Member LoginDividend CushionValue Trap |

Digital Realty Trust is Holding Up Quite Well

publication date: May 14, 2020

|

author/source: Callum Turcan

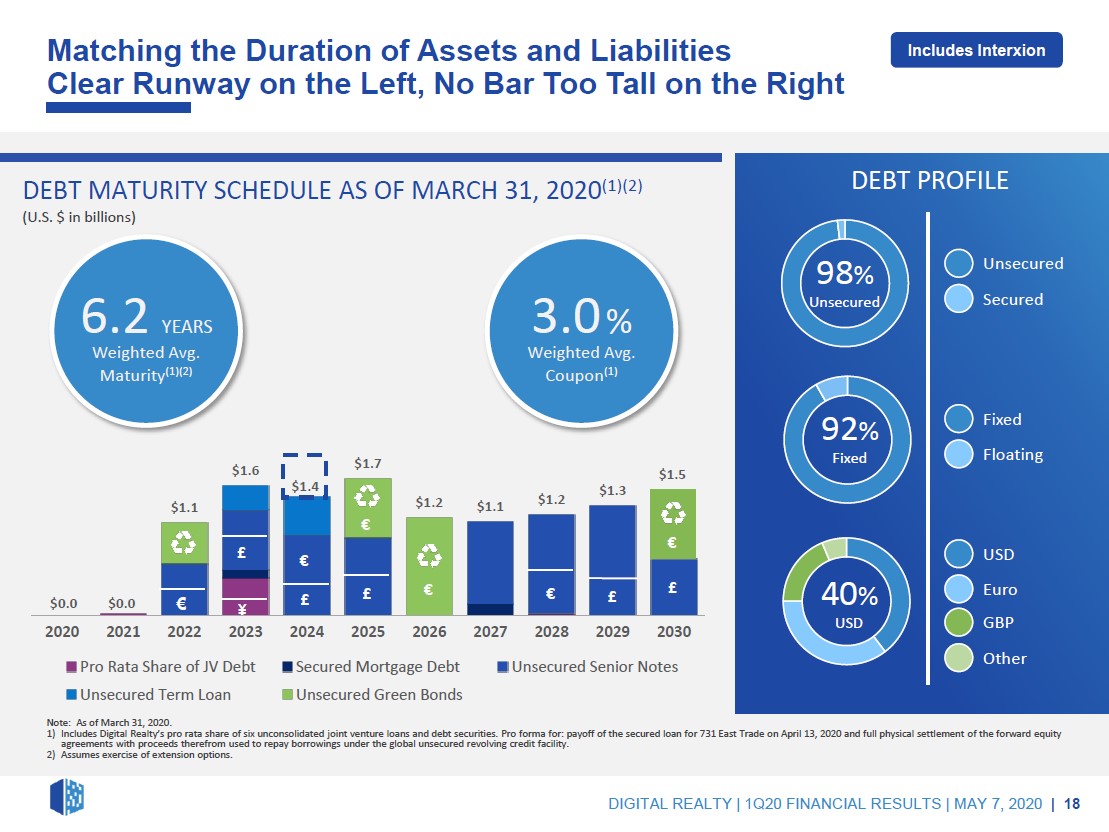

Image Shown: Shares of Digital Realty Trust Inc, a holding in both our Dividend Growth Newsletter and High Yield Dividend Newsletter portfolios, have outperformed the S&P 500 (SPY) by a wide margin over the past year and that’s before taking dividend considerations into account. By Callum Turcan On May 7, the data center real estate investment trust (‘REIT’) Digital Realty Trust Inc (DLR) reported first-quarter 2020 earnings. Though the firm’s near-term guidance disappointed investors, management communicated that the medium- and long-term trajectory of Digital Realty’s financial and operational performance remained strong. Furthermore, its liquidity position and its dividend coverage continued to be rock-solid, particularly after factoring in the data center REIT’s ongoing access to equity markets and lack of near-term debt maturities. Data centers are generally considered “essential” activities around the world given we live in the digital age and these assets have continued to operate during the pandemic. Shares of DLR yield ~3.4% on a forward-looking basis as of this writing. Outlook and Dividend Payout Strength Digital Realty expects to generate $5.90-$6.10 per share in core funds from operations (‘core FFO’) in 2020, and after taking foreign currency translation adjustments into account, that goes up to $5.95-$6.25 per share on a constant-currency basis. In 2019, Digital Realty generated $6.65 per share in core FFO, meaning that its financial performance is coming under fire from a few factors including 1) elevated lease expiration activity that saw Digital Realty’s cash rental rates shift lower last year (with that effect carried on into 2020), 2) the expiration of “vintage” lease agreements, and 3) pressures from the ongoing coronavirus (‘COVID-19’) pandemic. Management expects that the new rental rates on lease renewals this year will be down by low single-digits on a cash basis (and flat on a GAAP basis) as many of these are renewals covering vintage lease agreements that were signed at arguably premium rates several years ago. Stay-at-home orders have negatively impacted construction activity (Digital Realty’s construction activities have also been negatively impacted to varying degrees) which could lead to supply constraints. Going forward, management also mentioned (during the firm’s latest quarterly conference call) that “(it) expect(s) to see continued gradual improvement on cash re-leasing spreads into 2020 and beyond” as Digital Realty cycles through its vintage lease renewals--and the uplift from rising data center demand and constraints on supply growth due to barriers to entry (eventually) kick in. While many market participants were expecting that rising data center demand would result in a more favorable outlook for Digital Realty (particularly as it concerns the near-term trajectory of cash rental rates), management noted that “(it has) yet to see broad-based rental rate growth across most markets” other than in “a few select supplies constrained regions and metro areas,” which indicates that the pandemic must be making rent increases a trickier task than expected (and that’s coming on top of the headwinds created by vintage leases expiring). All things considered, demand for data centers remains very strong, and that supports Digital Realty’s expected cash flow generation this year (even if those cash flows are now expected to come in slightly below previous consensus expectations). As many households are forced indoors due to stay-at-home orders and the “cocooning” of households (as the world waits for a COVID-19 vaccine to get discovered and mass produced), Digital Realty’s asset base remains an integral part of the global economy as we get deeper into the digital era. Things are not looking dire at Digital Realty, far from it, as the REIT continues to possess solid dividend coverage and a nice liquidity position (which we’ll cover in the next section in this article). On a core FFO payout basis, at the midpoint of Digital Realty’s 2020 guidance, its payout ratio is expected to be ~75% this year (derived from Digital Realty’s annualized dividend payout of $4.48 per share divided by expected core FFO of $6.00 in 2020). Digital Realty’s adjusted (to take into account its access to equity markets) Dividend Cushion ratio of 2.9 provides for solid support during these harrowing times. Please note that as a capital-market dependent entity, Digital Realty needs to retain access at all times to debt and equity markets to raise funds (ideally at attractive rates) to have the cash on hand to meet its growth ambitions and dividend obligations (that appears to be the case, which we’ll cover later on in this article). Digital Realty generated negative free cash flows during the first quarter of 2020, and historically, the data center REIT has not generated meaningful positive free cash flows as the firm is investing heavily in growing its asset base. While same-store cash net operating income (‘NOI’) is expected to shift lower by 2.5%-3.5% this year, Digital Realty’s payout coverage remains rock-solid. As the global economy eventually emerges from the pandemic-induced lockdown and related economic recession, Digital Realty should be on much stronger operational footing as headwinds fade and tailwinds emerge (in part due to expected future supply constraints and in part due to Digital Realty growing its presence in key metropolitan hubs where supply constraints already exist). Recent and Expected Financing Maneuvers In January 2020, Digital Realty issued "€1.7 billion of Euro-denominated notes with a weighted-average maturity of approximately seven years and a weighted-average coupon of approximately 1.0%” with a large portion of those proceeds used to retire “€1.2 billion of Interxion's outstanding senior notes” which was taken on after Digital Realty acquired Interxion in March 2020. Interxion had a meaningful data center presence in mainland Europe, which now complements Digital Realty’s existing data center presence in the UK and Ireland. That deal included Digital Realty issuing our 54 million shares of DLR to acquire Interxion’s outstanding shares last quarter. Digital Realty raised $37 million through modest at-the-market (‘ATM’) equity offerings in the first quarter, and subsequent to quarter-end, raised an additional $615 million through ATM equity offerings. Additionally, the data center REIT has a forward equity sale agreement that should raise $1.1 billion in cash when the deal matures in September 2020 (that’s expected to net Digital Realty $1.0 billion after closing adjustments and fees when the deal matures according to its 10-Q filing). Furthermore, in May 2020, Digital Realty filed a prospectus that noted it may issue up to $1.0 billion in additional equity. It’s clear Digital Realty retains access to equity markets at attractive rates given the strength of shares of DLR over the past year. As it relates to debt issuance, the January 2020 Eurobond sale highlights that Digital Realty likely continues to possess access to debt markets at attractive rates as well. The data center REIT agreed to acquire a 49% ownership interest in the Westin Building Exchange (a major interconnected hub) in Seattle, Washington, in February 2020, and that deal is expected to close during the first half of 2020. Pro forma for recent acquisitions or expected acquisitions (the Interxion acquisition and the pending acquisition of a stake in the Westin Building), and recent and expected financing transactions (particularly the forward offering and the completed ATM equity issuance), Digital Realty exited the first quarter of 2020 with a net debt to adjusted EBITDA ratio of 5.1x. Please note that doesn’t include the potential proceeds Digital Realty would raise through the recently filed prospectus. Pivoting now to the data center REIT’s liquidity position, Digital Realty’s management team had this to say during the firm’s latest quarterly conference call (emphasis added): “Pro forma for a full quarter contribution from Interxion and the Westin Building, the equity issuance activity on the ATM after quarter end and settlement of the $1.1 billion forward equity offering, net debt to adjusted EBITDA remains in line with our targeted range at just over five times, while fixed charge coverage is just under five times. As a result of our proactive balance sheet management, we have ample liquidity to fund our capital spending with nearly $250 million of cash on the balance sheet as of March 31, another $1.7 billion of equity coming in post quarter end and $2 billion of availability on our global revolving credit facilities. The successful execution against our financing strategy reflects the strength of our global platform, which provides access to the full menu of public as well as private capital, sets us apart from our peers and enables us to prudently fund our growth.” --- Andrew Power, CFO of Digital Realty Digital Realty’s global revolving credit facilities mature in January 2023, providing the firm with ample access to liquidity during these challenging times (that maturity date could get extended as the facilities carry two six-month extensions). As one can see in the upcoming graphic down below, Digital Realty does not have a meaningful amount of debt coming due until 2022, and we appreciate the balanced nature of its debt maturity schedule.

Image Shown: Digital Realty does not have a meaningful amount of debt coming due until 2022, supporting its medium-term outlook. Image Source: Digital Realty – First Quarter of 2020 Earnings IR Presentation On a final note, Digital Realty’s management team mentioned that “(it is) obviously going after the enterprise customer in hybrid multi-cloud environments” in light of the pending Westin Building deal and the acquisition of Interxion. These deals are building up a rental base that come with “15-year steady Eddie bump contracts” that should allow Digital Realty to slowly but steadily grow its organic rental revenues over time. While its financials may be lumpy in 2020, the firm’s long-term growth outlook remains promising. Concluding Thoughts We continue to like Digital Realty as a holding in both our Dividend Growth Newsletter and High Yield Dividend Newsletter portfolios given its strong dividend coverage and quality access to capital markets (which lends support to its dividend coverage). The data center REIT continues to generate meaningful cash flows during the pandemic, and we like Digital Realty’s long-term outlook. ----- Retail REIT Industry – CONE DLR FRT O REG SPG WPC Related: VNQ, SCHH, SRVR, SPY, RTL, NETL Other: COR, EQIX, PLD ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Realty Income Corporation (O) and Digital Realty Trust Inc (DLR) are both included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Real Estate ETF (VNQ) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. Digital Realty Trust and Vanguard Real Estate ETF are also both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment