Member LoginDividend CushionValue Trap |

ICYMI: Valuentum’s Improved Stock and ETF Web Pages

publication date: Apr 18, 2018

|

author/source: Brian Nelson, CFA

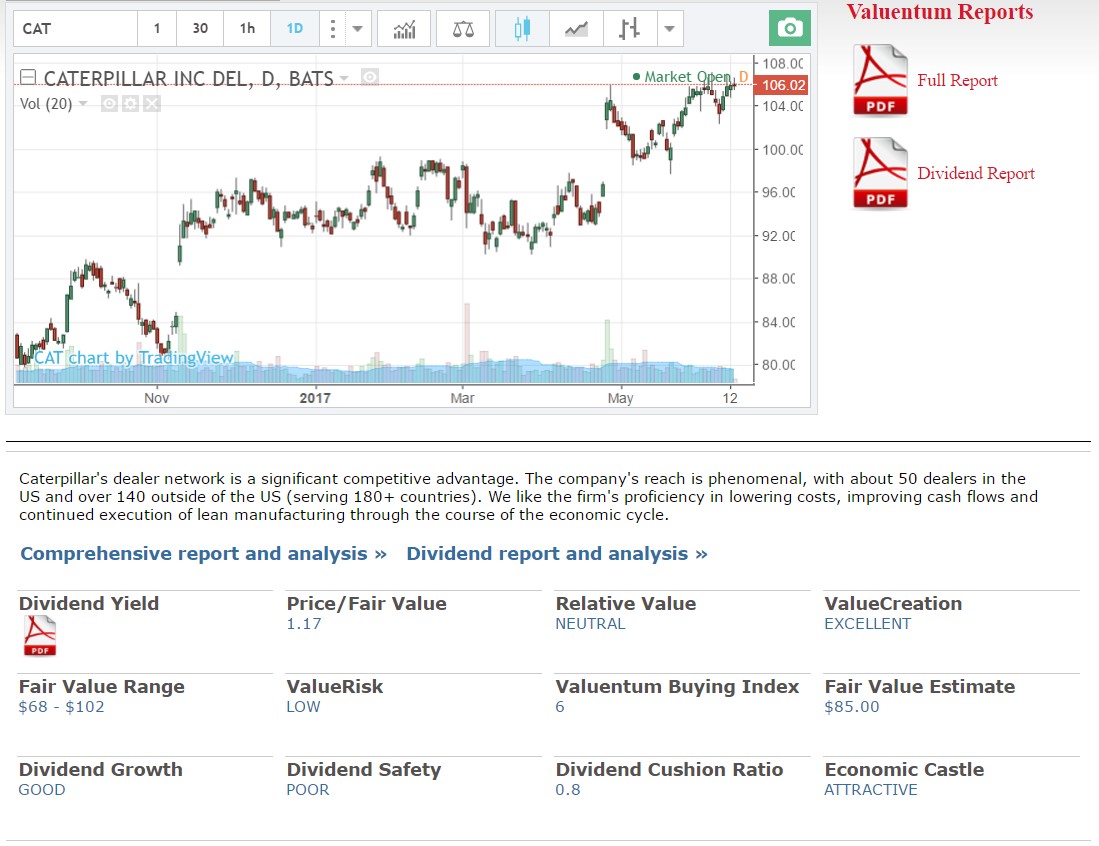

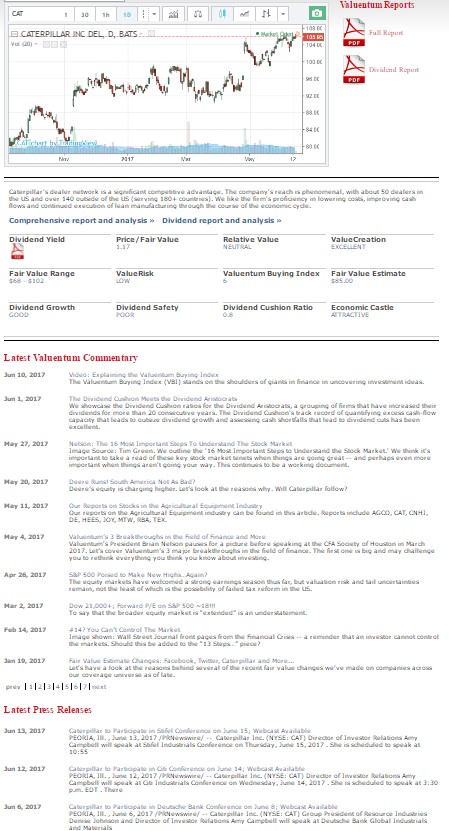

Valuentum has rolled out improved stock and ETF web pages on its website www.valuentum.com. Now, subscribers can access key proprietary information on the stock and ETF web pages in addition to the customary stock and ETF reports. Dear reader, We have some exciting news that we can’t wait to share with you! At www.valuentum.com, we have rolled out new stock and ETF pages that conveniently include a variety of our proprietary metrics from the Dividend Cushion ratio to the Economic Castle rating and beyond! There’s even mouseover functionality so you can learn about how we define the key metrics across our stock-selection and dividend growth methodologies. You’ll still have access to the stock and dividend reports on the landing pages, of course, as well as advanced real-time charting technology. Valuentum’s commentary and the company’s latest press releases will also be available on the landing pages. We continue to invest in Valuentum to make it the most valuable independent resource for investment opinion and analysis on the web. Please have a look at the new landing pages when you have a chance! Here are some examples. Caterpillar: https://www.valuentum.com/search2?searchtext=cat&searchtype=symbol Exxon Mobil: https://www.valuentum.com/search2?searchtext=xom&searchtype=symbol Cracker Barrel: https://www.valuentum.com/search2?searchtext=cbrl&searchtype=symbol Microsoft: https://www.valuentum.com/search2?searchtext=msft&searchtype=symbol Vanguard REIT ETF: https://www.valuentum.com/search2?searchtext=vnq&searchtype=symbol Guggenheim S&P 500 Equal Weight Industrials: https://www.valuentum.com/search2?searchtext=rgi&searchtype=symbol We’ve also updated the FAQ and a variety of other pages on our website: FAQ: https://www.valuentum.com/articles/20120411_2 How Do We Use the Valuentum Buying Index?: https://www.valuentum.com/articles/20120823 Why Simulated Newsletter Portfolio Holdings Can Sometimes Have Low VBI Ratings: https://www.valuentum.com/articles/20151026_1 A snapshot of the full stock and ETF web page shown below.

|