Member LoginDividend CushionValue Trap |

Boeing's Fall from Grace

publication date: Mar 21, 2020

|

author/source: Brian Nelson, CFA

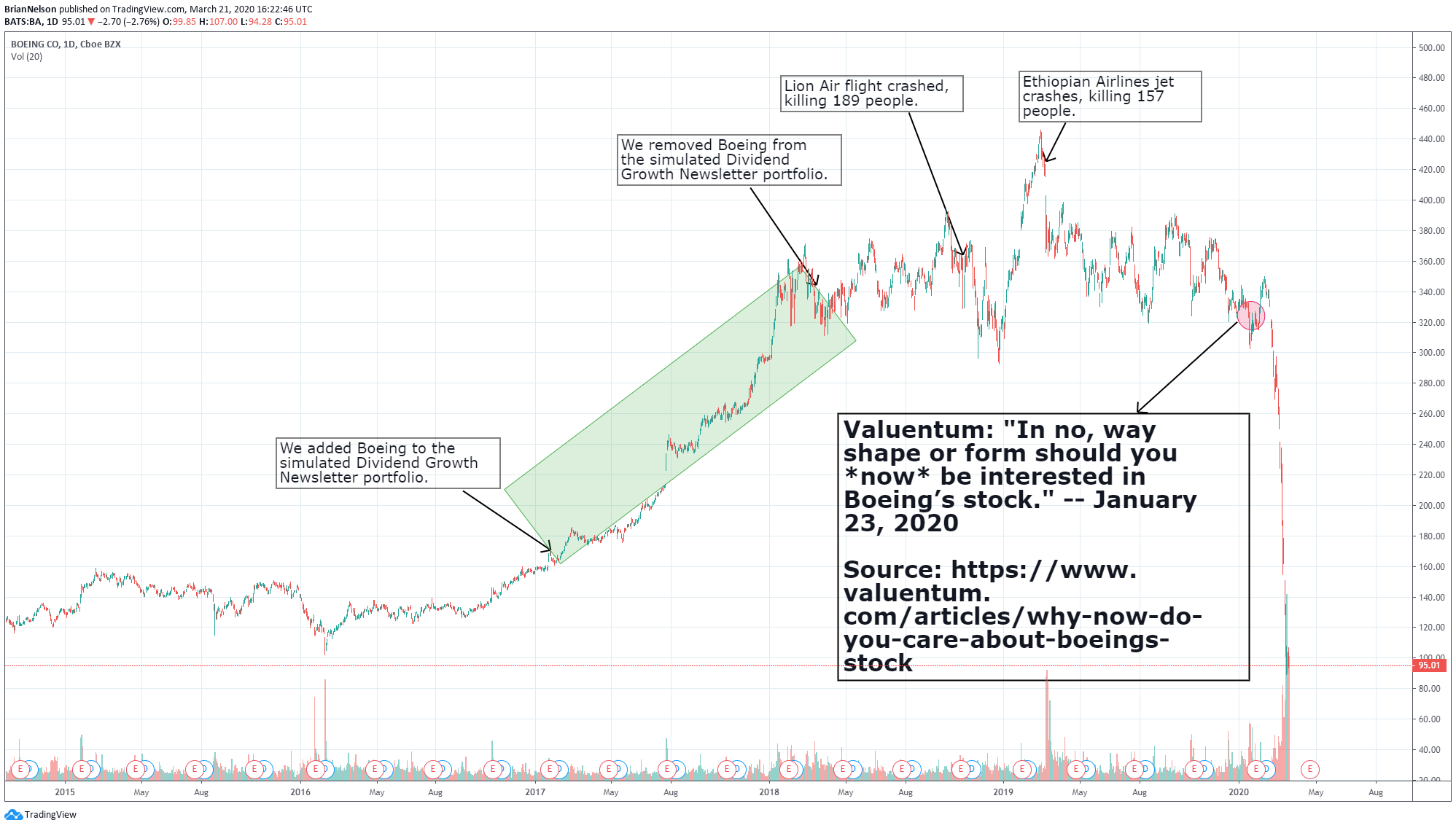

Image: Boeing was added to the Dividend Growth Newsletter portfolio January 27, 2017, and removed March 16, 2018, prior to the unfortunate accidents that have claimed the lives of hundreds of people. We warned readers to stay far away of Boeing's stock days before its huge collapse. The rating agencies have slashed Boeing's credit rating, and the firm has now suspended its dividend. By Brian Nelson, CFA We received a comment from a guest about Boeing, and we wanted to clarify our prior research calls on the company. Boeing's (BA) fall from grace has been largely documented in our prior writings here (March 11, 2020) and here (January 23, 2020), so we won't spend much time recapping the series of unfortunate events at the aerospace giant. The company's decline has been swift and painful, too, as shareholders abondon ship and as Congress debates on what sort of bailout package the firm may receive, if anything, and how the equity may fare as a result. It's clear that Boeing could be facing a liquidity event in the near term, with its 5Y CDS spreads blowing out, and just on Friday night, the firm announced it would suspend its dividend. That's right--Boeing's dividend is now nil (its Dividend Cushion ratio stood at 0.9 prior to the cut), almost hard to believe, but something investors could have only expected. This comes after the agencies took an axe to its credit rating in the midst of what could be an unprecedented cash burn cycle. Boeing is up against the ropes. The news, however, is boring to our members. We added Boeing to the Dividend Growth Newsletter portfolio in January 2017 and removed it in March 2018, capturing most of the strong upswing of the equity during the past several years. What's more, prior to the collapse, we absolutely pounded the table on the view that Boeing was a falling knife and went so far as to say in our January 2020 note, "Why *NOW* Do You Care About Boeing's Stock?: In no, way shape or form should you *now* be interested in Boeing’s stock (January 23). You can view our calls on Boeing in the image above (at the top of the article), but I also wanted to point you to another one of our more timely calls in the spirit of "Resetting Your Mental Model." Forward-looking analysis is the only analysis you should be paying attention to--backward-looking empirical analysis tells you what has happened, not what is likely to happen. Even the smartest professionals misrepresent this important distinction. Investing is not about best-fitting the past with spurious data; it's about using the mosaic method to position for the future. As you saw in what just happened during the past few weeks, those that were looking backward were absolutely slaughtered. Those that were looking forward, however, fared much differently. You know that we've been worried about the coronavirus since at least late January, "Coronavirus May Trigger Long-Anticipated Global Recession (January 31)," when most of the Wall Street establishment was still talking about growth in the first half of 2020. We also alerted members to a coming crash February 22, "Is a Stock Market Crash Coming? -- Coronavirus Update and P/E Ratios," and we followed through with alerting members about crash protection the first of two times that Monday, February 24, "ALERT: Adding Market Crash 'Protection,' Removing MSFT, BKNG." You can see the timing of when we went all in December 2018 and added crash protection February 2020 in the chart below.

Image: In December 2018, we took both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio to an "all-in" position, expecting a melt up in the markets. On February 22, we warned members of an impending stock market crash, alerting them about "portfolio protection."

Concluding Thoughts Here's what we wrote February 26, a few days after our warning about the impending market crash: In our Saturday, February 22 note, we said that a contraction of the S&P 500 to a 16x forward multiple on earnings estimates only 10% lower than current forecasts would imply an S&P 500 of 2,566, or a swoon of about 15%-25% from current levels of 3,116 --and that would just get us down to 16x still-respectable forward numbers (the market could still overreact from that point!). How quantitative-driven price-agnostic trading may impact this scenario is not known either… It would not be surprising to me if we tripped the circuit breakers at some point. Markets remain severely overpriced in light of current conditions, and panic selling might ensue as fear takes hold. Most all of what we said would happen has happened thus far; the circuit breakers have even tripped several times. While bear markets are generally short in duration compared to bull markets--according to information from First Trust, the average bear market lasts 1.4 years, leading to an average cumulative loss of ~41% over such a short time--we've only been experiencing pain in equities for just the past few weeks. The Great Depression that engulfed the U.S. following the Crash of 1929 sent the markets lower more than 80% over what can be considered, by historical standards, a brief 2.8-year period. The markets could be falling for some time yet. All told, we continue to stay far away from Boeing's equity, and we're maintaining our fair value range on the S&P 500 of 2,350-2,750, with expectations of panic/forced selling down to 2,000 on the broad market index (it closed at 2,304.92 on Friday, March 20). We believe that savvy investors have been nibbling at this market during the past couple weeks and may have achieved up to 50%-75% of their equity allocation in a well-diversified portfolio via dollar-cost averaging strategies, with expectations of further market declines. Our best ideas remain in the Best Ideas Newsletter portfolio, Dividend Growth Newsletter portfolio, High Yield Dividend Newsletter portfolio and Exclusive publication. We're available for any questions. Tickerized for holdings in the XAR. ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Brian Nelson owns shares in SPY and SCHG. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

0 Comments Posted Leave a comment