Member LoginDividend CushionValue Trap |

Earnings Roundup: Chipotle, PayPal, Qualcomm

publication date: Feb 4, 2021

|

author/source: Callum Turcan

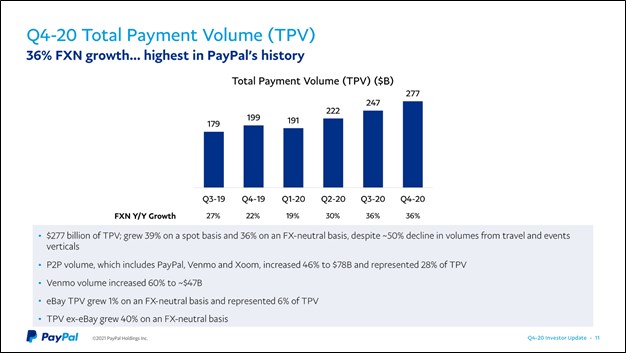

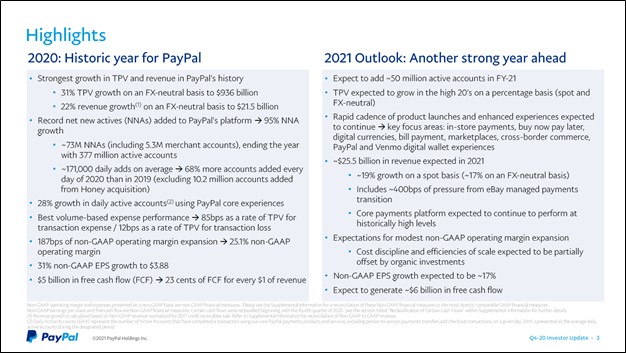

Image Shown: PayPal Holdings Inc, a top-weighted idea in our Best Ideas Newsletter portfolio, continued to grow at a brisk pace during the final quarter of 2020. Image Source: PayPal Holdings Inc – Fourth Quarter of 2020 IR Earnings Presentation By Callum Turcan In alphabetical order by ticker: CMG, PYPL, QCOM Several of the newsletter portfolio ideas recently reported earnings, and we are quite pleased with the performance that our favorite ideas have put up so far this earnings season (more on that here). Though the ongoing coronavirus (‘COVID-19’) pandemic created significant headwinds for the three companies we cover in this article, each firm remained incredibly free cash flow positive, highlighting the resilience of their business models. Looking ahead, the outlook for these companies is bright and getting brighter. Chipotle (CMG) We added Chipotle Mexican Grill Inc (CMG) to the Best Ideas Newsletter portfolio back on January 12 (link here) as we are big fans of its pristine balance sheet, quality cash flow profile, promising growth outlook and impressive omni-channel selling capabilities. Chipotle reported fourth-quarter earnings for 2020 on February 2 that beat consensus top-line estimates and beat consensus bottom-line estimates on a GAAP basis, though its non-GAAP bottom-line performance missed consensus estimates. On a GAAP basis, Chipotle’s revenues climbed higher by roughly 11% year-over-year in the fourth quarter, supported by its digital and delivery operations. Chipotle reported that its digital sales were up over 177% year-over-year last quarter and represented 49% of its total sales which enabled its comparable restaurant sales growth to clock in at 5.7% year-over-year during this period. Roughly half of Chipotle’s digital sales were fulfilled via delivery options which “benefit[ed] from [Chipotle’s] expanded partnerships” and the remainder were from Chipotle’s customers ordering ahead of time and showing up to a physical location. We appreciate Chipotle’s omni-channel sales capabilities and its strong digital presence. Chipotle’s delivery service revenue almost tripled year-over-year last quarter, keeping in mind this is revenue generated from delivery and service fees from orders conducted through its app and website. At the end of 2020, Chipotle had almost $1.1 billion in cash and cash-like assets on hand (inclusive of both short- and long-term investments) and no debt on the books, though Chipotle does have sizable operating lease liabilities to be aware of ($0.2 billion in current operating lease liabilities and $3.0 billion in long-term operating lease liabilities at the end of 2020). The firm generated $0.3 billion in free cash flow last year and spent less than $0.1 billion buying back its stock during this period; note Chipotle does not pay a common dividend at this time. Chipotle’s GAAP revenues advanced 7% year-over-year in 2020, though its GAAP operating income faced significant headwinds due to elevated expenses arising from the COVID-19 pandemic (the firm’s GAAP net income was still up year-over-year in 2020 due to a favorable tax provision). In the company’s latest earnings press release, management noted Chipotle’s comparable sales continued to trend in the right direction during the month of January 2021 (emphasis added): Comparable restaurant sales began to improve towards the end of December and this trend has continued with January comparable restaurant sales growing around 11%. Comparable restaurant sales in the last week of January were in the high single digits, with winter weather across the country contributing to the lower comp. Assuming the pandemic doesn't worsen, we expect first quarter 2021 comparable restaurant sales to be in the mid to high teens range given an easier comparison during the second half of March. The company’s near-term outlook is improving, and ongoing COVID-19 vaccine distribution efforts in the US (and elsewhere) should help keep things going in the right direction. However, we caution that serious short-term headwinds remain. Chipotle did not provide full-year sales or profit guidance for 2021 due primarily to headwinds created by the COVID-19 pandemic, though the burrito maker did note it plans to open 200 new restaurants this year (keeping potential delays in mind). In 2020, Chipotle opened 161 new restaurants (including six relocations) and closed nine, with 100 of those new restaurant locations having a “Chipotlane” which is a drive-thru option. Management noted in Chipotle’s earnings press release that part of the strength of the company’s digital operations comes from customers ordering ahead on Chiptole’s app and using the Chipotlane drive-thru, creating a seamless and convenient experience for the customer. At the end of 2020, Chipotle had 2,768 restaurant locations. We continue to like exposure to Chipotle in the Best Ideas Newsletter portfolio. The high end of our fair value estimate range for CMG sits at $1,531 per share, and when we roll forward our valuation model forward, we expect Chipotle’s fair value estimate to trend a bit higher given a more optimistic bent to our future forecasts. PayPal (PYPL) We are huge fans of PayPal Holdings Inc (PYPL) and include the payment processing giant as a top-weighted holding in the Best Ideas Newsletter portfolio. PayPal’s pristine balance sheet, stellar growth outlook and high-quality cash flow profile underpins why we view the firm’s capital appreciation upside favorably. On February 3, PayPal reported fourth quarter earnings for 2020 that beat both consensus top- and bottom-line estimates. Total payment volume (‘TPV’) grew 39% year-over-year and PayPal added 16.0 million net new active accounts last quarter, which helped enable the company to grow its GAAP revenues by 23% and its GAAP operating income 21% year-over-year (modest restructuring charges held down its GAAP operating income last quarter). PayPal has been a huge beneficiary of the proliferation of e-commerce and the rising number of digitally-enabled financial transactions. Its peer-to-peer money transfer app Venmo continued to post stellar performance as the app’s TPV was up 60% year-over-year in the final quarter of 2020 according to management commentary during PayPal’s latest earnings call (emphasis added): “Venmo continued its strong performance with Q4 TPV of $47 billion, up 60% year-over-year. Venmo’s customer base grew by 32% in 2020, ending just shy of 70 million active accounts. This continued momentum reinforces our conviction that [Venmo’s] revenues will approach $900 million in 2021. In early January, eligible customers were able to cash their stimulus checks within the Venmo app for the first time. Later this month, our Venmo credit card will be available to 100% of our base. And in the coming months, we will launch the ability to buy, hold and sell crypto via the Venmo app. And finally, our revamped Pay with Venmo experience will launch in Q2, offering a best-in-class checkout experience. Today’s digital reality is rapidly accelerating the need for a digital wallet that encompasses payments, financial services and shopping. This year, our digital wallet will change more than it has ever changed before, significantly increasing its functionality within a single, integrated and beautifully designed app that should meaningfully increase consumer engagement.” --- Dan Schulman, President and CEO of PayPal The company’s nascent Venmo monetization efforts underpin our optimistic view on PayPal’s long-term cash flow growth trajectory. PayPal recently launched a Venmo credit card that is powered by Visa Inc’s (V) payment network and issued by Synchrony Financial (SYF), and PayPal aims to expand that offering to its entire Venmo user base by the end of this month. Adding cryptocurrency transaction capabilities to Venmo will provide PayPal with another way to start generating meaningful revenue streams from this popular financial app. We are intrigued by the potential upside PayPal will be able to generate from its Venmo operations; as an aside, please note we include Visa in the Best Ideas Newsletter portfolio as a top-weighted holding and continue to be big fans of the payment network giant. At the start of 2020, PayPal completed its acquisition of Honey Science Corporation for ~$4 billion in cash. Honey’s operations are built around a browser extension that helps users save money when shopping online and Honey also has its own loyalty program. When PayPal acquired Honey, the service had ~17 million monthly active users and since then PayPal has done a solid job building Honey’s active user base. During PayPal’s latest earnings call, management noted that the firm “intend[s] to fully integrate the entire suite of Honey’s shopping tools, including wish lists, price monitoring, deals, coupons and rewards for use in the physical and digital worlds.” At the end of 2020, PayPal had $13.1 billion in cash, cash equivalents and short-term investments on hand stacked up against no short-term debt on the books and $8.9 billion in long-term debt. Furthermore, PayPal had $6.1 billion in long-term investments on the books at the end of last year. However, a portion of that line item is represented by strategic investments and a portion is represented by cash-like assets (such as available-for-sale debt securities). Even when not considering its long-term investments, PayPal’s balance sheet is pristine. PayPal generated $5.0 billion in free cash flow last year (up from $3.4 billion in 2019) while spending $1.6 billion buying back its stock. Looking ahead, management issued favorable full-year guidance that indicates PayPal’s growth trajectory is expected to continue this year. Annual revenue growth is estimated to come in at ~19% (~17% on a constant currency basis) while its non-GAAP EPS annual growth is forecasted in come in at ~17%. More importantly, PayPal forecasts it will generate $6.0 billion in free cash flow this year, as one can see in the upcoming graphic down below.

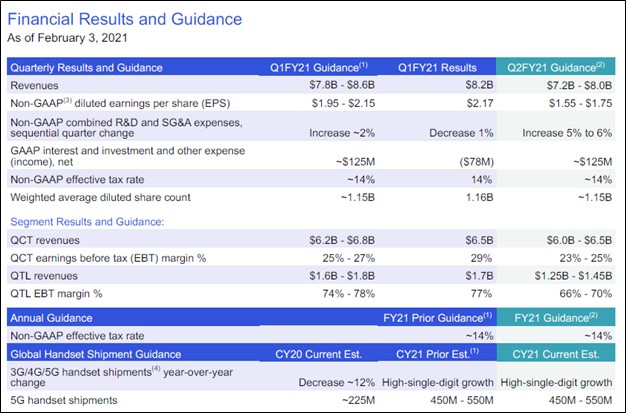

Image Shown: An overview of PayPal’s impressive financial and operational performance in 2020. According to the firm’s guidance for 2021, management expects PayPal will maintain its stellar growth trajectory going forward. Image Source: PayPal – Fourth Quarter of 2020 IR Earnings Presentation As of this writing, shares of PYPL are trading above the top end of our fair value estimate range after soaring higher on the back of its latest earnings report. We are huge fans of the company and continue to like exposure to PayPal in the Best Ideas Newsletter portfolio. Please note that we expect to increase our fair value estimate for PayPal when we roll forward its valuation model for the new year. Qualcomm (QCOM) On February 3, Qualcomm Inc (QCOM) reported first quarter earnings for fiscal 2021 (period ended December 27, 2020) that missed consensus top-line estimates but beat consensus bottom-line estimates. We include Qualcomm in the Dividend Growth Newsletter portfolio and are big fans of its stellar cash flow profile, relatively strong balance sheet, promising dividend growth trajectory and impressive growth outlook. Qualcomm’s GAAP revenues and GAAP earnings before taxes were up 62% and 175% year-over-year, respectively, last fiscal quarter due in large part to strong demand for 5G smartphones and the equipment that supports 5G wireless networks. Additionally, Qualcomm’s automotive and Internet of Things (‘IoT’) offerings sold well last fiscal quarter and its high-margin licensing business continued to grow at a nice clip. Here is what management had to say regarding the company’s 5G adoption outlook during Qualcomm’s latest earnings call (emphasis added): “Turning to 5G adoption, we estimate approximately 225 million 5G handsets in calendar 2020 and forecast 450 million to 550 million units in calendar 2021. We are extremely pleased by the adoption of our 5G chipsets across OEM partners with over 800 designs using 5G modem and RF Solutions. Our recently announced 5G premium tier mobile platform, the Snapdragon 888 already has over 120 design wins. We now have 5G offerings across several tiers, from our premium tier Snapdragon 888 to our recently-announced Snapdragon 480, all capable of supporting millimeter-wave. For global 3G, 4G, 5G handsets, we estimate that shipments declined 12% on a year-over-year basis in calendar 2020. In calendar 2021, we expect total handsets to grow in high single-digits year-over-year. This assumes an impact from COVID in the first half, consistent with the exit rate of 2020 and a recovery in the second half.” --- Akash Palkhiwala, CFO of Qualcomm Qualcomm’s management team also noted that the fiscal first quarter marked the first time Qualcomm’s IoT business posted a $1.0+ billion quarter (in terms of sales) with demand supported by the growing digitization of consumer, industrial and networking applications. Additionally, management had this to say regarding Qualcomm’s guidance for the fiscal second quarter during its latest earnings call: “Turning to our second quarter guidance, we are forecasting revenues of $7.2 billion to $8 billion and non-GAAP EPS of $1.55 to $1.75, a year-over-year increase of 46% and 88%, respectively at the midpoints.” --- CFO of Qualcomm We appreciate Qualcomm’s optimistic near-term outlook. Management stressed that semiconductor demand was outstripping supply during the earnings call, a situation Qualcomm thinks will resolve itself by the second half of the year. Please note Qualcomm primarily uses contract manufacturing services to produce most of the “chips” that it designs, though the company primarily utilizes its own manufacturing facilities to produce its RF front-end (‘RFFE’) modules and RF filter products. Qualcomm views itself as being in a prime position to gain market share in premium categories, particularly as it concerns semiconductor components for smartphones, with management expecting the firm to realize market share gains on this front in fiscal 2021.

Image Shown: An overview of Qualcomm’s near-term outlook and recent historical performance. Image Source: Qualcomm – First Quarter of Fiscal 2021 Financial Results and Guidance IR Presentation Qualcomm generated $2.7 billion in free cash flow while spending $0.7 billion covering its dividend obligations and $0.4 billion buying back its stock last fiscal quarter. As of December 27, Qualcomm had a net debt position of $3.4 billion (inclusive of current marketable securities and short-term debt), which we view as quite manageable given its stellar cash flow profile and ample liquidity on hand. As of this writing, shares of QCOM are trading below our fair value estimate of $164 per share and yield ~1.8%. We continue to like exposure to Qualcomm in the Dividend Growth Newsletter portfolio. On a final note, Qualcomm’s current CEO Steve Mollenkopf plans to step down this upcoming June and will be replaced with by Qualcomm’s current President, Cristiano Amon. We wish them the best in their endeavors. Concluding Thoughts The outlook for Chipotle, PayPal and Qualcomm is bright and getting brighter. All three of these companies have stellar free cash flow generating abilities, strong balance sheets, and promising growth outlooks. We continue to like exposure to these high-quality names in our newsletter portfolios. ----- Related: CMG, PYPL, QCOM, SYF, V ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Chipotle Mexican Grill Inc (CMG), PayPal Holdings Inc (PYPL), and Visa Inc (V) are all included in Valuentum’s simulated Best Ideas Newsletter portfolio. Qualcomm Inc (QCOM) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment