be given immediate access to premium content on the site.

|