Member LoginDividend CushionValue Trap |

ALERT: Going to “Fully Invested” -- The Fed and Treasury Have Your Back

publication date: Apr 29, 2020

|

author/source: Brian Nelson, CFA

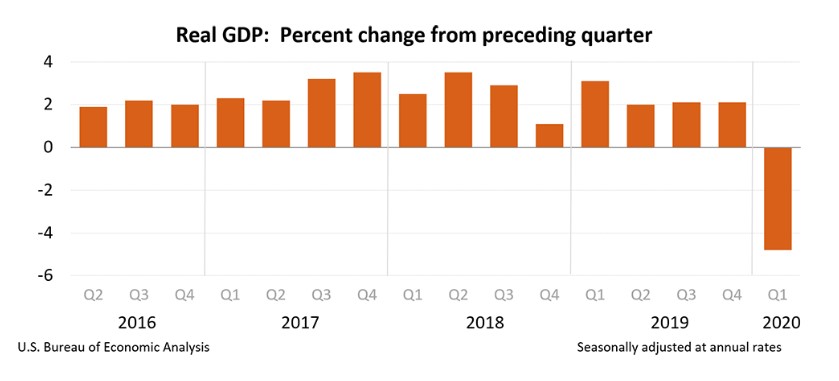

Image Source: BEA. Real GDP fell at an annual pace of 4.8% in the first quarter of 2020, according to the "advance" estimate released by the Bureau of Economic Analysis. Summary For members to our new options commentary service, the second April options idea will be released tomorrow. We’re taking the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio to “fully invested,” scaling up our existing positions to reflect that status. We plan to consider put options to hedge against downside risk, if or when the time comes. Moral hazard continues to run rampant, and the Fed and Treasury may have no choice but to continue artificially propping up this market, even buying stocks through certain vehicles, if necessary. Having warned members about the impending “Great Crash of 2020” and identifying savvy opportunities near the bottom, we are now withdrawing our S&P 500 target range as we move now to focus more on individual ideas through this turbulence. We expect to continue to identify opportunities for relative outperformance. 2019 was one of the best years in the Best Ideas Newsletter portfolio yet. In the Exclusive, we just registered our 25th consecutive monthly short idea in a row that has worked out. The markets may go much lower from here before we go higher again, but the Fed and Treasury won’t let this market go down in the longer run, in our view--even as we navigate a Depression-type economic environment in the near term. Stay the course. By Brian Nelson, CFA In the past, we’ve talked extensively about a blow-off top scenario in the equity markets, despite Depression-type economic numbers, and we think this is growing more likely given recent stock market pricing action. A number of members were able to potentially dollar-cost average near the bottom of this swoon with some of our favorite picks amid COVID-19 (see here and here). We’re now going to “fully invested” in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio, at levels well below where we alerted members to consider put options near the February top. As we did in warning about the “Great Crash of 2020,” we plan to consider put options to hedge against downside risk, if or when the time comes. At this time, we are also withdrawing our S&P 500 target range, as we prioritize individual idea generation and stock selection. What is our rationale to move to “fully-invested” now? For starters, it’s becoming more and more difficult to envision a scenario where the Fed and Treasury aren’t going to artificially prop up this market at any and all costs to preserve the wealth effect (stock market wealth helps the economy), and that, itself, is fueling more buying and moral hazard at the expense of prudent investors. If stocks do start to revisit the March 23 lows, it’s probably very likely the Fed would step in (or threaten) to actually buy stocks (as it is doing with junk bond ETFs) through certain vehicles, and that view alone may be enough to avoid such a “revisit-the-lows” scenario. Against a backdrop of unlimited quantitative easing and runaway government spending plus the Fed/Treasury put, it’s hard for stocks to reflect true price discovery (if indexing and quant weren’t enough, read Value Trap), especially with Fed-backed credit markets willing to lend to zombie entities and what looks to be very little possibility for actual bankruptcies—Whiting Petroleum (WLL) and JC Penney (JCP) are two of maybe a few in the news. It seems as though the Fed and Treasury will do anything to keep stocks moving higher, no matter what, even buying them outright. Separately, the Fed and Treasury may be joined at the hip with regulatory policy. How seemingly wrong is it for Vanguard to buy anything at any price, as in indexing, and receive implicit support via lifelines to the airlines (Vanguard owns about 6-9% of the major airlines). Furthermore, the public backlash against Boeing (BA) remains in light of 737 MAX troubles, yet Vanguard, which again is not doing any due diligence on individual holdings in the traditional sense, is the largest owner of the company at 7%+. It seems flat-out wrong that Vanguard’s lack of due diligence and its buy-anything-at-any price strategy isn’t being drilled by Congress at the moment (in fact, nobody is talking about it), and that the U.S. is not looking to tax index funds due to their irresponsible behavior (and to pay for their implicit bailout given their equity stakes in the airlines), or even consider raising corporate taxes to support the growing fiscal deficits and sovereign debt load. Furthermore and importantly, if fiduciaries are allowed to own index funds, despite what has happened during this crisis and the volatility that has ensued, and as a result are still largely buying anything at any price (perhaps a more accurate definition of indexing)--and this is also okay with regulators--then how can the Fed and Treasury not continuously support prices? Prudent investors were ready to scoop up even more bargains (with expectations of further declines from the March 23 lows), but instead, the Fed and Treasury bailed out indexers and quants (again). Due diligence doesn’t seem to be the regulatory emphasis, but rather regulators continue to seemingly support a buy-anything-at-any-price strategy (the Fed is even doing this). As a result, the government is probably on the hook to continue to prop up the markets if anything goes wrong. This line of thinking may come down to the view that if Vanguard is somehow not responsible for its lack of due diligence on individual holdings and can get an implicit bailout via its major ownership in the airlines, how can the government put any responsibility on the investor at all, especially with buy-anything-at-any-price fiduciary rules on the books? Let’s not forget that we are still in the midst of a global pandemic, however. Of course we don’t think the V-shaped economic recovery is going to happen, but because the rest of the world is so much worse off than the US as it relates to economic health, the Fed/Treasury can keep stimulating for months and months, and it may not have much of an impact on the US dollar or much of anything. Currency is relative to other countries, and if other countries are doing worse economically than the US, such repercussions may be muted, if noticeable at all. What is even more startling, however, is that there’s not even a consideration of reverting to prior corporate tax rates despite all of the outsize government spending (the one prudent member of Congress that even inquired about whether spending trillions was reasonable was ridiculed). There now seems to be even less responsible investing given the buy-at-any-price mentality that has been bailed out again, and there’s very little responsible spending with respect to fiscal policy given all the ridiculous bailouts of airlines and beyond (there’s little consideration of the national debt at this point). As we’ve noted, the Fed and Treasury may not be effective in staving off a Depression, as we’ve already witnessed Depression-type numbers with unemployment rates—the real unemployment rate at the moment may be 20%+--and the first indication that GDP may be worse than expected (down 4.8%)--but the stock market could still take off regardless of the economy (and the terrible data that comes in during the next few quarters). We’re also starting to get progress with COVID-19, too, with Gilead’s remdesivir, even if a vaccine is not effectively manufactured for years. We maintain our view that it's likely the economy may have to be shut down again as a result of too-rapid of a re-opening, and this may require trillions more in stimulus in the coming months (if it happens), but if Congress is not even talking about replacing government coffers with higher corporate tax rates, and if the rest of the world is so worse off than the US, we can’t point to many negative repercussions on the equity markets as a result of government policy. All things considered, we think the Fed/Treasury has your back, and that’s how we’re going to play it for the foreseeable future. It’s not as easy calling market direction from here as it was near the top in February or even in calling for dollar-cost-averaging near the bottom in mid-March, but as has always been the case, we will continue to focus on generating outperformance in the newsletter portfolios via idea generation and stock selection. Expect more volatility going forward as the news continues to ebb and flow. --- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson owns shares in SPY and SCHG. Some of the other securities written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |

5 Comments Posted Leave a comment