Member LoginDividend CushionValue Trap |

Darden Restaurants Adapts to Survive

publication date: Jun 26, 2020

|

author/source: Callum Turcan

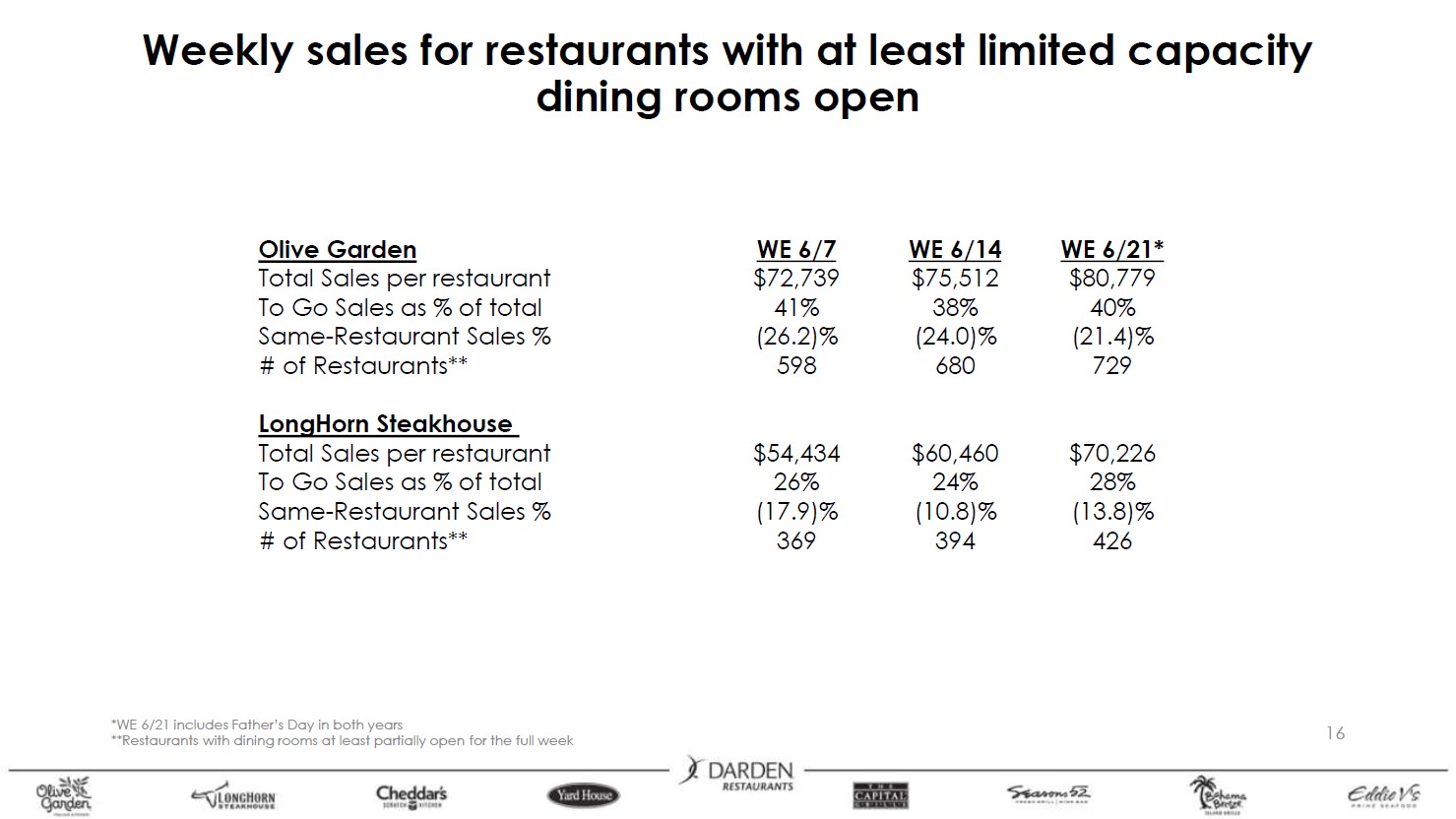

Image Source: Darden Restaurants Inc – Fourth Quarter Fiscal 2020 IR Earnings Presentation By Callum Turcan On June 25, the owner of the Olive Garden, LongHorn Steakhouse, and Cheddar’s Scratch Kitchen restaurant chain brands Darden Restaurants Inc (DRI) reported fourth quarter fiscal 2020 earnings (period ended May 31, 2020) that matched consensus top-lines estimates and beat consensus bottom-line estimates. Please note the fourth quarter of fiscal 2020 included an extra week versus the same period the previous fiscal year. Darden Restaurants saw its GAAP revenues drop by 43% year-over-year which led to the firm generating a large GAAP net loss of $0.5 billion last fiscal quarter as the ongoing coronavirus (‘COVID-19’) took its toll on the company’s operations. Background As of the end of Darden Restaurants’ fiscal 2019 (period ended May 26, 2019), roughly 96% of the total restaurant locations operating under one of Darden Restaurants’ brands were owned and operated by the company. Those locations were all in the US and Canada. Darden Restaurants also has a small franchise business as well (70 franchised locations as of the end of fiscal 2019), with roughly half of those restaurants located in the Middle East and Latin America as of May 2019. Operational Update Stay-at-home orders to contain the pandemic led to Darden Restaurants’ same-restaurant sales dropping by 47.7% year-over-year last fiscal quarter. This forced the restaurant chain operator to lean heavily on less conventional delivery options (such as curbside delivery pickup and for larger orders, home delivery options). While the firm’s Olive Garden chain held up better than the rest of its portfolio during this period, same-restaurant sales at the brand were still down 39.2% year-over-year. Darden Restaurants pivoted towards online sales to better position itself to ride out the pandemic. The company was able to create “contactless curbside pickup” options by “designing what was essentially a drive through in our parking lots.” Here is a lightly edited excerpt of what the firm’s management had to say on those efforts during Darden Restaurants’ latest quarterly conference call: “During this time, we have strengthened our digital platform and made meaningful progress [on] our digital strategy… our strategy is focused on using technology to help our guest easily order outside and inside the restaurant, improve the wait to be seated, streamline the order pickup process, and speed up how they pay… During the quarter, online ordering at all of Darden grew by more than 300% over the prior year... And at LongHorn, online ordering grew by 400%... Additionally, we accelerated our timeline and rolled out online ordering at our brands that had not yet deployed it. We also added the ability to order alcohol online for all of our brands and markets where that was allowed… Each one of our brands did a phenomenal job delivering a new guest experience… contactless curbside pickup… enabling our guests to order and pay online, and have our team members seamlessly place their sealed orders in their vehicles.” --- Gene Lee, COO of Darden Restaurants The company noted that the sales trajectory at both its Olive Garden and LongHorn Steakhouse brands had improved materially throughout the month of June (relatively speaking, as same-restaurant sales were still down year-over-year, just down significantly less than in the fourth quarter of fiscal 2020) as containment efforts were eased in Canada and numerous US states. In the upcoming graphic down below, Darden Restaurants highlights how its sales trajectory has improved in recent weeks.

Image Shown: Things are starting to improve at Darden Restaurants’ core brands, particularly the trajectory of those brand’s sale-restaurant sales. Image Source: Darden Restaurants Inc – Fourth Quarter Fiscal 2020 IR Earnings Presentation Financial Update Darden Restaurants suspended its common dividend and share buyback programs as the pandemic spread across North America, with the dividend suspension announced back in March 2020.The company issued equity, drew down its revolver credit facility, and took out a term loan in recent months to bolster its liquidity position in the face of the pandemic. Here’s some key commentary from management during Darden Restaurants’ latest quarterly conference call: “During the quarter we suspended the dividend and share repurchases, fully drew down our $750 million credit facility, took out a $270 million term loan and raised over $500 million in a follow on equity offering. All these efforts, and the strong loyalty of our guests resulted in us tripling our prior To Go sales run rate averages [To Go includes the company’s online ordering and curbside delivery pickup system), and materially reducing our cash burn as we disclosed to you through our periodic business updates. Given the confidence in our cash flow trends and the ability to access it in the future, we fully repaid our credit facility in early May.” --- Rick Cardenas, CFO of Darden Restaurants Management did not provide full-year guidance for Darden Restaurants’ fiscal 2021, but the firm did provide guidance for the fiscal first quarter. Shares of DRI jumped higher during the regular trading session on June 25 as Darden Restaurants’ outlook looked less dire than feared. Please note shares of DRI are still down by over 30% year-to-date as of this writing. Here’s what management had to say about Darden Restaurants’ near-term outlook during the firm’s latest quarterly conference call (emphasis added): “While it is our normal practice to provide an annual financial outlook, due to the uncertainty in business performance moving forward, we are only providing an outlook for the [fiscal] first quarter. We expect to achieve approximately 70% of prior year sales levels, total EBITDA of at least $75 million and diluted net earnings per share of greater than or equal to zero on a diluted share base of 131 million shares.” --- CFO of Darden Restaurants Darden Restaurants appears to be communicating to investors that the worst is behind it and that the firm expects to be profitable this fiscal quarter as its sales appear set to recover on a sequential basis. The company’s liquidity position, aided immensely by its recent equity raise, provides Darden Restaurants with the ability to navigate its way out of the storm (further aided by the suspension of its dividend). At the end of the fiscal first quarter, Darden Restaurants had $0.8 billion in cash and cash equivalents on hand versus $0.3 billion in short-term debt and $0.9 billion in long-term debt. While the firm has a net debt load, that burden appears manageable all things considered. Furthermore, the company noted in its earnings press release that “based on week ending June 21 results, the Company is generating positive operating cash flow” which could allow for Darden Restaurants to start generating meaningful free cash flows again in the not-so-distant future. The company appears to have generated negative net operating cash flow in the fiscal fourth quarter as its total net operating cash flow for fiscal 2020 shifted lower from the end of the fiscal third quarter (period ended February 23, 2020) to the fourth. Going forward, Darden Restaurants expects to allocate $250 million - $350 million towards capital expenditures in fiscal 2021 (versus $460 million in capital expenditures in fiscal 2020). Those funds will be used in part to open 35 – 40 net new restaurants this fiscal year. The undrawn capacity on Darden Restaurants $0.75 billion revolving credit line that matures in October 2022 provides the firm with additional access to liquidity, which management noted was fully paid off in early-May 2020 (we will know more after the company files its 10-K SEC filing covering fiscal 2020). Concluding Thoughts Darden Restaurants’ outlook is improving as plenty of North American households are apparently taking advantage of company’s curbside delivery pickup options. Additionally, the widespread easing of pandemic containment efforts will likely see restaurant sales improve materially in North America over the coming months. While we caution that the risks posed by a second wave of COVID-19 infections remain very real, Darden Restaurants’ seems to have adapted to the “new normal” well enough to ride out the storm after making some tough adjustments. ----- Restaurants - Fast Food & Coffee/Snack: ARCO, DPZ, DNKN, JACK, MCD, PZZA, SBUX, WEN, YUM Related: SPY ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment