Member LoginDividend CushionValue Trap |

Call Me Unconcerned

publication date: May 23, 2023

|

author/source: Brian Nelson, CFA

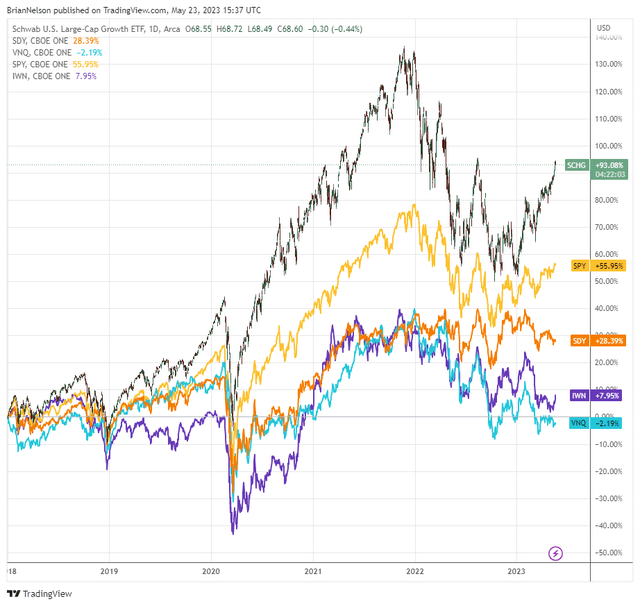

Image: Large cap growth has dominated returns the past five years. The Best Ideas Newsletter portfolio continues to have significant exposure to this area. By Brian Nelson, CFA When it comes to the financial markets, the debt ceiling debate is nothing to worry about. Countries (sovereigns) cannot generally default on debt that is denominated in their own currency. The concern that there will be any sort of calamity if the U.S. government doesn’t raise the debt ceiling is far overblown, in our view. The political will of the U.S. to pay its debt will only resolve itself in time, and any risk premium built into Treasuries as a result of the debt ceiling showdown will be fleeting. Of course, nobody can know what the next two weeks will bring but call me unconcerned. The U.S. will make good on its debts. That said, the market is often irrational and very short-sighted at times. If we do get some sort of shock to the markets as a result of the debt ceiling showdown, even if it may be temporary, we’re ready to put the incremental cash that was “raised” in the newsletter portfolios to work. The media has clearly shifted gears from talking all day about the Fed to talking all day about the debt ceiling, and now that the topic has everyone’s attention, we can only brace for some sort of silly overreaction. But for all intents and purposes, if your financial plan or investment strategy is influenced by the media’s coverage of the debt ceiling, it may be time to pause and reflect. The regional banking crisis is likely now in the rear-view mirror, and to no surprise, quantitative value investors were punished yet again by the debacle. Year-to-date, the iShares Russell 1000 Growth ETF (IWF) has advanced nearly 20%, while the iShares Russell 1000 Value ETF (IWD) has been flat and the SPDR S&P Dividend ETF (SDY) is down 3%. What’s 20+ percentage points between friends, right? The Schwab U.S. Large-Cap Growth ETF (SCHG) is doing even better, up nearly 25% since the start of the year. Last year was a big anomaly, and we expect big cap tech and large cap growth to continue to power these markets higher. But why? Well, for a bunch of reasons. First, these areas include companies with strong net cash positions on the balance sheets and solid expectations of future free cash flow. Net cash on the books and future expected free cash flow are the two primary cash-based sources of intrinsic value. Second, these companies are subject to the potential for substantially improved expectations of free cash flow in the future. Look at what artificial intelligence [AI] is doing to the group. These stocks are rallying, in part, on the potential for AI to drive cost take-outs and create future opportunities for growth across the stylistic area. We expect this decade to continue to be dominated by large cap growth.

We’re taking it slow this time of year. With the area of large cap growth nearly doubling since the beginning of 2018, trouncing the return of the broader market, dividend growth strategies, the area of small cap value and general REIT indices (VNQ), it’s just hard to find much wrong with staying pat. The proliferation of artificial intelligence will likely propel big cap tech and large cap growth to new highs, while small cap value may continue to be weighed down by the banks--and dividend-oriented strategies may face continued pressure from rising interest rates and tired real estate markets. Things were a bit murky during 2022, but thanks for keeping the faith. NOW READ: There Are No Free 'Income' Lunches ---------- It's Here!

The Second Edition of Value Trap! Order today!

-----

Tickerized for holdings in the QQQ. Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson's household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. |