Member LoginDividend CushionValue Trap |

Best Idea PayPal Soars on Very Promising Outlook

publication date: May 7, 2020

|

author/source: Callum Turcan

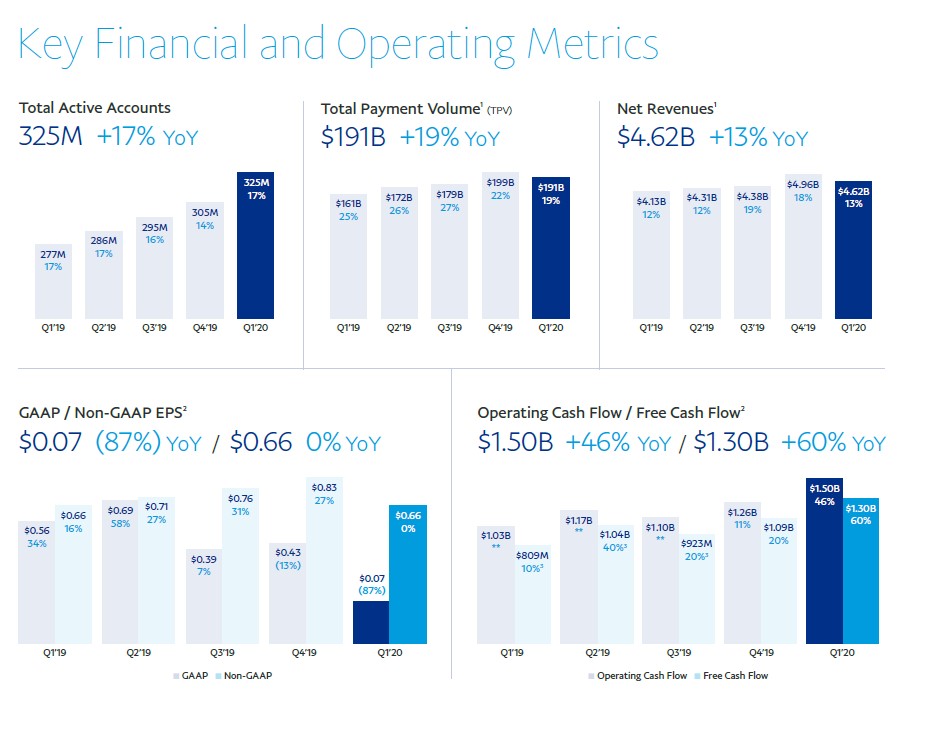

Image Shown: Best Ideas Newsletter portfolio idea PayPal is surging after a strong outlook that speaks to underlying strength of the “new” consumer in a post COVID-19 world. By Callum Turcan On May 6, one of our favorite companies PayPal Holdings Inc (PYPL) reported first quarter 2020 earnings. While PayPal missed consensus estimates on both the top- and bottom-line, investors looked towards the future and shares of PYPL rose sharply after the report on May 7. We continue to like PayPal as a near top-weighted holding in our Best Ideas Newsletter portfolio. Please note we increased the weighting of PYPL shares in that newsletter portfolio back on January 13, 2020 (link here) and further increased PayPal’s weighting in our Best Ideas Newsletter portfolio after going “fully invested” in April 29, 2020 (link here). The top end of our fair value estimate range sits at $150 per share, and in our view, shares of PYPL have room to run further from current levels as of this writing (even after their strong performance of late). PayPal is very well-positioned to ride out the storm created by the ongoing coronavirus (‘COVID-19’) pandemic as the world continues to transition towards an era heavily reliant on digital payments. Earnings Overview PayPal’s total payment volumes (‘TPV’) rose 18% year-over-year (19% on a constant-currency basis), driving 12% year-over-year GAAP revenue growth (13% on a constant-currency basis) last quarter. An increase in its credit loss reserves, a product of the ongoing COVID-19 pandemic and the negative impact that is having on employment rates and consumer incomes, held down PayPal’s bottom-line (transaction and credit losses on a GAAP basis rose by 73% year-over-year last quarter, hitting $0.6 billion) as its GAAP diluted EPS came in at $0.07 in the first quarter (down 88% year-over-year). Share repurchases reduced PayPal’s diluted outstanding share count marginally last quarter versus the same period a year-ago.

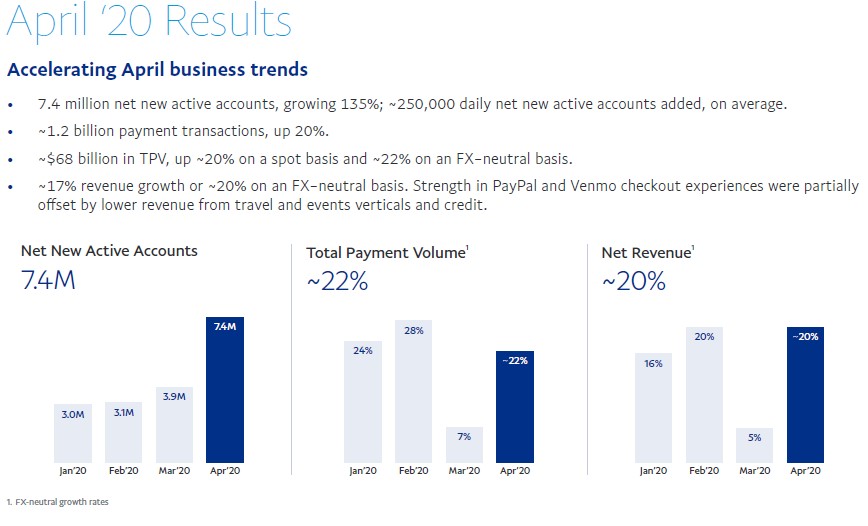

Image Shown: PayPal posted solid performance during the first three months of 2020, save for the large but expected increase in its credit loss reserves relating to its modestly-sized lending operations. Image Source: PayPal – First Quarter 2020 Earnings Press Release PayPal remains a free cash flow cow, generating $1.5 billion in net operating cash flow and spending $0.2 billion on capital expenditures in the first quarter of 2020 which allowed for $1.3 billion in free cash flows. That fully covered $0.8 billion in share repurchases last quarter, and PayPal does not have a common dividend policy at this time as management prefers to reinvest cash flow back into the business. PayPal completed its purchase of Honey last quarter (we covered the acquisition in detail here and reiterated those thoughts here), which resulted in its long-term debt load growing from $5.0 billion at the end of 2019 to $8.0 billion at the end of the first quarter of 2020 (the firm did not have any short-term debt at the end of either periods). However, PayPal retained its net cash position and exited March 2020 with $7.9 billion in cash and cash equivalents, $2.3 billion in short-term investments, and $2.4 billion in long-term investments on hand. PayPal paid $3.6 billion in cash along with $0.4 billion in assumed restricted stock, restricted stock units, and options to acquire Honey (the deal was completed in January 2020). Here’s what the firm had to say about the transaction in its 10-Q filing covering the first quarter of 2020: We believe our acquisition of Honey will enhance our value proposition by allowing us to further simplify and personalize shopping experiences for consumers while driving conversion and increasing consumer engagement and sales for merchants. Part of PayPal’s success came from a 17% year-over-year increase in its total active accounts last quarter, assisted by Honey adding 10.2 million accounts to its user base (a one-time event before factoring in organic growth, which remained strong and we’ll cover that in a moment) along with another 10 million net from its existing operations which includes the very popular peer-to-peer (‘P2P’) money transfer app Venmo. As it relates to Venmo, management noted during PayPal’s first quarter conference call that Venmo’s TPV was up 48% last quarter which apparently was on a year-over-year basis (including “well over 50%” growth in January and February before apparently slowing down modestly in March). Furthermore, management highlighted that this success carried on into April, with PayPal adding 7.4 million net accounts last month. That helped boost PayPal’s revenues in the month of April up by roughly 17% (20% on a constant-currency basis) versus April 2019 levels. For the second quarter of 2020, PayPal is guiding for its revenues to climb higher by ~15% on a constant-currency basis versus the same period the prior year. Here’s some key management commentary from PayPal’s latest quarterly conference call (emphasis added): “Our net new actives hit record highs in April, surging over a 140% from January and February levels, averaging approximately 250,000 net new active accounts per day. For the month of April, we added an all-time record of 7.4 million net new customers. I don't want to lose sight of the fact that we also had a record Q1 adding 10 million net new accounts, but that will pale in comparison to the 15 million to 20 million net new active accounts we anticipate adding in Q2. And last but certainly not least, in April, our revenues grew by 20% on an FX-neutral basis, including record revenue growth of 35% in our PayPal checkout experiences… The opportunities for Honey and PayPal to help consumers find the items they need at prices they can afford have never been more important for both merchants and consumers. To put that in perspective, in April, Honey's net new actives grew nearly 180% from pre-COVID levels. And for the month of April, revenues for Honey were up over 40% from January and February.” --- Dan Schulman, CEO of PayPal A growing active user base should work wonders in extending and enlarging PayPal’s long-term growth runway. In the upcoming graphic down below, PayPal provides an overview of its strong April 2020 performance which in our view is management’s way of highlighting PayPal’s optimistic outlook.

Image Shown: PayPal’s strong operational performance carried on into the month of April 2020 from the first quarter of this year. Image Source: PayPal – First Quarter 2020 Earnings Press Release

PayPal has also had success in winning over new users from demographic cohorts it previously hasn’t had as much (relatively speaking) success in engaging with until more recently. Management had this to say in response to a question from an analyst asking about PayPal’s active user growth (and the dynamics concerning that growth trend) during PayPal’s latest quarterly conference call: “We're also seeing new segments of customers come in. We're seeing like older cohorts come in, calling it, silver tech, let's just say, those who are older or haven't used PayPal before and now are using it as their kids and family members are explaining to them how to use the service. When we look at engagement and this is a really important question you asked about cohorts in here. What we really look at and our best indicator of lifetime value as well as propensity to stay with us and not to churn is what we call our 10-day adoption rate, and that is within the first 10 days of somebody signing on that they do three or more transactions with PayPal, three or more. And so when we find when they do that, they're just a lifelong PayPal customer.” --- CEO of PayPal We appreciate PayPal’s solid financial and operational performance in the first quarter and in April, credit loss provisions aside. Looking Ahead While PayPal provided guidance for the second quarter of 2020, the firm withdrew its full-year guidance due to uncertainties created by COVID-19. The acquisition of Honey reinforces PayPal’s relationships with its merchant client base as PayPal now has access to greater amounts of consumer purchasing habits and trends, which in theory could be used in the future to help merchants grow their sales and thus grow PayPal’s TPV over time. That upside is entirely incremental to our current fair value estimate and fair value estimate range and highlights why we like PayPal as a long-term capital appreciation opportunity. This year, PayPal is losing its exclusive payment processing deal with eBay Inc (EBAY), and we would like to stress that PayPal is very well positioned to keep growing its TPV even after eBay pivots to another payment processing provider (which will likely see PayPal’s revenues and TPV from customers using eBay’s marketplace platform decrease significantly). Please note that eBay has increasingly become a smaller part of PayPal’s overall business and TPV in just the past few years alone. In 2019, revenue from customers using eBay’s marketplace platform accounted for 14% of PayPal’s revenues, down from 20% in 2017 and 29% in 2014. Additionally, please note that throughout 2019, PayPal’s exposure to eBay continued to decrease materially as we highlighted in this article here. The operating agreement between PayPal and eBay expires in July 2020 (more on that here). During PayPal’s fourth quarter of 2019 conference call, management noted that eBay was expected to represent ~6% of PayPal’s TPV by the middle of 2020. PayPal will experience some short-term headwinds from the eBay operating agreement coming to an end, along with potential headwinds posed by foreign currency movements and COVID-19, but the firm’s long-term growth trajectory continues to shine bright. Investors, in our view, are looking past the noise and focusing on the kinds of long-term free cash flow growth PayPal could potentially generate. That trajectory is assisted by its pristine balance sheet. PayPal has successfully leveraged its financial tech operations and money transfer infrastructure to help get funds to small- and medium-sized businesses through the Payroll Protection Program (‘PPP’), created through the Coronavirus Aid, Relief, and Economic Security Act (‘CARES Act’) that was recently passed by the US Congress to combat the negative economic effects of COVID-19. Here’s some management commentary on the issue, from PayPal’s latest quarterly conference call: “It was an important and proud moment when we became one of the very first non-bank lenders approved to distribute the Paycheck Protection Program funds to the small businesses we serve. We have already funded tens of thousands of loans, distributed well over $1 billion with an average loan size of $35,000, and PayPal and Venmo customers in the US are eligible to receive their economic stimulus payment directly into their digital wallet.” --- CEO of PayPal While a small part of its company-wide operations, incremental moves such as these are crucial for PayPal as it seeks to prove it can offer all kinds of financial services to its clients and potential clients. Concluding Thoughts The jump in shares of PayPal after it reported its first quarter earnings report is a welcome sign but didn’t surprise us given how impressed we have been with the payment processing and financial tech company’s operations, financials, and growth trajectory. We continue to really like PayPal as a holding in our Best Ideas Newsletter portfolio and see room for additional capital appreciation upside going forward. PayPal’s lending business took a hit last quarter due to expectations that some of its loans won’t get repaid, but as that remains a small part of its overall operations, PayPal remains a solid way to play secular growth tailwinds within the financial services, payment processing, and financial tech space. ----- Financial Tech Services Industry – MA MELI PYPL VRSK V Banks & Money Centers Industry – AXP BAC BBT BK C DFS FITB GS HSBC JPM KEY MS NTRS PNC RF STI TCF USB WFC Related: EBAY, IYG, IPAY, IYF ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Visa Inc (V) and PayPal Holdings Inc (PYPL) are both included in Valuentum’s simulated Best Ideas Newsletter portfolio. Bank of America (BAC) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment