Member LoginDividend CushionValue Trap |

Volatility Spikes, Oh Cisco, the Mighty US Dollar, and More

publication date: May 17, 2017

|

author/source: Brian Nelson, CFA

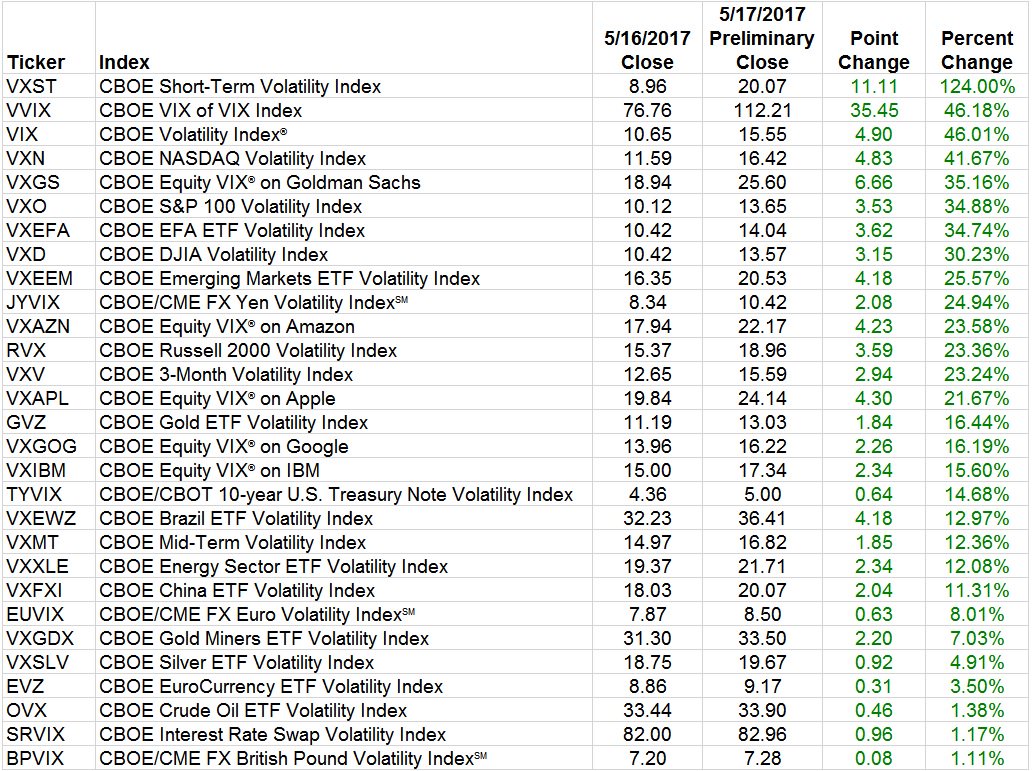

Image Source: CBOE Let’s talk about recent market events May 17. There’s a lot going on. By Brian Nelson, CFA It looks like volatility is back in a big way, with “all 29 volatility indexes at the CBOE ris(ing) today,” one more-than-doubling, the CBOE Short-Term Volatility Index (VXST). The ridiculously-named “fear gauge” or “fear index” or the CBOE Volatility Index, the VIX (VIX) leapt nearly 50%. On May 17, we effectively bought volatility intraday by adding put options to the newsletter portfolios, both on the S&P 500 SPDR (SPY) and Netflix, a company whose valuation we think remains ridiculous. We may continue to add put options on entities whose equity prices we believe have become too stretched, positions that may be aided by the increased cost of adding protection, which is favorably impacted by rising rates of volatility. The CBOE NASDAQ Volatility Index (VXN) also spiked nearly 50% on the trading session May 17, and the measure likely won’t be helped by Cisco’s (CSCO) weak revenue guidance after the close. The networking giant put up a solid fiscal 2017 third-quarter report, better than expected, but it guided fiscal fourth-quarter (the current quarter) revenue and earnings below expectations. For non-GAAP earnings per share, Cisco is targeting $0.60-$0.62 in the fourth quarter, the midpoint slightly below consensus numbers, while revenue expectations for the period are in the range of $11.88-$12.13 billion, also below expectations, and implying a 4%-6% decline. We weren’t pleased to see product gross margins during the fiscal third quarter decline either, with the networking giant blaming pricing and product mix for the headwind. Cash conversion remains solid, however, with cash flow from operations of $3.4 billion in the quarter, up 10% from the mark in last year’s period. Cash and cash equivalents stood at $68 billion at the end of the fiscal third quarter. We’re not worried about Cisco’s financial health at all. The company will get a chance to buy back its stock at a lower price. We’ve been watching performance of the US dollar given its implications on US ADRs and revenue trends of multinationals, which often face headwinds as the greenback strengthens. Ongoing uncertainty in Washington amid talks of a possible Trump impeachment (the Comey memo), as unlikely a scenario as it might be, the US dollar has given back all of its post-election gains. This might help GAAP reporting at some of the largest US-based multi-nationals (as currency translation impacts are mitigated), but the market has been making adjustments related to this since the beginning of time, it seems, so the trading impact may be immaterial. Interestingly, as the US dollar has fallen, the 10-year Treasury yield (TLT, TBT) has fallen with it (to 2.22%), an interesting dynamic as usually, a weakening dollar often signals the sale of US Treasuries (as money moves out of the US), and correspondingly a rising interest-rate environment. Market participants seem to be growing less confident in the pace of Fed rate hikes this year. It would also appear that most of the selling is happening in equities as worries that Trump’s ambitious agenda may not come to fruition creep into the market, ever so subtly. Reduced prospects for bank regulatory reform and a flattening yield curve aren’t helping sentiment related to the financials (KBE, KRE, XLF). Despite the growing uncertainty, we continue to have a difficult time making the case to own gold (GLD) or silver (SLV). Things aren’t that dire. We received word that Kraft Heinz (KHC) may be putting together a bid for Colgate-Palmolive (CL), and while the deal makes sense on some strategic levels, we think it probably has more to do with Kraft Heinz looking to make “something happen” to justify its own exorbitant valuation. Kraft-Heinz’s shares are overpriced, in our view, but not unlike those of other consumer staples (XLP) entities, however. According to FactSet, consumer staples equities are trading at 20+ times forward earnings, above their 10-year average of ~16 times. The group has a long way to come down to revert to normalized measures, but so does the market, which itself is trading at 17.5 times forward earnings, above near-term historical averages. If Kraft Heinz does put together an offer for Colgate-Palmolive, we hope it uses equity, but something tells us that debt will be a huge portion of any future transaction. Unilever (UL, UN) could be involved in M&A talks, too. We’ll just have to wait and see how things unfold. Retail continues to be in a world of hurt, with Dick’s Sporting Goods (DKS) perhaps epitomizing the latest troubles. First, the company disclosed an accounting error May 12 that said it overstated fiscal 2017 EBITDA by a sizable sum and then it dropped another bombshell on investors May 16, with same-store sales coming in much lighter than expected during its first fiscal quarter ending April 29. Many have posited that Dick’s is immune to the threat of Amazon (AMZN), but we’re not so sure. Interestingly, May 16 marked the twentieth year since Amazon made its debut on the Nasdaq, and news the e-commerce giant may be building its own internal pharmacy benefits manager (PBM) has investors in CVS Health (CVS) and Walgreens (WBA) somewhat on edge. Frankly, it’s too early to tell what the long-term implications are with this initiative, and with the healthcare backdrop in flux given the very recent political uncertainty, we doubt we’ll hear much more about this anytime soon. I encourage you to read the May edition of our Best Ideas Newsletter here (pdf), where I touch briefly on an idea to capture the proliferation of spending related to cybersecurity, namely via the PureFunds ISE Cyber Security ETF (HACK). The WannaCry “randomware” attack coupled with news that hackers infiltrated Disney’s (DIS) security to steal an upcoming film, perhaps the latest Pirates of the Caribbean sequel, is enough, in my view, to support the thesis behind expectations calling for considerable growth in cybersecurity spending. Netflix recently had its own run in with hackers that released episodes of Orange is the New Black after it declined to pay a ransom. Both Disney and Netflix have their own respective problems as it relates to the shifting media landscape, the former with ESPN in particular, which continues to suffer from higher programming costs. As I wrap up this note, I wanted to make quick mention of Home Depot’s (HD) first-quarter results, released May 16. I have been continuously impressed with the company’s ability to execute during this cyclical upswing in housing, and I encourage readers to listen in to our previous podcast on the company. Even though we’re cautious on its valuation, there’s a lot to like about Home Depot on a fundamental basis, “Housing Is Back! Trends in Home Improvement (November 2016).” That’s all for now! Currency ETFs: FXE, UUP, EUO, UDN, FXB, ERO, GBB, USDU, DRR, ULE, EUFX, URR Other Volatility Indices: VVIX, VXGS, VXO, VXEFA, VXD, VXEEM, JYVIX, VXAZN, RVX, VXV, VXAPL, GVZ, VXGOG, VXIBM, TYVIX, VXEWZ, VXMT, VXXLE, VXFXI, EUVIX, VXGDX, VXSLV, EVZ, OVX, SRVIX, BPVIX Tickerized for holdings in HACK. |