Member LoginDividend CushionValue Trap |

Nelson: Is Visa the Best Company Ever?

publication date: Jan 8, 2018

|

author/source: Brian Nelson, CFA

Visa’s business model is phenomenal and its competitive advantages among the best in the world. The company’s free cash flow generation is remarkable, and it alone covers its cash dividend payment by more than 5 times. There are few companies with higher levels of profitability than Visa's, and even fewer that also have as strong of growth potential. The company’s valuation is starting to get a little stretched, but it has the free-cash-flow generation to grow into it. By Brian Nelson, CFA Very few companies draw me to them like Visa (V). For starters, the company is one of the largest retail electronic payments networks based on payments volume, total volume and number of transactions. Though scale is appealing, the driver behind it is even more so. Visa benefits from one of the strongest competitive advantages out there, in my opinion – the network effect. For example, as more consumers use its credit/debit cards, more merchants accept them, thereby creating a virtuous cycle. This kind of cycle is incredibly difficult to break, and as society moves more toward cashless, Visa is right there to capture not only the incremental demand, but also market share. It is in a sweet spot. Another characteristic of Visa that I like is that it is not a bank in the traditional sense and does not even issue credit cards, meaning the company doesn’t take on credit risk, unlike American Express (AXP) and Discover Financial (DFS), even as it remains an integral part of the global payments industry. Sales are primarily generated from payments volume on Visa-branded cards in toll-road fashion (every swipe of a Visa card generates revenue for the company). I learned a lot during the Financial Crisis about the hazards of credit risk and the havoc it can wreak on a company’s balance-sheet health, and ultimately, an entity’s equity price. Though there are numerous regulations that could stymie the pace of Visa’s rate of expansion and the company remains inextricably tied to the global financial system, I think it is somewhat shielded from the dynamics that shook the financial markets late last decade. The company is not resting on its success either. In June 2016, Visa acquired Visa Europe in a deal valued north of 21 billion euros ($23+ billion). The deal has unified the brand globally after eight years as separate companies. The transaction includes a payment of 16.5 billion euros upfront and another of as much as 4.7 billion euros after the fourth anniversary of closing. Visa added $15+ billion debt to finance the deal, flipping its balance sheet to a net debt position. Though we weren’t exactly pleased that Visa’s balance sheet took a hit, bringing in-house valuable assets offers it considerably more flexibility to achieve global growth and a better claim on non-US cash-flow generation. As is often the case, the best assets to acquire are already in your backyard (“portfolio”), and the purchase of Visa Europe fit the mold in this case. Europe isn’t the only place that Visa is looking to grow. Along with other US payment card companies, the company is reportedly preparing to request licenses to operating in China in the near future. Though it can take up to two years for the requests to clear scrutiny from Chinese regulators, what a tremendous opportunity it could bring. For starters, the ~$8 trillion yuan bank card network is currently dominated by state-backed China UnionPay, and even a fraction of the market would be a nice boost to incremental growth for Visa. Rivals in China are many, and we may have not seen the last of the new entrants to the payments processing market there, but Visa has a long track record and know-how, and we believe whether organically, if permitted, or via joint-venture or other means, Visa will find a way to tap into China’s rapid growth over the long haul.

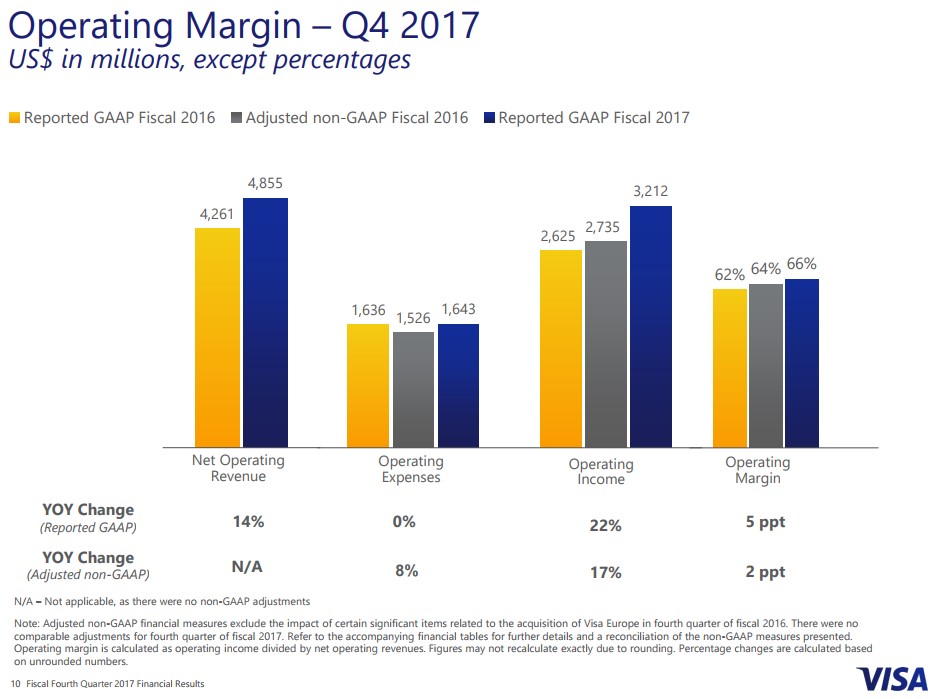

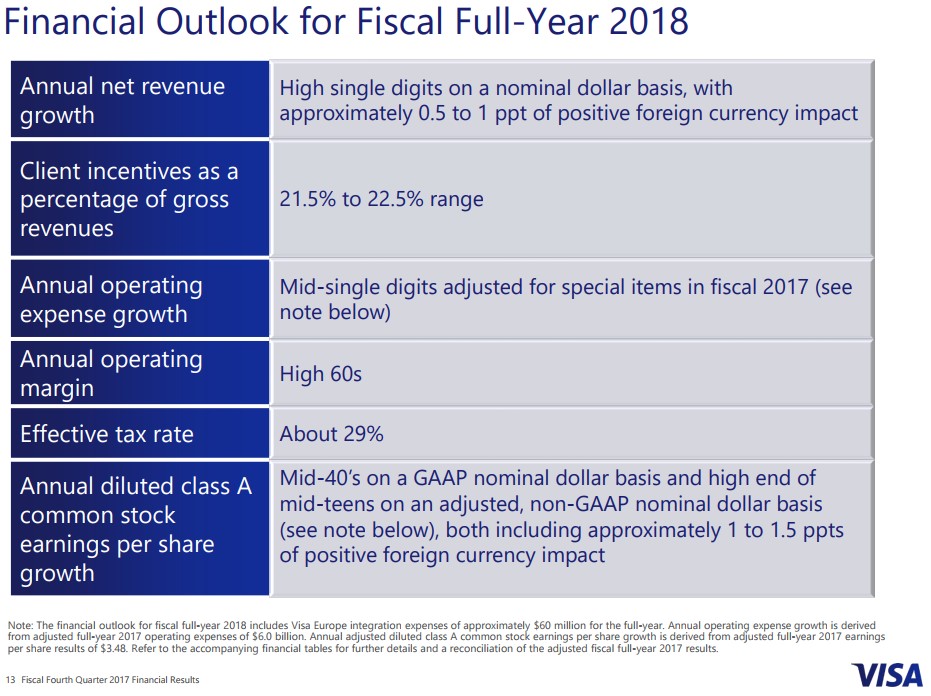

Image Source: Visa’s fiscal fourth-quarter 2017 earnings slide deck Despite the good things I’ve said thus far, I’ve somehow managed to leave the elephant in the room out! Visa is arguably one of the most profitable companies on the planet when it comes to operating margins (and it translates to strong measures of return on invested capital, too). This is what really gets me excited about the company’s business model: annual operating margins in the high 60s. Not only is Visa expecting to grow annual net revenue in the high-single-digits on a nominal basis, as its financial outlook for fiscal 2018 revealed in its fiscal fourth-quarter press release, released October 25, the revenue growth is coming at a tremendously high level of profitability. Some companies don’t even have 60%+ gross margins, but Visa has 60%+ operating margins, levels of profitability that include overhead costs. Visa’s competitive advantages and high-margin revenue model are the “real deal,” and management is focused on doing what's right for shareholders. Let’s talk about that for a bit. I spend a lot of time talking about balance-sheet health and free cash flow generation when it comes to a dividend, and our team came up with this very interesting metric called the Dividend Cushion ratio--it blends the two into a very nice coverage ratio that considers both the balance sheet and cash flow statements. I already mentioned that Visa has a manageable net debt position of ~$5-$7 billion (depending on whether you give it credit for restricted cash), but let’s quantify its free cash flow generation relative to its dividend payment. During 2017, Visa generated $9.2 billion in net cash flow from operations during 2017 and only spent ~$700 million in property, plant, and technology assets. Its free cash flow generation during 2017 was ~$8.5 billion, and it only paid out ~$1.6 billion in cash dividends for the year. This amounted to free cash flow coverage of the dividend of ~5.4 times. This speaks of tremendous dividend growth potential to enhance its modest annual dividend yield of ~0.7% at the time of this writing.

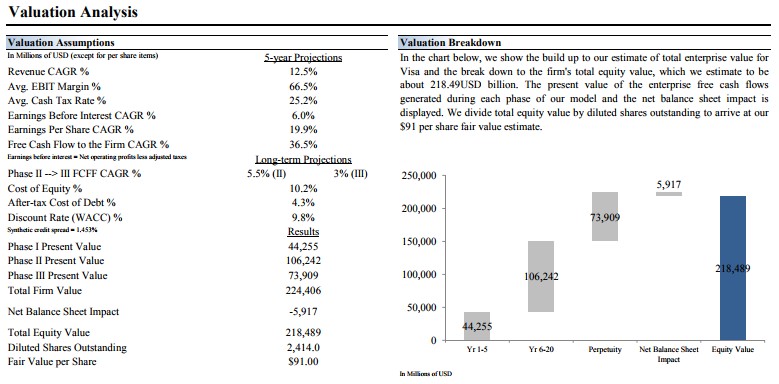

Image Source: Visa’s fiscal fourth-quarter 2017 earnings slide deck I like to look at valuation in the context of a discounted cash-flow framework, coupled with a fair value estimate range. I think this just makes sense. The value of a company is in part a function of what it has plus what it will generate in the future. Visa has a net debt position currently, but its future free cash flow generation potential continues to be phenomenal. We assume revenue will grow at a low-double-digit clip during the next five years (includes fiscal 2017) as operating margins average in the mid-to-high 60% range. This should drive a very nice ramp in earnings and enterprise free cash flow, in our view, as the magnitude of cash-flow-from-operations generation trumps any comparatively modest increases in necessary capital outlays. Though we estimate Visa’s shares are worth ~$90 today, meaning the market may be getting ahead of it a bit, strong free cash flow generation offers Visa the potential to grow into its current share price. The high end of our fair value estimate range is ~$109.

Image Source: Valuentum’s 16-page Report. Let’s now talk about risks. The financial industry is highly-regulated, and any changes in the regulatory environment could be a positive or negative for Visa, especially as it relates to the fees it can charge. This is certainly a long-term risk, but the current Trump administration is considerably pro-business if the recent tax cuts are any indication, and we doubt that any measures implemented in coming years will do damage to Visa’s business model. There is the threat of other competitors such as PayPal (PYPL) and the rise of cryptocurrencies such as Bitcoin (XBT), but the cashless payment market is big enough for a large number of competitors, in our view. Some estimates reveal, for example, that as of 2015, approximately 85% of payments across the globe are still completed with cash or check, revealing a significant opportunity for a great number of companies within the financial tech industry, from Visa and Mastercard (MA) to PayPal and Square (SQ) to Bitcoin and beyond! All things considered, here is what you need to know about Visa: It has strong competitive advantages, very high levels of profitability, tremendous free cash flow generation, solid growth prospects, and incredible dividend growth potential. No company is without risks to the long term, but Visa may have more things going for it than any other company. The one thing to be cautious about is Visa’s valuation, but the payments giant has the potential to grow into it, especially in a bull market that has overcome so much during the past 8 or so years. Society is going to continue to need new ways to pay for “things,” and Visa is at the heart of this long-term secular trend! Is it the best company ever? You be the judge. |