Member LoginDividend CushionValue Trap |

Dow Jones Surges Past 27,000; Bull Market Continues!

publication date: Jun 5, 2020

|

author/source: Brian Nelson, CFA

Dow Jones Surges Past 27,000; Bull Market Continues!

---

By Brian Nelson, CFA

---

Hi everyone!

---

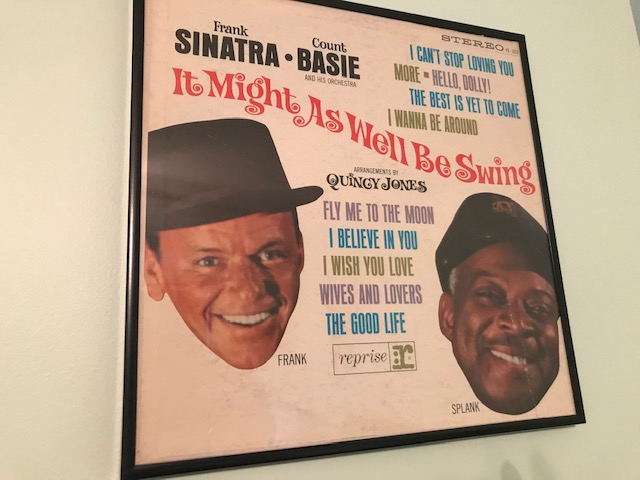

What a bull market off the lows we are having. I don't think we're finished, as I have pounded the table time and time and time again about how bullish I am. In the words of Frank Sinatra, "The Best Is Yet to Come," and I truly believe that. Yesterday, I explained to readers why we're seeing this huge rally, "Stay Optimistic. Stay Bullish. I Am."

---

If you understand the duration and composition of equity value (page 74-83 in Value Trap), you can start focusing on what drives share prices and returns. How else could a market rally this much with 13% unemployment, right? How wonderful it would be if everyone understood the duration of stock value composition! What would happen to ambiguous, backward-looking factor investing? Finance could then start talking about things that make sense again.

---

You know we came off one of our best years in the Best Ideas Newsletter portfolio in 2019, you know we called the top and Great Crash of 2020, "Is a Stock Market Crash Coming" in February with highlighting put option candidates here (Feb 24) and here (March 6), which were subsequently closed. You know we called "the bottom" in dollar cost averaging, March 23, you know we highlighted outperforming ideas amid this crisis (17 of 20 outperformed!), and you know we've been pounding the table on this bull market, with expectations of an unprecedented blow-off top!

---

Not only this, but 3 of the first 4 option ideas in a new options commentary have "worked out." Further, we have success rates in the Exclusive that are simply through the roof. Through March 2020, we've put up success rates in the Exclusive of 84%+ and 95%+ for capital appreciation and short-idea considerations. This is simply incredible. We have also held the line nicely with the High Yield Dividend Newsletter portfolio, not overreacting when the bottom looked like it was going to fall out. Our team has done a lot right.

---

Today, I wanted to ask you for two things:

---

1) We'll be releasing a survey next week. I need your participation please. It will cover a new business we are considering. You know how much we put investors' interests first, "Video: A Call for More Policy Action in a Post COVID-19 World," and in such spirit, we seek to move forward.

---

2) Let's get to 40 reviews on Value Trap! On Amazon, you can talk about how we called the crash in the quant 'value' factor during the first quarter (how enterprise valuation saved you from the crisis), how we called the unprecedented levels of volatility as a result of price-agnostic trading (a key theme of the text), you can talk about how we called the collapse in airline stocks (despite Warren Buffett's views), or anything else. But please -- get out there and talk about us!

---

With all that said, thank you for your membership, and don't forget to renew your membership to the Exclusive! The next edition will be released June 6. Thank you!

---

Kind regards,

---

Brian Nelson, CFA

President, Investment Research

Valuentum Securities, Inc.

brian@valuentum.com

---

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

---

Brian Nelson owns shares in SPY and SCHG. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment