Member LoginDividend CushionValue Trap |

Malkiel Balks, Yellen Talks

publication date: Jul 1, 2017

|

author/source: Brian Nelson, CFA

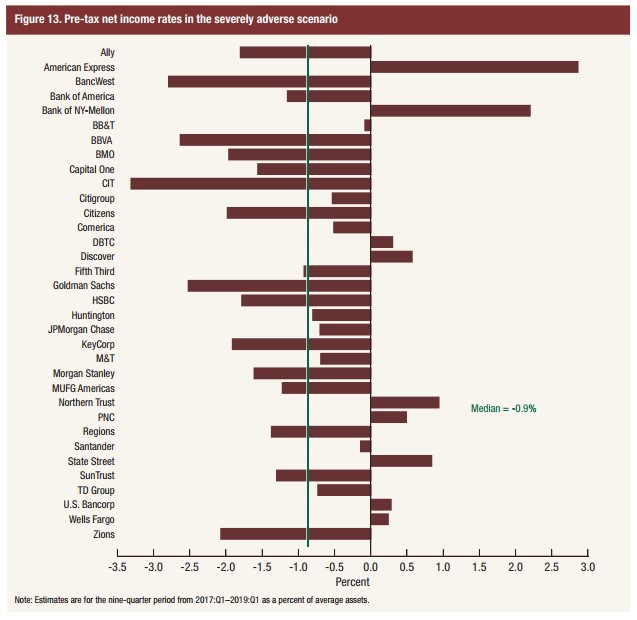

Let’s first address how research in the financial industry is becoming more and more open to combining value and momentum considerations. We’ll also cover a few takeaways from the stress tests and some ‘strong’ talk from Fed Chair Janet Yellen. By Brian Nelson, CFA It was 1973, and a Princeton economist by the name of Burton Gordon Malkiel had just published A Random Walk Down Wall Street, a book that would turn into one of the most influential studies in support of the efficient markets hypothesis. The book would suggest that asset prices typically exhibit signs of a “random walk,” and as a result, an investor could not consistently outperform market averages in part due to powerful reversion-to-the-mean tendencies. Three years later, the book would offer a backbone for the launch of the first “passive” index fund, and the ideas within it would serve as the rallying cry for indexers far and wide for decades. As of the end of 2016, index equity mutual funds’ share of total net assets had increased to nearly 25%, and the advance shows no signs of slowing. According to the latest information I could find, there have now been 11 editions of A Random Walk Down Wall Street published with over 1.5 million copies sold. Perhaps you own a copy? I think I may have two. In an incredible turn of events, at least from my perspective and that of many long-time market veterans, The New York Times reported June 22 that Burton G. Malkiel has now changed his mind, “An Index-Fund Evangelist Is Straying From His Gospel.” Now the chief investment advisor for Wealthfront, Malkiel is championing a new strategy that “aims to exploit market inefficiencies and beat the passive approach.” The article says Malkiel isn’t “abandoning the essence of (his) long-held belief in passive investing,” but I can’t see it any other way. One either believes the markets are random or one believes they are not, in my opinion. But why is this news relevant to the ‘Valuentum’ investor? Well, interestingly, Malkiel’s firm Wealthfront will be focusing on value and momentum factors in addition to a few others (high dividend yields, low market beta, and low volatility), and The New York Times had the following to say about recent developments in academic research: A large and growing body of academic research suggests there are market anomalies that can be exploited to beat a strict index approach. Some of that research has been recognized with Nobels in economic science — William F. Sharpe in 1990 and Eugene F. Fama in 2013. One of these findings is that value outperforms growth, rewarding those who identify stocks with lower price-earnings ratios and other metrics that suggest they’re undervalued. Another factor is momentum, in which stocks that are already outperforming market averages continue to do so. No matter your opinion about active or passive investing or the likelihood of “beating the market” or not, the change of events this June highlights one very important consideration: the financial industry continues to learn and adapt to the ever-changing stock market. There will always be timeless principles, of course, but even dogmas of the 1970s are being refined, or overturned, as researchers continue to study the markets. What we find most encouraging, however, is that the word is getting out that combining value and momentum has tremendous potential, and this is something we’ve been saying for years. I admire Burton Malkiel, his work and opinion, and I look forward to seeing how his new strategy performs. In other news, the banks (XLF, KBE, KRE) seem to be making headlines quite a bit of late, and while concerns over a flattening yield curve and the likelihood of overhauling Dodd-Frank legislation remain, the most recent stress tests revealed that the US banking system is on solid ground. My favorite table in the stress-test report is the one that ranks ‘Pre-tax net income rates in the severely adverse scenario’ as it shows, in my opinion, which banking entities’ P&L would be most resilient in the face of broad-based economic weakness, falling asset prices, and rising unemployment. In no particular order, American Express (AXP), Bank of NY-Mellon (BK), Northern Trust (NTRS), State Street (STT), and Discover (DFS) are likely able to handle the greatest adversity on the P&L, while CIT Group (CIT), Goldman Sachs (GS) and Banco Bilbao (BBVA) may be most exposed should financial markets encounter another crisis.

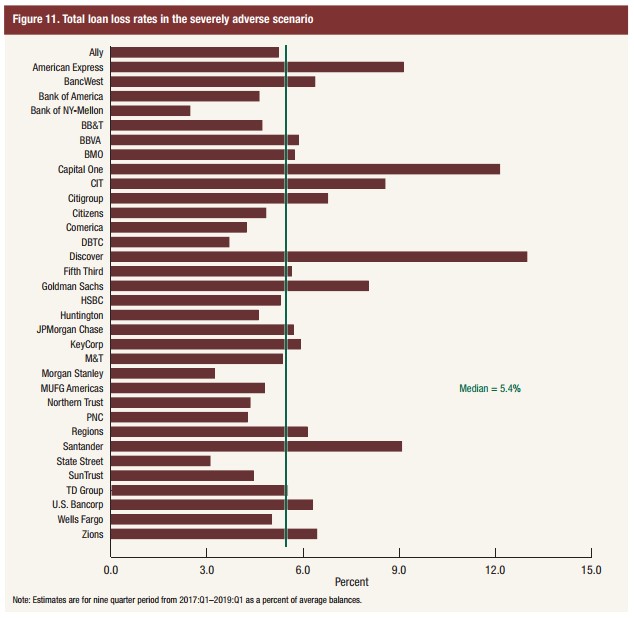

Image Source: Dodd-Frank Act Stress Test 2017: Supervisory Stress Test Methodology and Results June 2017 There are a variety of ways to gauge the financial risk of banking entities, however, and I find the ‘total loan loss rates in the severely adverse scenario’ to be an informative one, too. Interestingly, a couple of the same credit card companies--American Express, and Discover, as well as Capital One (COF)--and Santander (SAN) would be most exposed to heavy losses in this department. Under a crisis scenario, hardly anything happens as expected, so investors should take the results of such tests with a grain of salt.

Image Source: Dodd-Frank Act Stress Test 2017: Supervisory Stress Test Methodology and Results June 2017 Perhaps the biggest news related to the banking system probably wasn’t the stress tests, per se, or even Berkshire Hathaway’s decision to exercise warrants to buy 700 million shares of Bank of America (BAC) stock, but instead, Fed Chair Janet Yellen’s comment that another financial crisis not likely “in our lifetime.” Many have since jokingly pondered whose lifetime she may be referring to – regardless, it seems as though we have some sort of crisis every 20 years or so, with each coming generation. Could this end up being the 2017 equivalent of Yale economist Irving Fisher’s famous 1929 quote: “Stock prices have reached what looks like a permanently high plateau.” Time will tell. In terms of Dividend Growth Newsletter portfolio ideas, Cisco (CSCO) guided investors to slower overall revenue growth over the next few years, but we have been aware of the top-line pressures at Cisco for some time now, and the guidance adjustment did not come as much of a surprise to our team. We don’t plan to adjust our fair value estimate as our current top-line assumptions are in-line with the updated guidance range. We are, however, expecting revenue growth at Cisco to accelerate slightly in coming years, a trajectory we are watching closely. Cisco’s shares remain undervalued, in our view, and we continue to be big fans of its free cash flow generating capacity and cash-rich balance sheet. In case you missed it, we also tidied up the newsletter portfolio a bit June 20, too, removing a “trade” we should never have made in the first place, the Alerian MLP ETF (AMLP). That’s it for now! |