Member LoginDividend CushionValue Trap |

AT&T Right-Sizing Dividend, WarnerMedia Joining Forces with Discovery

publication date: May 18, 2021

|

author/source: Callum Turcan

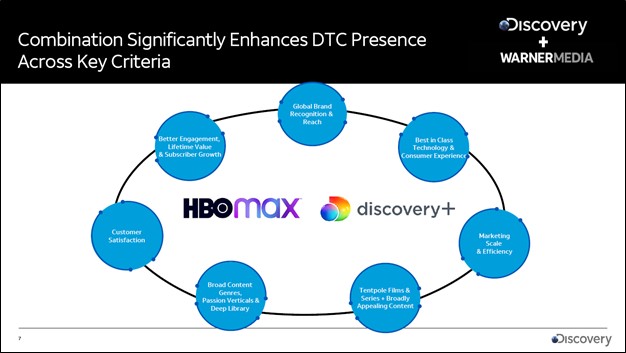

Image Shown: AT&T Inc’s WarnerMedia unit is joining forces with Discovery Inc. This transaction, if it goes through as planned, will create another giant in the video streaming services industry. Image Source: Discovery Inc – Discovery Joining Forces with WarnerMedia IR Presentation By Callum Turcan Despite the upcoming rightsizing of its dividend payout in light of a pending spin-off, the telecommunications and media giant AT&T Inc (T) continues to be one of our favorite income generation ideas. We're not making any changes to the newsletter portfolios at this time, and the recent news indicates AT&T’s balance sheet is about to improve significantly. Major Transaction On May 17, AT&T announced a major transaction with Discovery Inc (DISCA) that involves AT&T using a Reserve Morris Trust transaction to merge its WarnerMedia unit with Discovery, effectively separating AT&T’s telecommunications, fiber optic, and pay-TV provider operations from its media and entertainment division (AT&T is also divesting a minority stake in its pay-TV business). AT&T shareholders would own 71% of the pro forma company’s equity and Discovery shareholders would own the remaining 29% equity stake. As an aside, this deal is expected to consolidate Discovery’s multiple share class structure to just one share class. Here is a summary of the transaction (from the press release): The combination will be executed through a Reverse Morris Trust, under which WarnerMedia will be spun or split off to AT&T’s shareholders via dividend or through an exchange offer or a combination of both and simultaneously combined with Discovery. The transaction is expected to be tax-free to AT&T and AT&T’s shareholders. In connection with the spin-off or split-off of WarnerMedia, AT&T will receive $43 billion (subject to adjustment) in a combination of cash, debt securities and WarnerMedia’s retention of certain debt. The new company expects to maintain investment grade rating and utilize the significant cash flow of the combined company to rapidly de-lever to approximately 3.0x within 24 months, and to target a new, longer term gross leverage target of 2.5x-3.0x. AT&T and Discovery aim to close the transaction by the middle of 2022, though regulatory approvals are required, and Discovery shareholders still need to approve the deal. Both AT&T and Discovery’s board of directors have approved the transaction. Looking ahead, AT&T expects to have a 2.6x net debt to adjusted EBITDA ratio after the deal closes (due to the ~$43 billion in considerations AT&T expects to receive as noted above) and is targeting a leverage ratio less than 2.5x by the end of 2023. Please note AT&T has a leverage ratio of 3.1x at the end of the first quarter of 2021, highlighting how this transaction is expected to have a powerful impact on its financial strength by significantly improving its leverage ratio. Here, we would like to note that AT&T intends to right-size its dividend after the spinoff given that WarnerMedia is quite a large part of its business, which in our view, is a reasonable move. AT&T noted that the firm expects to have an annual dividend payout ratio (annual dividend obligations divided by its annual free cash flows) of 40%-43% once the deal closes with its free cash flow expected to be in the $20+ billion range (or ~$8.6+ billion in cash dividends versus ~$15 billion previously). Furthermore, AT&T noted that once deleveraging activities were complete, it may consider sizable share repurchases (in the medium-term, this indicates that the pace of AT&T’s share buybacks will likely remain subdued). New Media and Video Streaming Giant Combining Discovery with WarnerMedia will create a media, entertainment, and video streaming services powerhouse. HBO Max (part of WarnerMedia) and Discovery+ (part of Discovery)--two nascent video streaming services that are beginning to gain some real traction as it concerns paid subscriber growth--will be supported by a vast content library and the ability to invest enormous sums towards high-quality and engaging original content. Here is a quick summary of the pro forma company (from the press release): The “pure play” content company will own one of the deepest libraries in the world with nearly 200,000 hours of iconic programming and will bring together over 100 of the most cherished, popular and trusted brands in the world under one global portfolio, including: HBO, Warner Bros., Discovery, DC Comics, CNN, Cartoon Network, HGTV, Food Network, the Turner Networks, TNT, TBS, Eurosport, Magnolia, TLC, Animal Planet, ID and many more. By 2023, AT&T and Discovery forecast that the entity will generate ~$52 billion in annual revenues and ~$14 billion in adjusted EBITDA, along with an industry-leading free cash flow conversion rate. Cost synergies are expected to come in at ~$3 billion per year as the enlarged firm continues to scale key direct-to-consumer offerings, namely the HBO Max and Discovery+ videos streaming services. For instance, when it comes to launching HBO Max in additional markets around the globe, those activities could be supported by Discovery’s existing infrastructure. When it comes to content creation, the combined company will have the capacity to invest vast sums towards original TV shows and movies, aided by the expected cost savings (which frees up cash that can be used to further invest in the business). Significance for AT&T This move comes on the heels of AT&T announcing a deal with TPG Capital to sell a minority interest in a new entity, DIRECTV, which will house its US pay-TV operations (DIRECTV, AT&T TV and U-verse video services), back in February 2021. Effectively, AT&T is pivoting towards its core business, providing wireless and fiber services to customers in the US. These moves will allow AT&T to invest more towards its 5G telecommunications infrastructure while steadily growing its fiber optic Internet service provider business, two attractive areas with ample room for growth in the coming years. Here is what AT&T had to say on its outlook (from the press release): Expected increased capital investment for incremental investments in 5G and fiber broadband. The company expects annual capital expenditures of around $24 billion once the transaction closes. AT&T expects its 5G C-band network will cover 200 million people in the U.S. by year-end 2023. And the company plans to expand its fiber footprint to cover 30 million customer locations by year-end 2025. In the recent past, AT&T has done a stellar job adding wireless and fiber customers to its business, and we expect the firm to continue outperforming on this front going forward. For instance, in the first quarter of 2021, AT&T reported 823,000 net postpaid adds (including 595,000 net postpaid phone adds), 207,000 net prepaid phone adds, and 235,000 net AT&T Fiber adds. The expansion of AT&T’s 5G wireless infrastructure will not be cheap, and the firm has already spent handsomely building out these operations. AT&T launched nationwide 5G wireless services in the US last year. Considering the vast technological improvements 5G technology offers over 4G technology, AT&T should be able to continue enticing retail customers, enterprises, and government entities to make the switch, which supports its revenue growth outlook and ultimately the firm’s ability to make these large investments. AT&T Fiber is marketed to more 14.5 million customer locations, and the goal is to aggressively expand the customer service area of this business going forward. Concluding Thoughts We view AT&T’s growth outlook quite favorably. Though HBO Max was intended to complement its wireless operations (bundling HBO Max with 5G wireless services to ideally create “stickier” revenue streams), AT&T can still bundle its various wireless services with video streaming services just as it is currently doing. Many of AT&T’s competitors, including Verizon Communications Inc (VZ) and Comcast Corporation (CMCSA), are doing the same thing. AT&T’s pivot to its core operations is a welcome sign. Though the market was disappointed by the announcement, we see this as a major positive for AT&T as the company will be able to significantly improve its balance sheet while sharpening its operational focus and enhancing its cash flow growth outlook. For WarnerMedia and Discovery, the pro forma firm will be in a much stronger competitive position as it seeks to build up a vast paid subscriber base at its core video streaming services. We are keeping a close eye on further developments and continue to like shares of T as an idea in the High Yield Dividend Newsletter portfolio. Members interested in reading more about the video streaming space are encouraged to check out one of our latest articles covering The Walt Disney Company (DIS) by clicking this link here. Disney is another of our favorite ways to gain exposure to this industry, and its stock is included as an idea in the Best Ideas Newsletter portfolio. We’ll have more to say about AT&T in the coming weeks to months, but for now, we’re not making any changes to the newsletter portfolios. ---- Telecom Services Industry - CMCSA, LUMN, DISH, T, TMUS, VZ, SBAC, AMT, CCI, VIAC Related: NFLX, DIS, DISCA, ROKU, FOX, FOXA, FUBO Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. The Walt Disney Company (DIS) is included in Valuentum’s simulated Best Ideas Newsletter portfolio. AT&T Inc (T) and Crown Castle International Corp (CCI) are both included in Valuentum’s simulated High Yield Dividend Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment