Member LoginDividend CushionValue Trap |

Cigna Is An Intriguing Health Care Idea

publication date: Mar 18, 2021

|

author/source: Callum Turcan

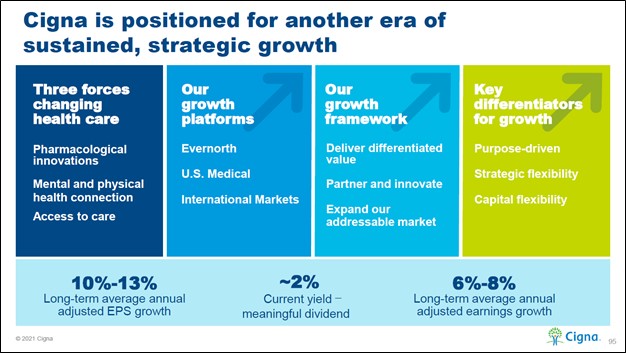

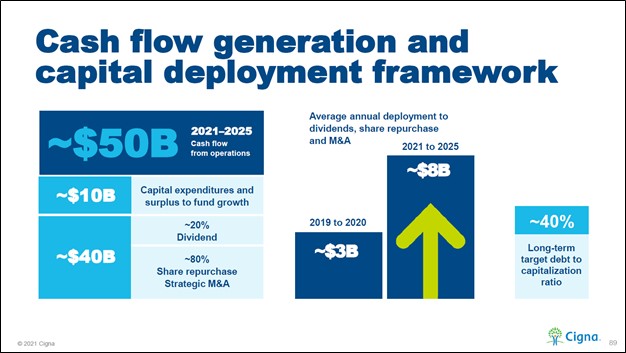

Image Source: Cigna Corporation –2021 Investor Day Presentation Executive Summary: Health care giant Cigna Corporation has a stellar cash flow profile, pristine balance sheet, promising growth outlook, and remains committed to rewarding shareholders. The company initiated a quarterly dividend at the start of 2021 and intends to continue buying back a sizable amount of its stock going forward. Management recently issued favorable guidance that indicates Cigna’s growth story is expected to continue this year as the world emerges from the COVID-19 pandemic. Cigna’s telehealth ambitions are quite intriguing as well. Recent updates at Cigna have placed the health care company on our radar. By Callum Turcan Cigna Corporation (CI) offers various health care products and services including health insurance plans, behavioral and mental health solutions, home delivery pharmacy services, group disability and life insurance plans, pharmacy benefit management (‘PBM’) services, specialty pharmacy services, vision and dental insurance plans, and more. In December 2018, Cigna completed its ~$67 billion cash-and-stock acquisition of Express Scripts which significant grew its exposure to the pharmacy, specialty pharmacy and PBM space. Cigna places a great emphasis on working with employers such as small- and medium-sized businesses, corporates, and federal government agencies to provide health care products and services to a larger group of people. The firm also offers individual and family health insurance plans. Recent updates from Cigna have caught our attention, especially the news that the company was initiating a common dividend (announced January 2021). Cigna’s financials are stellar (pristine balance sheet, strong free cash flow generating abilities) and its growth outlook is quite bright. The health care giant is now on our radar. Overview In the third quarter of 2020, Cigna rebranded some of its operations as ‘Evernorth’ which houses its Express Scripts, eviCore and Accredo operations (Evernorth provides benefit management, pharmacy and specialty pharmacy services). The company’s other major business operating segment, ‘U.S. Medical,’ provides health insurance products to enterprises and individuals. Last year, these two business operating segments generated close to $155 billion in revenue (~96% of its GAAP revenues) and over $9 billion in adjusted pre-tax segment-level operating income (~88% of its non-GAAP pre-tax adjusted income from operations before including expenses at its ‘corporate’ segment) and represent the backbone of Cigna’s business model. According to its 2020 Annual Report, Cigna noted that its “revenues from U.S. Federal Government agencies, under a number of contracts, represent[ed] 15% of our consolidated revenues in 2020.” Please note that Cigna is heavily exposed to the nature of the US health care landscape on multiple levels. At the end of 2020, Cigna had almost 176 million ‘customer relationships’ including pharmacy customers, health insurance customers, behavior care plan customers, dental insurance customers, Medicare Part D plan customers, overseas customers, and customers of its other offerings. While most of Cigna’s business is in the US, it does have a sizable international business (particularly in South Korea) that offers comprehensive and supplemental health, life, and accident insurance plans. Cigna’s data and analytics operations aim to improve the quality and delivery of health care products and services for its customers while seeking to discover efficiency gains. That was part of the justification for its acquisition of Express Scripts (Cigna noted that the combination would allow it to save money for its customers). Another core part of Cigna’s business involves its vast health care network that is built upon a serious of relationships and arrangements with primary care groups, pharmacies, hospital systems, specialist groups, and other health care entities. Financial Overview Cigna’s financial performance held up quite well in the face of the COVID-19 pandemic, all things considered. In 2020, Cigna grew its GAAP revenues 4% year-over-year on the back of single-digit annual sales growth seen at both its ‘pharmacy revenues’ and ‘premiums’ line-items indicating its pharmacy and insurance businesses held up well last year. Cigna’s GAAP operating income climbed higher 1% year-over-year in 2020 as revenue growth was offset by rising operating expenses, though given the headwinds that faced the firm due to the pandemic, that is solid performance. Due to special items, namely a $4.2 billion divestment gain, Cigna’s GAAP net income surged higher by 66% year-over-year in 2020. We're impressed with Cigna’s cash flow generating abilities and the high-quality nature of its cash flow profile (relatively modest capital expenditure requirements to maintain a certain level of revenues). In 2020, Cigna generated $9.3 billion in free cash flow (up from $8.4 billion in 2019) which fully covered $4.0 billion in share repurchases made during this period. As noted previously, Cigna initiated a quarterly dividend program in January 2021 at $1.00 per share or $4.00 per share on an annualized basis. As of this writing, shares of CI yield ~1.7% on a forward-looking basis and we applaud management for putting shareholders first by initiating the dividend program. We are big fans of Cigna’s fortress-like balance sheet. Cigna had $34.8 billion in cash, cash equivalents, short-term investments, and long-term investments on hand versus $3.4 billon in short-term debt and $29.5 billion in long-term debt at the end of 2020. The company’s ~$1.9 billion net cash position at the end of last year is a tremendous source of support as it concerns Cigna’s forward-looking dividend coverage. Guidance Looking ahead, Cigna expects to generate at least $165.0 billion in revenue this year (versus $160.4 billion in GAAP sales in 2020), indicating its growth story is expected to continue as the world emerges from the COVID-19 pandemic. The company’s non-GAAP adjusted income from operations per share is expected to hit at least $20.00 in 2021, up from $18.45 in 2020, and its 2021 guidance includes an expected $1.25 per share headwind from the COVID-19 pandemic and Cigna’s recent acquisition activity (which we will cover later in this article). Management expects Cigna will post at least $6.95 billion in non-GAAP adjusted income from operations (up from $6.8 billion in 2020) and at least $7.5 billion in cash flow from operations in 2021 (down versus 2020 levels, likely due to Cigna realizing quite favorable working capital movements last year). We appreciate Cigna expects to continue churning out gobs of cash flow going forward. As Cigna’s capital expenditures are forecasted to stay broadly flat this year versus 2020 levels at ~$1.0 billion, the firm apparently aims to generate around $6.5 billion in free cash flow in 2021 based on its annual guidance. Its dividend obligations are expected to total ~$1.4 billion in 2021, though the company also intends to keep buying back a meaningful amount of its stock as well going forward. The company forecasts that its weighted average shares outstanding will fall to 346 million – 349 million this year (down from ~368.4 million in 2020). Considering Cigna has a pristine balance sheet, high-quality cash flow profile, and its dividend obligations are relatively modest, its forward-looking payout coverage looks quite strong. However, a major acquisition or a fundamental change in the landscape of the US health care sector could change that picture in an instant. Additionally, Cigna’s share buyback plans will compete with its dividend obligations for capital going forward. On March 8, Cigna filed an 8-K SEC filing that noted the company was reaffirming its 2021 guidance ahead of its 2021 Investor Day event. During that event, Cigna put out long-term guidance highlighting its capital allocation prioritizes, expected growth rates, and other goals. From 2021 to 2025, Cigna expects to generate approximately $50.0 billion in cash flow from operations which will enable the company to continue investing in the business while stepping up its share buybacks and covering its dividend obligations over the coming years. Additional M&A activity is also under consideration.

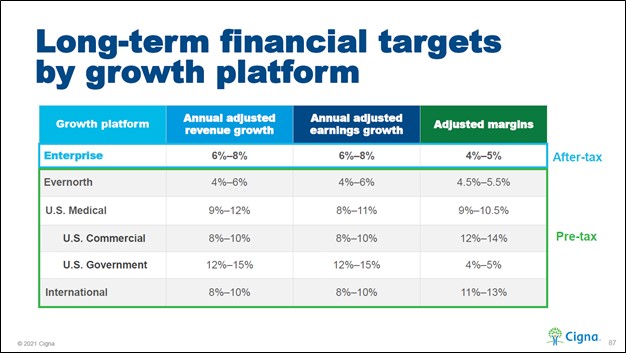

Image Shown: A snapshot of Cigna’s cash flow and capital allocation guidance through the middle of this decade. Image Source: Cigna –2021 Investor Day Presentation Powerful demographic tailwinds (expected growth in the cohort aged 75+ in the US and elsewhere), synergies from its acquisition of Express Scripts, new partnerships with health care providers, insights from its enlarged business generated from its data and analytics operations and locating ways to grow its total addressable market (‘TAM’) underpin Cigna’s long-term growth outlook. Cigna expects its Evernorth segment’s adjusted revenues and earnings will both grow by mid-single-digits annually while its U.S. Medical segment’s adjusted revenues and earnings are expected to grow by high single-digits to low double-digits annually over the long haul. The company expects its ‘International Markets’ segment will also grow at a relatively brisk pace going forward.

Image Shown: Cigna’s targeted long-term growth rates are respectable. Image Source: Cigna –2021 Investor Day Presentation Part of Cigna’s growth strategy rests on the firm building out its domestic individual and family health insurance business. That strategy involves Cigna expanding this business into new states over the next few years.

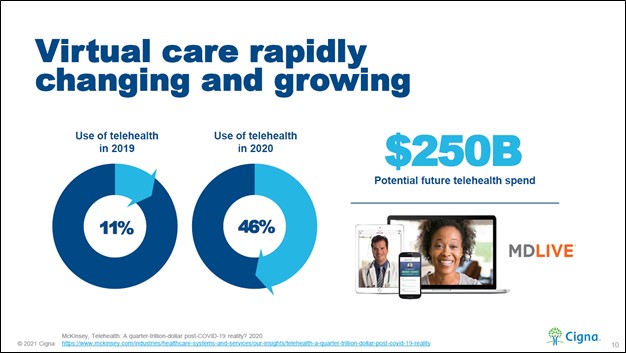

Image Shown: Cigna aims to grow its domestic individual and family health insurance business by expanding into new states over the coming years. Image Source: Cigna –2021 Investor Day Presentation Telehealth Upside In late February, Cigna announced that Evernorth would acquire telehealth platform company MDLIVE and that the deal would close in the second quarter of 2021. According to commentary given during its 2021 Investor Day Event, Cigna expects telehealth visits to generate on average $425 in savings per virtual visit, offering a way to wring out costs from the US health care system. The telehealth market is vast and growing quickly as the COVID-19 pandemic accelerated demand for such offerings due to the desire for households to socially distance and due to the immense strain the public health crisis has placed on the health care systems of virtually every country worldwide.

Image Shown: The TAM of the telehealth industry is vast and growing at a rapid pace, supported by a sharp increase in adoption of the technology of late. Image Source: Cigna –2021 Investor Day Presentation Cigna held its fourth quarter of 2020 earnings call in early February (before the MDLIVE acquisition was announced) and during that call management was asked a question from an analyst regarding the firm’s view on how telehealth operations could fit in with Cigna’s operations, if digital monitoring of high-risk patients would be part of this strategy, and how Cigna could potentially roll out such offerings. Management had this to say in response to the question during the earnings call: “…[W]e see significant opportunity to deliver more value, more choice, more simplicity, with appropriate coordination back to customers and patients through effective use of virtual programs. This is well beyond telemedicine, it's well beyond Urgent Care triaging. There's longitudinal nature that is attached to that, it is aided by remote monitoring, it is aided by a coordinated system to make that longitudinal delivery work. We see this transcending from healthcare through behavioral health to coordinated health care and behavioral health services from that standpoint, and we see it as a significant opportunity. I'd also note that, we've been mindful in terms of the positioning of the corporation whereby we see that as not only a significant opportunity in the market, but for us, because we've sought not be positioned in, we'll call it bricks and mortar delivery or fixed delivery infrastructure, but having the flexibility of the variable delivery infrastructure that is aided for clients.” --- David Cordani, CEO of Cigna We are intrigued by Cigna’s upside on the telehealth front. Teladoc Health Inc (TDOC) experienced surging demand for its telehealth offerings last year, its GAAP revenues roughly doubled in 2020 versus 2019 levels. In our view, there is an immense opportunity that benefits all parties given that telehealth offerings, if utilized properly, can (for instance) free up time for doctors while providing greater convenience for patients and potentially enabling sizable cost savings and efficiency gains in the process (all without sacrificing the quality of the delivery of health care services). Concluding Thoughts Cigna’s growth outlook is promising, its balance sheet its pristine, its cash flow profile is stellar, and its guidance is quite favorable. The company’s pending acquisition of MDLIVE is a good fit, in our view, and should help further expand Cigna’s TAM alongside its other initiatives. Recent updates from Cigna, with an eye towards the firm initiating a dividend program and its promising growth outlook, has put the health care giant on our radar. Please note that we continue to be huge fans of Cigna’s peer UnitedHealth Group Inc (UNH), an idea in the Dividend Growth Newsletter portfolio, and interested members can read our thoughts on UnitedHealth by checking out this article here. ----- Health Care Bellwethers Industry - JNJ, WBA, CVS, ISRG, MDT, ZBH, BAX, BDX, BSX, MTD, SYK, BIIB, GILD, ABT, ABBV, LLY, AMGN, BMY, MRK, PFE, VRTX, ZTS, REGN, UNH Tickerized for UNH, CNHG, BX, MOH, ANTM, CNC, CI, HUM, THC, UHS, CYH, HCA, ABC, CAH, LLY, CVS, WBA, EHTH, GTS, TDOC Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) and Health Care Select Sector SDPR Fund (XLV) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio. Vertex Pharmaceuticals Inc (VRTX) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. UnitedHealth Group Inc (UNH) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Vanguard Consumer Staples ETF (VDC) is included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment