Member LoginDividend CushionValue Trap |

Philip Morris Shocks the Tobacco Space But Why?

publication date: Apr 19, 2018

|

author/source: Brian Nelson, CFA

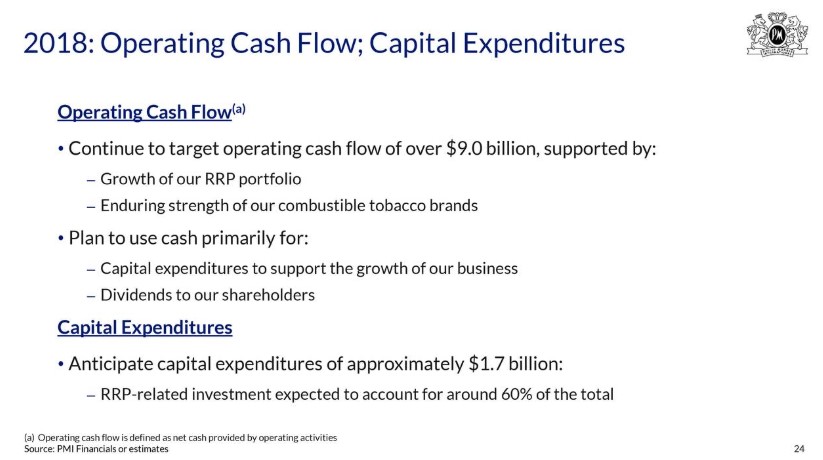

Image Source: Philip Morris Investors are overreacting to Philip Morris’ first-quarter 2018 report, and the company is dragging the entire tobacco industry down with it. By Brian Nelson, CFA The market seems like it has gone “mad,” with Philip Morris trading off nearly 20% following its first-quarter report April 19. The company beat on the bottom line, while revenue roughly came in-line for the period, and the cigarette maker raised its full-year diluted earnings per share forecast to be in a range of $5.25-$5.40, above consensus forecasts of $5.26 and representing ~35%-39% growth versus the $3.88 mark in 2017. The regulatory landscape in tobacco remains in influx, with the FDA looking to set maximum nicotine levels in cigarettes, new rules on menthol tobacco, and revised rules for e-cigs, but this sell-off in shares of Philip Morris may make little sense as the company conducts business outside the US. Reports are suggesting that investors had been banking on Philip Morris’ smokeless (vapor) tobacco system, iQOS, to offset declines in core traditional smoking, and while the first-quarter report may have disappointed some in that department, one quarter the long term does not make, especially with a company that raised its full-year earnings per share guidance mark above consensus. We think investors may be rushing to make a determination on the progress of iQOS, which heats rather than burns tobacco, and extrapolating shortfalls over the long haul, something that we think is premature. Given the stock price decline, we almost feel like we’re looking at different numbers than the market on a completely different company. Heated tobacco unit shipment volume of 9.6 billion units was up 5.1 billion units versus the same period in 2017. Philip Morris is targeting a whopping $9+ billion in operating cash flow during 2018 and capital expenditures of $1.7 billion, good enough for free cash flow expectations of $7.3 billion for the year. The tobacco company has a strong capital structure and garners A2/A credit ratings from S&P and Moody’s, respectively. Furthermore, even in its slide deck, Philip Morris says “IQOS (is) performing exceptionally” with “strong sequential quarterly share growth across launch markets.” Though we assign Philip Morris a Dividend Cushion ratio of 0.6, and we think its dividend metrics could be better, it’s way too early to say its dividend is in jeopardy. Simulated newsletter portfolio holding Altria (MO) faces unique risks with respect to US regulation, but we don’t think a 5.1 billion-unit jump in heated tobacco during the first quarter of 2018 from Philip Morris is necessarily a bad thing, and the damage to the equity prices of industry constituents seems unsubstantiated. The market is overreacting to Philip Morris' first-quarter report, in our view, but our fair value estimate of Philip Morris stands at $84 per share, now about where shares are trading following the sell-off. We’re not making any changes to our fair value estimates of tobacco companies at this time. Tobacco: BTI, MO, PM, SWM, VGR Related equities: UVV, JAPAY, IMBBY Related ETFs: XLP, VDC, KXI, IYK ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |