Member LoginDividend CushionValue Trap |

Aon and Willis Towers Watson to Join Forces

publication date: Mar 2, 2021

|

author/source: Callum Turcan

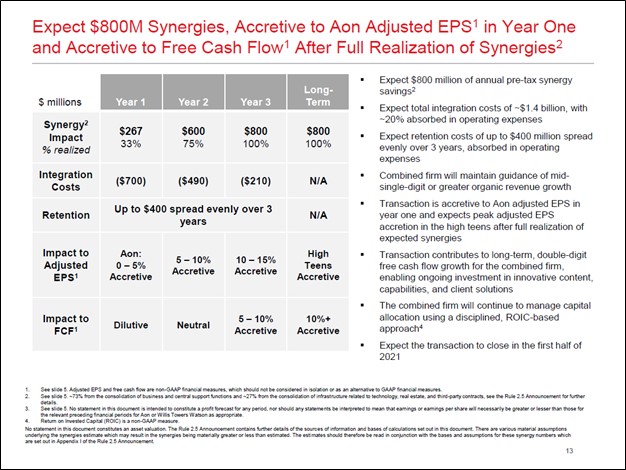

Image Source: Aon Plc – Willis Towers Watson Plc Merger IR Presentation March 2020 Executive Summary: Two global professional services firms, Aon and Willis Towers Watson, are in the process of merging through an all-stock deal. Should the transaction proceed as envisioned, the pro forma company should be able to unlock material synergies within a few years after the deal closes. We would want to see how the combined company performs first before updating our opinion on the pro forma entity, though we view the merger quite favorably given the expected free cash flow uplift. By Callum Turcan Aon Plc (AON) is in the process of merging with Willis Towers Watson Plc (WLTW) through an all-stock transaction announced back in March 2020. In the event the deal closes as envisioned, Aon shareholders will own ~63% of the combined company and Willis Towers Watson shareholders will own the remaining ~37% of the pro forma entity. The European Commission (‘EC’) is reviewing the deal on antitrust grounds, though both firms remain confident that the transaction will close in the first half of this year. We caution that nothing is for certain as the EC has already made decisions that indicate the regulatory review could take a while to complete (after pausing the investigation this past February). The current CEO of Aon, Greg Case, will be CEO of the combined company while the employment contract of Willis Towers Watson’s CEO John Haley was extended until the Aon merger is completed (though that employment contract terminates at the end of 2021 according to the 8-K SEC filing). John Haley will take on the role of Executive Chairman and Christa Davis, currently CFO of Aon, will become CFO of the combined company should the merger proceed as envisioned. Each Willis Towers Watson share will be exchanged for 1.08 shares of Aon under the current arrangement. Willis Towers Watson bills itself as “a leading global advisory, broking and solutions company that designs and delivers solutions that manage risk, optimize benefits, cultivate talent and expand the power of capital to protect and strengthen institutions and individuals. Willis Towers Watson has 45,000 employees serving clients in more than 140 countries and markets.” Aon bills itself as “a leading global professional services firm providing a broad range of risk, retirement and health solutions. Our 50,000 colleagues in 120 countries empower results for clients by using proprietary data and analytics to deliver insights that reduce volatility and improve performance.” Transaction Overview In the event the merger is approved, the combined company will operate under the Aon brand. Aon and Willis Towers Watson are targeting $0.8 billion in pre-tax annualized cost synergies within three years of the deal closing. Please note there is room for significant revenue synergies here as well (not included in the $0.8 billion in forecasted annualized pre-tax synergies figure) due in part to the ability for the pro forma firm to cross-sell products and solutions to its enlarged client base. Data and analytics offerings are another source of upside, especially as the combined company will likely be able to generate more impactful insights for its client base.

Image Shown: The merger of Aon and Willis Towers Watson is expected to generate a powerful free cash flow uplift for the pro forma company within three years of the deal closing. Image Source: Aon – Willis Towers Watson Merger IR Presentation March 2020 Just under three-quarters of the targeted cost synergies are coming “from the consolidation of business and central support functions, including leveraging the capabilities of the Aon Business Services operational platform across the combined group” while the remainder is “from the consolidation of infrastructure related to technology, real estate and third-party contracts.” Due to expected integration and retention expenses, it is forecasted that it will take a few years before this merger is materially accretive to the pro forma company’s free cash flows. However, once the targeted cost savings have been achieved, this deal is expected to provide the combined company will a powerful free cash flow uplift going forward. For reference, Aon and Willis Towers Watson combined spent $16.5 billion on operating expenses and generated $4.0 billion in GAAP operating income in 2020. The duo expects to incur approximately $1.4 billion in integration-related expenses over the coming years. Both Aon and Willis Towers Watson report their financial statements in accordance with US Generally Accepted Accounting Principles (‘GAAP’). Furthermore, both companies have a major corporate office presence in London, UK. Willis Towers Watson’s parent company is domiciled in Ireland and Aon plans to redomicile in Ireland before the transaction closes. That means Aon Ireland would become the publicly traded parent company of Aon Group. Here is what Willis Towers Watson’s website has to say on the issue: It is expected that the Reorganization of the Aon Group described in the Reorganization Proxy Statement will be completed prior to the completion of the combination, such that prior to completion of the combination, Aon Ireland will be the publicly traded parent company of the Aon Group. The Reorganization remains conditional on, among other things, the sanction of the UK scheme of arrangement forming part of the Reorganization by the UK Court, as more particularly described in the Reorganization Proxy Statement. Upon completion of the Reorganization, it is expected that the Aon Ireland Directors will be the same as the current Aon UK Directors. The transaction is subject to the approval of the shareholders of both Aon Ireland and Willis Towers Watson, as well as other customary closing conditions, including required regulatory approvals. The parties expect the transaction to close in the first half of 2021, subject to satisfaction of these conditions. Here is what Willis Towers Watson’s website has to say on the pro forma entity’s longer term outlook: The combined firm is committed to maintaining long-term financial goals of mid-single digit or greater organic revenue growth and double-digit free cash flow growth; and is expected to maintain Aon’s current credit rating. For reference, Aon has investment grade credit ratings as Moody’s Corporation (MCO) rates Aon’s senior unsecured debt at Baa2 with a stable outlook and Fitch rates Aon’s long-term issuer default rating at BBB+ with a negative outlook (these credit ratings are current as of August 2020). We appreciate that the pro forma entity aims to maintain investment grade credit ratings going forward, though we caution that integration efforts during the coronavirus (‘COVID-19’) pandemic may prove to be a difficult task. Ongoing vaccine distribution efforts should help global health authorities eventually bring the public health crisis under control. Aon Overview In 2020, Aon’s GAAP revenues grew marginally year-over-year as strength at its ‘Commercial Risk Solutions’ and ‘Reinsurance Solutions’ segments offset weakness elsewhere. Corporate-level cost containment efforts, a significant decline in its ‘amortization and impairment of intangible assets’ line-item expense, and other factors helped Aon reduce its operating expenses by 8% year-over-year in 2020, resulting in 28% year-over-year GAAP operating income growth. Aon’s financial performance staged a nice rebound in the final quarter of last year when its GAAP revenues and GAAP operating income grew by 3% and 36% year-over-year, respectively. The company’s ‘Health Solutions’ segment put up strong performance in the fourth quarter of 2020 alongside sustained strength at its Commercial Risk Solutions and Reinsurance Solutions segments. Here is what Aon’s management team had to say during the firm’s fourth quarter of 2020 earnings call: “Turning into financial performance in the fourth quarter, we delivered a great finish to the year with 2% organic revenue growth across the firm, including 12% growth in reinsurance solutions and 4% growth in commercial risk resolutions. As in recent quarters, organic revenue growth in the fourth quarter was driven by strength in the core areas of our business, reflecting the resilience of our firm in a challenging economic environment, overcoming ongoing unexpected pressure in the more discretionary areas. In particular, we would highlight growth in the core, driven by ongoing strong retention and net new business generation. As we continue to deliver innovative solutions to our clients in a challenging environment. We saw increased organic revenue growth as compared to the third quarter despite that somewhat larger portion of more discretionary revenues in the fourth quarter. The strong results stem partially from improvements in economic factors, and sentiment around the virus and vaccine, which drives client buying behavior and investment.” --- Greg Case, CEO of Aon Last year, Aon generated $2.6 billion in free cash flow, up sharply from $1.6 billion in 2019. The firm spent $0.4 billion covering its modest dividend obligations in 2020 on top of $1.8 billion that was spent on share buybacks, and both activities were fully covered by its free cash flows last year. At the end of 2020, Aon had a net debt load of roughly $6.5 billion (inclusive of short-term debt), though we caution that the firm also had significant fiduciary and operating lease liabilities on the books as well. Please note that Aon’s current fiduciary liability line-item is matched by a current fiduciary asset line-item of the exact same size (at ~$13.8 billion as of the end of 2020). Willis Towers Watson Overview In 2020, Willis Towers Watson grew its GAAP revenues by over 3% year-over-year though significant operating expense growth saw its GAAP operating income slide lower by 11% year-over-year. However, that was partially due to expenses related to the pending combination of Aon and Willis Towers Watson. In the final quarter of 2020, Willis Towers Watson posted just under 3% GAAP revenue growth on a year-over-year basis, though its GAAP operating income was down by 15% year-over-year due in part to integration expenses and in part to headwinds due to the COVID-19 pandemic. Almost all of Willis Towers Watson’s revenue growth in 2020 came from its ‘Benefits Delivery & Administration’ segment. In July 2019, Willis Towers Watson acquired TRANZACT which is “a direct-to-consumer health care organization that links individuals to U.S. insurance carriers.” During Willis Towers Watson’s fourth quarter of 2020 earnings call management had this to say: “Revenue for the Benefits Delivery & Administration, or BDA segment increased by 16% on both a constant currency and organic basis from the prior year fourth quarter. The growth in revenue was largely driven by individual marketplace, primarily by TRANZACT, which contributed $279 million to BDA's topline this quarter, with growth in Medicare Advantage products. The Benefits Outsourcing business also contributed to the increase in revenue, which was largely driven by its expanded client base. The BDA segment had revenue of $693 million with a 50.7% operating margin, as compared to 52.4% in the prior year fourth quarter. The margin declined as TRANZACT's rapid growth outpaced the rest of the segment. We continue to be optimistic about the long-term growth of our BDA segment. The pandemic threated the well-being of people all over the globe. In this time of heightened stress and uncertainty, BDA empowers employees and retirees by providing easy access to the tools they need to understand their benefits options and to take control of their health care.” --- John Haley, CEO of Willis Towers Watson Willis Towers Watson generated $1.6 billion in free cash flow in 2020 (defining capital expenditures as ‘additions to fixed assets and software for internal use’), which was almost double year-ago levels. The company spent a bit over $0.3 billion covering its dividend obligations to common shareholders and did not spend a material amount buying back its stock last year. At the end of 2020, Willis Towers Watson had $3.5 billion in net debt (inclusive of short-term debt) along with sizable fiduciary and lease liabilities on the books. Please note that like Aon, Willis Towers Watson’s current fiduciary liability line-item is matched by a current fiduciary asset line-item of the exact same size (at ~$15.2 billion as of the end of 2020). It appears that the pro forma company should be comfortably free cash flow positive however, the enlarged entity will also have a sizable net debt load. We view that burden as quite manageable given that the pro forma firm will likely have rock-solid free cash flow generating abilities and due to the expected improvements in its cash flow profile going forward. That is on top of the sizable cash-like position both firms have on hand, which stood at a combined ~$3.3 billion at the end of last year (providing the pro forma entity with ample liquidity). Concluding Thoughts There is ample operational overlap between Aon and Willis Towers Watson, and a combination of the two should result in material synergies that go beyond back office consolidation efforts. Potential revenue-related synergies are intriguing, especially on the data and analytics front. We would want to see how integration efforts unfold first, and if regulators will allow the deal to proceed as envisioned, before updating our opinion towards the pro forma entity. On a final note, while the combined company will have a meaningful net debt load, its free cash flow generating abilities should impress and its cash flow growth outlook is supported by expected improvements in its cost structure. We are intrigued by this merger. --- Related: AON, WLTW, MMC, ALL, PGR, CB, HIG, TRV, ACGL, RNR, AJG, BHF, MET, LNC, PRU, NGHC, AIG, TRRSF, EQH Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

|

0 Comments Posted Leave a comment