Member LoginDividend CushionValue Trap |

Ameresco Targets Green Growth by Offering Customers Cost Savings

publication date: Aug 7, 2020

|

author/source: Callum Turcan

Image Source: Ameresco Inc - May 2020 IR Presentation By Callum Turcan We are going to cover Ameresco Inc (AMRC) in this article. Given the company’s more novel business strategy, we will start off by going over its operations before digging into its financials. Ameresco’s financials have held up well so far during the first half of 2020 in the face of the ongoing coronavirus (‘COVID-19’) pandemic, though we caution its financial statements can be a messy read. Operations Overview Ameresco offers a slate of comprehensive energy services that primarily involve designing, engineering, and installing projects at its client's operations. That includes upgrading the heating, cooling, ventilation, and lighting systems of its client's major facilities to improve efficiency (with an eye towards reducing energy consumption). By adding smart metering technology, upgrading lighting with light-emitting diode (‘LED’) systems, developing intelligent microgrids, building water reclamation infrastructure, and adding battery storage operations to these facilities, the goal is to cut down on its client’s operating and maintenance (‘O&M’) expenses over the long-term. Please note Ameresco often assists in helping its clients secure the funding needed to cover these investments, which we will cover later on in this article. Additionally, please note that once a project is complete, there are many instances where Ameresco secures a multi-year O&M contract to operate, maintain, and repair its client’s energy systems which provides the firm with recurring revenue streams. Though recurring revenue streams represent a modest portion of its total revenues, those revenues generate most of Ameresco’s EBITDA as you can see in the upcoming graphic down below (the picture cites first quarter 2020 data).

Image Shown: An overview of the significance of Ameresco’s reoccurring revenue streams as it relates to its overall profitability, using data from the first quarter of 2020. Image Source: Ameresco – May 2020 IR Presentation Furthermore, the company also develops small-scale renewable energy plants for its clients, particularly at or close to a client’s existing operations, with most of those plants being either solar photovoltaic (‘PV’) or landfill gas (‘LFG’) facilities. Ameresco notes its largest project in this space was a renewable energy facility powered by biomass. Please note that Ameresco sometimes retains ownership and operatorship of these facilities. The electricity, thermal energy, and “processed renewable gas fuel” that are generated by these facilities are generally sold under long-term contracts with the customer. At the end of 2019, Ameresco owned and operated 74 PV solar plants, two wastewater biogas plants, and 23 “renewable LFG plants” which combined “have the capacity to generate electricity or deliver renewable gas fuel producing an aggregate of more than 259 megawatt equivalents.” Ameresco operates in the US, Canada, the UK, and Greece. Historically speaking, “federal, state, provincial or local government entities” represent about ~75% of its annual revenues. Ameresco’s largest customer is the US federal government, which represented ~33% of its revenues in 2019. Part of Ameresco’s business model is built upon the company being able to provide its clients assistance in securing third-party financing (along with grants, subsidies, and rebates from government entities). The goal is to allow Ameresco to provide its customers with these upgrades with minimal to no upfront capital costs, which are steadily repaid over time (we will cover this in much greater detail later on). Financial Overview For some background, please take a look at the upcoming graphic down below. We appreciate the steady revenue and operating income growth Ameresco has been able to generate over the past few years. Ameresco’s growth trajectory has been supported by its growing backlog. The company’s project backlog stood at $1.1 billion at the end of 2019 (just including signed customer agreements), up from $0.7 billion at the end of 2018. Additionally, Ameresco had been awarded projects worth $1.2 billion that were not yet covered by signed customer contracts at the end of last year.

Image Shown: The figures above are in thousands of US dollars and represent Ameresco’s GAAP financial performance from 2017 to 2019. ‘YoY’ stands for year-over-year, ‘Op’ stands for operating. Image Source: Valuentum, with data sourced from Ameresco’s 2019 Annual Report In the first half of 2020, Ameresco generated $435 million in GAAP revenues, up 25% year-over-year. Management noted the firm reported strong demand for “design-build projects”, assisted by recent acquisition activity. Ameresco’s GAAP operating income was up 14% year-over-year during this period. Though impressive performance given the headwinds created by COVID-19, we want to stress that Ameresco’s GAAP operating margins came under pressure during the first half of this year due to its weakening GAAP gross margins. Those pressures were modestly offset by its SG&A expenses declining by 1% year-over-year during this period. The company’s GAAP gross margin contracted by ~385 basis points year-over-year during the first half of 2020, in part due to design-build projects carrying lower margins. Additionally, management noted that expenses involving dealing with the ongoing pandemic held down its first half performance, as did unplanned maintenance expenses. Looking Ahead Going forward, Ameresco sees its gross margin rebounding during the second half of 2020 according to management commentary provided during the firm’s second quarter earnings call. Combined with operating expense curtailment efforts, the company’s operating margins appear likely to rebound in the near-term if its guidance holds true. The company’s near-term performance is supported by its $1.0 billion project backlog at the end of June 2020 (just signed customer agreements), along with an additional $1.2 billion in projects that have been agreed upon, though the contracts have not yet been signed. In the upcoming graphic down below, Ameresco highlights its full-year guidance for 2020. At the midpoint, the company is forecasting it will generate 9% annual sales growth this year which we can appreciate, given the headwinds posed by the ongoing pandemic. Additionally, Ameresco expects to generate over 17% annual non-GAAP adjusted EBITDA growth in 2020 at the midpoint. Its full-year gross margin is ~110 basis points higher at the midpoint than its first half 2020 performance, highlighting the strong rebound management is expecting during the second half of this year. Ameresco reaffirmed its full-year guidance during its latest earnings report.

Image Shown: An overview of Ameresco’s full-year guidance for 2020. Image Source: Ameresco – Second Quarter of 2020 Earnings Press Release Balance Sheet and Financing Arrangement Considerations Ameresco exited June 2020 with $42 million in cash and cash equivalents on hand (along with $15 million in restricted cash). Stacked up against $44 million in short-term debt and finance lease liabilities, along with $295 million in long-term debt and finance lease liabilities, the firm’s net debt position is a burden that needs to be kept in mind. The company is capital market dependent as it has not historically been free cash flow positive in a traditional sense, though its cash flow statements are a messy read. That means Ameresco must be able to raise funds in debt and equity markets at attractive rates to cover its cash flow outspend and to refinance maturing debt. During the first half of 2020, Ameresco generated negative net operating cash flows, as was the case during the full-year periods from 2017 to 2019. Should Ameresco lose access to capital markets at attractive rates, its ability to function would be seriously impaired. Ameresco’s cash flow statement for the first half of 2020 is highlighted in the two upcoming graphics down below.

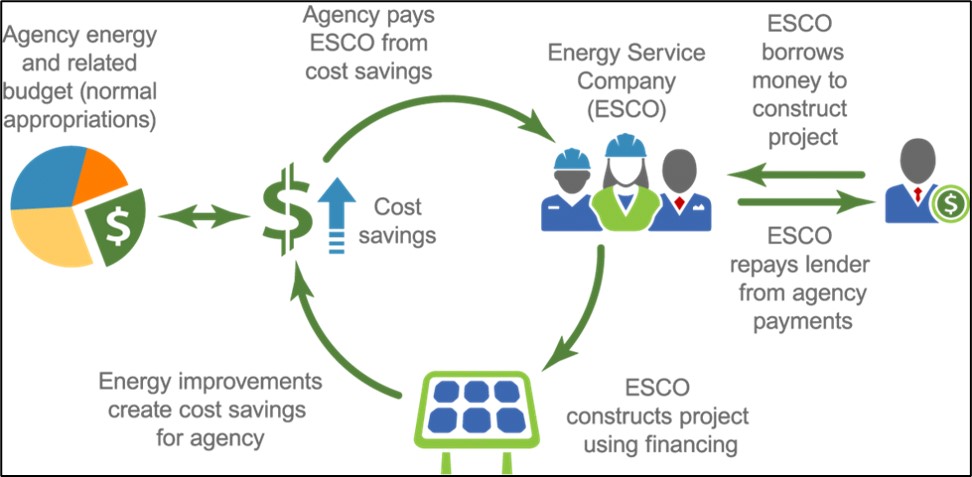

Images Shown: We caution that Ameresco’s cash flow statements are a messy read due to its financing arrangements with many of its key customers. Key line-items are underlined in red. Images Source: Ameresco – Second Quarter of 2020 Earnings Press Release with additions from the author Please note that part of Ameresco’s financing assistance offerings involves utilizing energy savings performance contracts (‘ESPCs’), which are awarded by federal US agencies to an energy service company (‘ESCO’) like Ameresco. Here is an excerpt on the nature of these contracts from the US Department of Energy’s website (‘DOE’): Energy savings performance contracts (ESPCs) are a partnership between a federal agency and an energy service company (ESCO). After being selected for a potential award, the ESCO conducts a comprehensive facility energy audit and identifies improvements to save energy. In consultation with the agency, the ESCO designs and constructs a project that meets the agency's needs and arranges financing to pay for the project. The ESCO guarantees that the improvements will generate sufficient energy cost savings to pay for the project over the term of the contract. After the contract ends, all cost savings accrue to the agency. The agency is responsible for contract administration for the entire term of the contract. In the upcoming graphic down below, the DOE provides a visual representation of how this process plays out. Please note that this financing arrangement requires the ESCO, in this case Ameresco, to tap outside sources of funding to cover the upfront costs.

Image Shown: An overview of how ESPCs, US federal government agencies, and the ESCO in question interact with each other in terms of cash flow movements over time. The ESCO in question needs to tap outside lenders for funds, or use cash on hand, to cover the upfront costs associated with these energy efficiency improvement projects. Image Source: US Department of Energy – Website When Ameresco gets paid for the services provided under the ESPC, that is listed as a financing cash flow activity. During the first half of 2020, the firm received $134 million in ‘proceeds from Federal ESPC projects’ that when factored into its traditional net operating cash flows would have turn the reported -$74 million (negative $74 million) into a positive $60 million adjusted net operating cash flow figure. The company highlighted this adjusted cash flow figure in its latest earnings press release which is dubbed ‘adjusted cash from operations’ though we prefer the traditional understanding of free cash flow. Ameresco still would not have been free cash flow positive during this period even with that adjustment given that it spent $77 million on ‘purchases of energy assets’ and $1 million on ‘purchases of property and equipment,’ keeping in mind that the purchases of energy assets appears to be a capital expenditure-like item (considering that Ameresco will at times continue to own and operate the energy assets going forward). At the end of June 2020, Ameresco had $274 million in long-term ‘Federal ESPC receivable[s]’ on its balance sheet along with $335 million in long-term ‘Federal ESPC liabilities.’ Management Commentary In the upcoming excerpt down below from the firm’s latest earnings call, Ameresco highlights how the company and its clients have been handling the COVID-19 pandemic: “Given ongoing budget constraints, worsened by COVID-19 municipalities across the country are looking for quick payback, money-saving projects. In response to this, Ameresco launched a customer-focused initiative promoting health and safety in the workplace, passive controls, updated HVAC systems, automated entry and access systems are just a few of the energy conservation measures that can be -- can make an immediate impact on reopening offices, schools, campuses, and facilities. These measures can be often implemented as part of the overall energy efficiency project with zero upfront costs. In addition, Ameresco continued our extensive work with LED streetlight conversions. With decades of experience and many large deployments under our belt, Ameresco is now the nation's largest ESCO provider of municipal LED streetlight conversion services. Dramatic cost reclines in LED technology has created a rapid payback for LED conversion projects, providing energy savings of 60% to 70% compared with legacy lighting solutions. In addition to immediate energy savings, LED conversions also substantially reduce expensive ongoing maintenance costs, given the much longer life span of LED technology. This is especially true for lights on high-speed roadways, given the extra requirement for expensive traffic control. Even though the savings are clear, only about half of existing municipal streetlights and traffic signals have been converted to LEDs. We expect the additional financial pressures from COVID-19 on municipalities will only accelerate the historic conversion rate and adoption of advanced technology controls. Ameresco is not only able to perform the conversion work, but we also can provide or assist in financing these projects creating an extra incentive requiring no upfront capital.” --- George Sakellaris, CEO and President of Ameresco We caution that stresses facing local and statement government bodies in particular (due to COVID-19) could negatively impact Ameresco. That being said, management reaffirmed Ameresco’s full-year guidance during the firm’s latest earnings report, highlighting the company’s confidence in its near-term performance. Long-Term Growth Ameresco seeks to capitalize on several secular growth tailwinds that are expected to materially grow its total addressable market (‘TAM’) over the coming years with an eye towards markets concerning distributed generation, distributed energy storage, electric vehicle (‘EV’) charging infrastructure, and microgrids. This is on top of the expected growth in energy efficiency projects over the coming years, as you can see in the upcoming graphic down below.

Image Shown: An overview of the forecasted growth in the markets Ameresco caters to through the mid-2020s. Image Source: Ameresco – May 2020 IR Presentation Based on these forecasts, Ameresco is guiding for its TAM to grow by roughly 150% from 2017 to 2026. It will be important for Ameresco to continue delivering top-tier operational execution, as current and potential customers are banking on the firm completing these energy saving projects in a timely and (most importantly) cost effective manner. Concluding Thoughts Ameresco is an interesting company that is capitalizing on some powerful secular growth tailwinds. We appreciate the company’s focus on recurring revenue streams, keeping in mind those represent just a modest portion of its business as things stand today. During the first half of this year, Ameresco won contracts (both signed and yet to be signed) worth just under $0.5 billion, highlighting its ability to keep winning new business. With an Enterprise Value to Adjusted EBITDA ratio of ~16 as of this writing (based on its forecasted adjusted EBITDA for 2020), Ameresco’s equity appears to carry a premium valuation. The company’s growth runway is quite long, and its financial performance has held up during the initial stage of the ongoing COVID-19 pandemic so investors have responded accordingly. As of the end of normal trading hours on August 5, shares of AMRC are up ~71% year-to-date and have more than doubled over the past year as of this writing. To justify its valuation, Ameresco will need to continue to shine. Related: AMRC, PBW, PBD, PZD, ACES, DWMC, QCLN, URTY ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Callum Turcan does not own shares in any of the securities mentioned above. Both the simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios include a SPDR S&P 500 ETF Trust (SPY) put option holding with a $295 per share strike price that expire on August 21, 2020. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

1 Comments Posted Leave a comment