Member LoginDividend CushionValue Trap |

ALERTS: Big Changes to the Portfolios; Goodbye Apple!

publication date: Jan 13, 2020

|

author/source: Callum Turcan and Brian Nelson, CFA

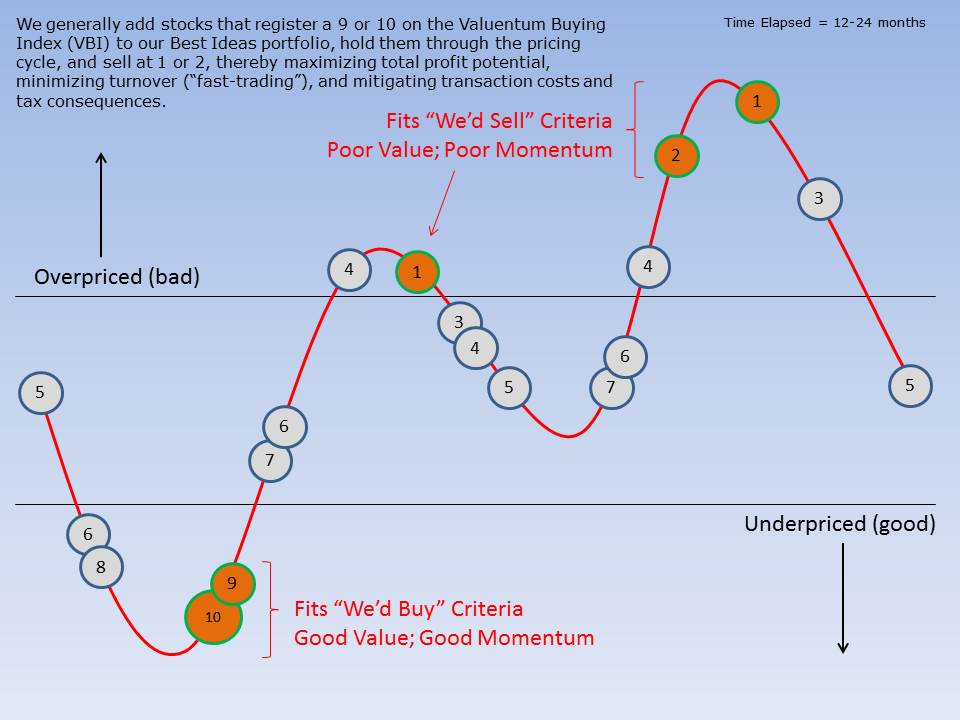

Image Source: GDS-Productions Summary Best Ideas Newsletter portfolio Remove: AAPL (7%-12%), GM (2.5%-4%) = 9.5%-16% Add to PYPL (increase weighting by 3%, to the range of 5.5%-7%), add DIS (2.5%-4%), add XAR (4%-5.5%) = 9.5%-14% Dividend Growth Newsletter portfolio Remove: AAPL (5.5%-7.5%), GM (3.5%-5.5%) = 9%-13% Add: BAC (2.5%-3.5%), NEM (2.5%-3.5%), RSG (2.5%-3.5%), LMT (2.5%-3.5%) = 10%-14% ----- By Callum Turcan and Brian Nelson, CFA We are making a number of changes to the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio as this market continues full steam ahead. We remain near fully invested in both newsletter portfolios, but we are positioning them more defensively as we enter 2020. The following changes will be reflected in the newsletter portfolios upon publishing of the next editions, respectively. The first change is probably expected. We are closing out a huge winner in Apple (AAPL) in both newsletter portfolios. The iPhone maker has surged past the high end of our fair value estimate range (now even higher than our latest upward revision – see Apple’s stock page here), and its shares are very extended from a technical standpoint at the moment. The firm now registers one of the lowest ratings of a 2* (1=worst) on the Valuentum Buying Index (VBI), suggesting its rally is getting very tired. Apple has been a huge winner in both newsletter portfolios (see here and here), but consistent with our methodological process, we generally add companies to the Best Ideas Newsletter when they register a high rating on the VBI (generally a 9 or 10), and we generally remove them when they register a low rating on the VBI (generally a 1 or 2). The holding period for this to occur could be years, and in Apple’s case, it has been about 9 years in the Best Ideas Newsletter portfolio. Valuentum is low turnover; momentum is high turnover. Apple has simply dominated this decade, and it has been at or near the top of the newsletter portfolios (in terms of both portfolio weightings and returns) since inception. We’re also removing General Motors (GM) from both newsletter portfolios. GM has been roughly flat since it was added to the newsletter portfolios, and while it is paid out a nice dividend yield along the way, we’ve grown less optimistic on shares in light of worsening labor relations, the ongoing US-China trade wars, and the resurgence of Tesla (TSLA). We think Tesla’s Cyber Truck is a game-changer that structurally changes consumer preferences, and GM is behind the curve. For starters, it took the rapid pre-ordering pace of the Cyber Truck for GM to revive the Hummer as a new electric pickup model. This was GM’s market, but it simply dropped the ball with its continued lack of focus on innovation; as a result, we expect it to cede considerable share to Tesla. We expect the Cyber Truck to be a huge success, and the market is sensing this, too. Shares of Tesla are trading over $500 at the moment, and while we think Tesla is “uninvestable” given its wide range of fair value outcomes, its thirst for innovation will continue to make life hard on GM. We’re out. We’ll be replacing the weightings of Apple and GM in the Best Ideas Newsletter portfolio by increasing the weighting in PayPal (PYPL). In this overheated market, shares of PayPal continue to trade below our fair value estimate with room for tons of upside via Venmo, its purchase of Honey, and strong total payment volume growth companywide. We’re also adding Disney (DIS) to the Best Ideas Newsletter portfolio given the strength of Disney+, its stellar IP portfolio and movie performance, strong live sports position, majority equity stake in Hulu (~67%), the profitability of its theme parks, and the ability to wring out synergies after buying 21st Century Fox. We’re also adding the SPDR S&P Aerospace & Defense ETF (XAR). Geopolitical uncertainty continues with US-Iran tensions, the US-China trade war, and ongoing threats from North Korea, among other national defense priorities. Following the assassination of their top military general, Iran deliberately attacked military bases in Iraq housing coalition forces and shot down a commercial jetliner with dozens of Canadian citizens on board. Cooler heads have since prevailed, but we wonder just how long coalition forces and Canada’s allies will allow Iran’s behavior to continue. Nobody wants a war, but we don’t have to look much further than World War I to point to the assassination of Archduke Franz Ferdinand and the sinking of the passenger liner Lusitania as causes of global conflict. We think the SPDR S&P Aerospace & Defense ETF offers a diversified way to gain exposure to these growing geopolitical tensions that won’t go away anytime soon. Drivers of defense spending tend to ebb and flow with geopolitical threats rather than the general economy, so we like the XAR’s counter-cyclical exposure, especially as markets hover near all-time highs (about the XAR). To replace Apple and GM in the Dividend Growth Newsletter portfolio, we’re spreading the proceeds across four largely defensive positions, with decent dividend yields and strong dividend growth prospects. First, we’re adding one of our favorite banks, Bank of America (BAC), to the Dividend Growth Newsletter portfolio. Shares are now trading roughly in-line with our fair value estimate, but we continue to like how the bank is executing in the areas of both growth and efficiency. Read our latest primer on the banking sector here. We’re also diversifying into a gold miner, and one that has raised its dividend in a big way recently. You can read our latest take on Newmont Mining (NEM) here. We’re adding back one of our favorite companies, Republic Services (RSG), a garbage hauler. Trash takers have recession-resistant business models, and we think shares of the group, while not cheap, have a tendency to outperform when things get tough. We like this positioning this far into the cycle. Another addition is Lockheed Martin (LMT), prime contractor on the $1+ trillion F-35 next generation fighter aircraft program, which fits the mold of playing rising geopolitical tensions across the globe. Bank of America yields ~2%, Newmont Mining yields 2.3%, Republic Services yields 1.8%, and Lockheed Martin yields 2.3%. Bank of America’s dividend is solid, and the Dividend Cushion ratios of Newmont, Republic, and Lockheed speak to resilience, coming in at 2.2x, 1.9x, and 1.8x, respectively (anything north of 1.3x is rather secure). Though the valuation opportunities for these new adds to the Dividend Growth Newsletter portfolio aren’t as robust as we would like, we like how they are positioned in today’s environment and view their payouts as rock solid. That’s it for now. Please let us know if you have any questions. ---------- * Note that empirical analysis of the VBI rating of 2 is the foundation for the ultra-momentum factor, and we could see Apple continue to surge to what is commonly referred to as a blow-off top before collapsing. Please note the location of the VBI rating of 2 in the hypothetical illustration below. Source: Value and Momentum Within Stocks, Too (pdf)

Image shown for informational/illustration purposes only. |

2 Comments Posted Leave a comment