Member LoginDividend CushionValue Trap |

Incyte’s Ongoing Disappointments and Ultragenyx’s Exciting Development

publication date: Apr 23, 2018

|

author/source: Alexander J. Poulos

The pharma/biotech sector, unlike other mainline industries, is driven by the clinical data readouts on the next-gen molecules in the clinical pipeline. We have witnessed many exaggerated moves with an often-binary outcome on the smaller single molecule entities, but we also have witnessed a negligible impact on the broader, more-diverse industry behemoths. We wanted to touch on a few recent data readouts to illustrate the volatile, risky yet potentially lucrative nature of the industry. By Alexander J. Poulos Key Takeaways The iShares Nasdaq Biotech ETF serves as an excellent proxy for investors to gain broad exposure to a number of biotech equities, but it is not for the faint of heart. Incyte has disappointed on a number of occasions. From the FDA’s refusal to grant marketing authority for its Jak 1&2 inhibitor Olumiant to abysmal performance at Epacadostat, a novel IDO-1 inhibitor, Incyte’s shares are now in the dog house. Incyte may be better off scrapping additional trials to conserve funds for additional molecules such as additional label expansion for Jakavi. Funding additional research into Capmatinib for the treatment of Hepatic and Non-Small Cell Lung Cancer may bear fruit as well. In our view, Ultragenyx has firmly planted itself into the lexicon of top rare drug companies with the recent approval of Crysvita for X-Linked Hypophosphatemia (XLH). The approval of Crysvita is a watershed moment in the evolution of Ultragenyx’s lifecycle. It is by far the most significant asset due to overall size of the patient population. We believe Ultragenyx is on the right path, but additional molecules will need to be brought to market for the company to challenge BioMarin’s dominance in rare disease. Though we’re not ready to pull the trigger, so to speak, on Incyte or Ultragenyx, the analysis informs our opinion about the fast-changing competitive environment in biotech, which ultimately impacts other ideas we may surface for members in the future. Incyte Has Disappointed We have followed the Incyte (INCY) story with great interest over the past year as the company seemed poised to shepherd two new exciting molecules to market with multi-billion-dollar annual revenue potential. Our interest in Incyte was piqued on the disruptive potential of these new entrants along with continued growth of its star molecule Jakavi. The thesis remained that, if Incyte could be successful in augmenting its formidable Jakavi franchise with an additional molecule or two, the company has the runway to morph into the next great biotech heavyweight, akin to the stellar move earlier in the decade by Regeneron Pharmaceuticals (REGN). Regeneron morphed from an afterthought with some interesting technology to a top-five biotech heavyweight thanks to a string of recent hits highlighted by the uber-successful Eylea franchise for the treatment of Macular Degeneration. From our point of view, Regeneron has cemented its position in the vanguard of biotech heavyweights with a top five weighting in the industry bellwether iShares Nasdaq Biotech ETF (IBB) along with household names such as Amgen (AMGN) and Biogen (BIIB). We view the strength of the iShares Nasdaq Biotech ETF as a proxy of the overall health of the large cap biotech space. As the largest ETF in the biotech sector (the Healthcare Select Sector SPDR is the largest in the overall pharma space), the iShares Nasdaq Biotech ETF serves as an excellent proxy for investors to gain broad exposure to Incyte, in our view. Alas, it was not meant to be as a string of disturbing events has blown the thesis beginning last year with the FDA’s refusal to grant marketing authority for Incyte’s Jak 1&2 inhibitor Olumiant. To say the least, we were stunned by the outcome as the product is approved in Europe. Incyte and its marketing partner Eli Lilly (LLY) remain optimistic the product will eventually gain access to the US market, but the delay cost the company crucial time in building out its critical first-mover advantage. The main underpinning of the bullish thesis on Incyte now rests on the clinical performance of Epacadostat, a novel IDO-1 inhibitor, in combination with a PD-1 such as Merck’s (MRK) Keytruda to form a more-potent combination for the treatment of a wide range of cancer. The first data read in melanoma is widely-viewed as the most critical as melanoma thus far has the highest response rate to treatment with a PD-1. The theory holds that, if a meaningful boost to the effectiveness of a PD-1 in melanoma is achieved, the read-through is the potential for a potent combination in harder-to-treat conditions is possible. To say the least, the stakes are elevated for Incyte as a “win” in melanoma would validate the molecule and underpin the need for additional funding for multiple indications. To the great dismay of Incyte, however, the results were abysmal as Epacadostat failed to hit its primary and secondary endpoints: Incyte Corporation (Nasdaq:INCY) and Merck (NYSE:MRK), known as MSD outside the United States and Canada, today announced that an external Data Monitoring Committee (eDMC) review of the pivotal Phase 3 ECHO-301/KEYNOTE-252 study results evaluating Incyte’s epacadostat in combination with Merck’s KEYTRUDA® in patients with unresectable or metastatic melanoma determined that the study did not meet the primary endpoint of improving progression-free survival in the overall population compared to KEYTRUDA monotherapy. The study’s second primary endpoint of overall survival also is not expected to reach statistical significance. Based on these results, and at the recommendation of the eDMC, the study will be stopped. The safety profile observed in ECHO-301/KEYNOTE-252 was consistent with that observed in previously reported studies of epacadostat in combination with KEYTRUDA. Quote Source: Incyte The shocking failure of Epacadostat, in our view, likely diminishes the commercial potential of the molecule as Incyte is now faced with the dilemma of funding additional trials of a product that thus far has shown to not be effective. We would like to caution that this does not necessarily preclude effectiveness in other forms of cancer, but the likelihood is diminished. The only way to fully ascertain the potential is to conduct the costly trials. We are leaning to the side of Incyte scrapping additional trials to conserve funds for additional molecules such as additional label expansion for Jakavi along with funding additional research into Capmatinib for the treatment of Hepatic and Non-Small Cell Lung Cancer. We would like to highlight the importance of having a marketed product to blunt the overall impact of the magnitude of such a clinical failure on the share price of Incyte. Granted a share price decline of over 20% is painful, but Incyte is a commercially viable entity. If a similar failure were to happen to a one-product company such as Global Blood Therapeutics (GBT), the likely results would yield a share price worth nothing more than the net cash on the balance sheet, in most cases. Late stage clinical failures can and will happen in this innovative sector. Ultragenyx Hits a Home Run with Crysvita Ultragenyx (RARE) has now firmly planted itself into the lexicon of top rare drug companies with the recent approval of Crysvita for X-Linked Hypophosphatemia (XLH). XLH is a genetic disorder resulting from a defect of the PHEX gene located in the X chromosome, thus potentially affecting males and females. Unlike most genetic disorders which tend to be recessive (two copies of the gene--one from each parent is necessary for the patient to have the disorder), XLH is a dominant genetic defect, hence only one copy is necessary for the patient to have the disease. Ultragenyx has reported there are some cases where a spontaneous mutation of the PHEX gene can directly lead to the disease even with absence of the defect in both parents. The patient afflicted by XLH will suffer from a decrease in phosphate reabsorption in the kidneys along with a subsequent decrease in the absorption of Vitamin D dependent phosphate. The inability of the patient to absorb phosphate directly leads to low levels in the body, which begins a negative cascade of skeletal issues culminating with poor bone health for the duration of the patient’s life. An XLH afflicted patient with suffer from frequent fractures, abnormal bone growth along with frequent bouts of bone pain which may be related to microfractures. XLH will cause severe dental abnormalities as well as the XLH patient may suffer from frequent abscesses (infections) of the teeth. FDA Gives the Nod to Crysvita As we have seen above with the rejection of Incyte’s Olumiant by the FDA, approval in Europe does not necessarily mean marketing approval in the US is a certainty. There was a great deal of anxiety on the part of Ultragenyx shareholders leading up to the PDUFA date--a rejection would be a significant setback in Ultragenyx growth cycle along with a tremendous disservice to the XLH community. The FDA did not disappoint as it gave marketing approval for Crysvita, a monoclonal antibody developed by Ultragenyx and its clinical partner Kyowa Hakka Kirin on the 17th of April. We view the approval of Crysvita as a watershed moment in the evolution of Ultragenyx lifecycle—granted this is the second approved product for Ultragenyx, but it is by far the most significant asset due to overall size of the patient population.

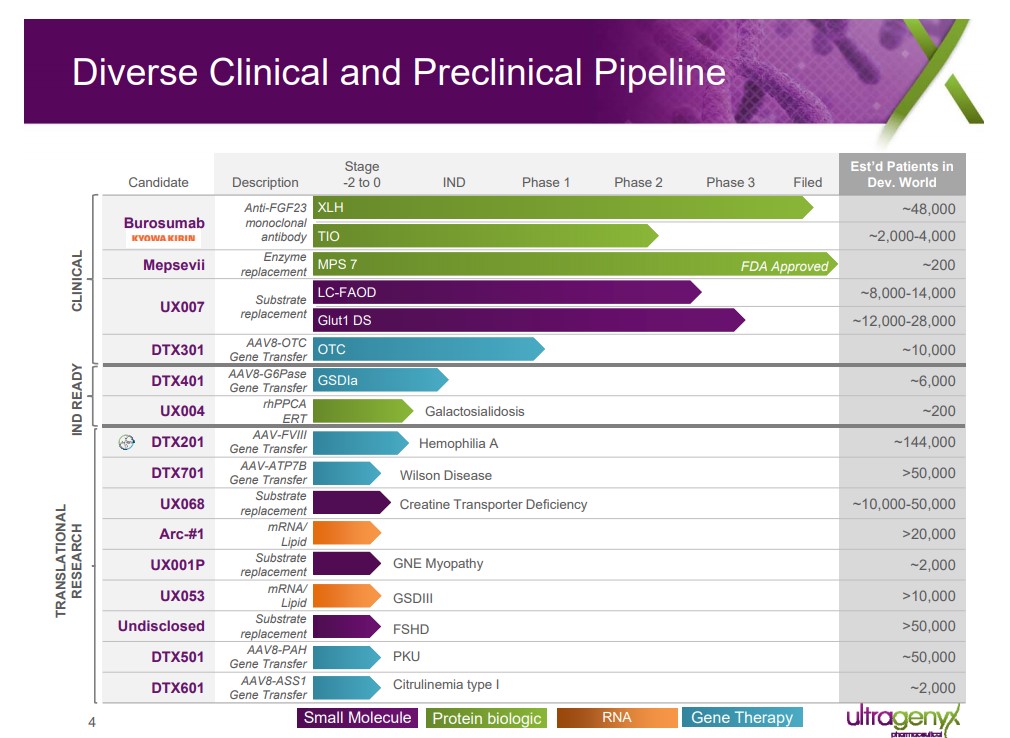

Image shown: Ultragenyx's promising pipeline of opportunities. Ultragenyx March 2018 Presentation Seasoned CEO Ultragenyx is run by the highly capable Emil Kakkis, one of the lead executives responsible for the rise of BioMarin Pharmaceuticals (BMRN), the premier operator in the rare-drug space. Kakkis has extensive expertise in lysosomal disease disorders, hence the approval of Mepsevil comes as no surprise as it is firmly within his field of expertise. The core market for Mepsevil is approximately 200 patients, thus we expect the product to post very modest sales. We have no doubt the drug will significantly improve the quality of life for its patient population, but it will not move the revenue needle much at Ultragenyx, thus underscoring the importance of a win in Crysvita. The Path Forward We believe Ultragenyx is on the right path, but additional molecules will need to be brought to market for the company to challenge BioMarin’s dominance in rare disease. UX007 for the treatment of long-chain fatty acid oxidation disorder (LC-FAOD) represented the most promising near-term asset in Ultragenyx clinical pipeline. The company is embarking on an aggressive phase 3 trial design with aspirations of a “quick win” with the FDA. We view a win with UX007 may be a pivotal moment for Ultragenyx. A win positions the company to enter the lexicon of a successful multi-product company with scant competition due to the unique aspects of the rare drug sector. The Lucrative Priority Review Voucher One of the most appealing aspects of the rare drug market is the issuance of a rare drug voucher upon successful approval of a product. The voucher entitles the holder to an accelerated review by the FDA, which on its face may not seem important in the rare drug space as each new entrant is typically unopposed. A quirk in the law allows for the vouchers to be sold to the highest bidder, however, thus paving the way for intense demand from the industry as it looks to establish a beachhead well before a rival product. Ultragenyx struck a deal with Novartis (NVS) to sell the voucher acquired with the approval of Mepsevil for $130 million dollars. With the recent approval of Crysvita, we expect a similar quick sale will be negotiated with the proceeds used to replenish the coffers thus preventing the need to issue additional stock to raise capital to fund additional clinical trials. Concluding Thoughts Our goal in the above piece is to touch in the unique dynamics of the biotech space: the need for continuous innovation coupled with smart tuck-in acquisitions. We are saddened with the clinical failure of Epacadostat, but this is the very nature of the business as companies will have some high-profile failures along the way. The management team at Incyte will need to further asses the failure and move on with additional compounds to bolster the commanding lead it has with Jakafi. We would not be surprised if a tuck-in acquisition is actively being considered considering Epacadostat’s failure. When acquisitions are conducted in a positive manner such as the partnership struck by Ultragenyx with Kowa, it unlocked the potential of Crysvita much to the delight of the long suffering XLH community. At this juncture, we are not interested in adding exposure to either name, though we are watching the industry closely for additional worthy opportunities. The analysis informs our opinion about the fast-changing competitive environment in biotech, which ultimately impacts other ideas we may surface for members in the future. ----- Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free. Independent Healthcare Contributor Alexander Poulos is long Incyte and BioMarin. Some of the companies written about in this article may be included in Valuentum's simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies. |