Member LoginDividend CushionValue Trap |

How Have Our “Best Ideas” Performed During 2017?

publication date: Nov 14, 2017

|

author/source: Brian Nelson, CFA

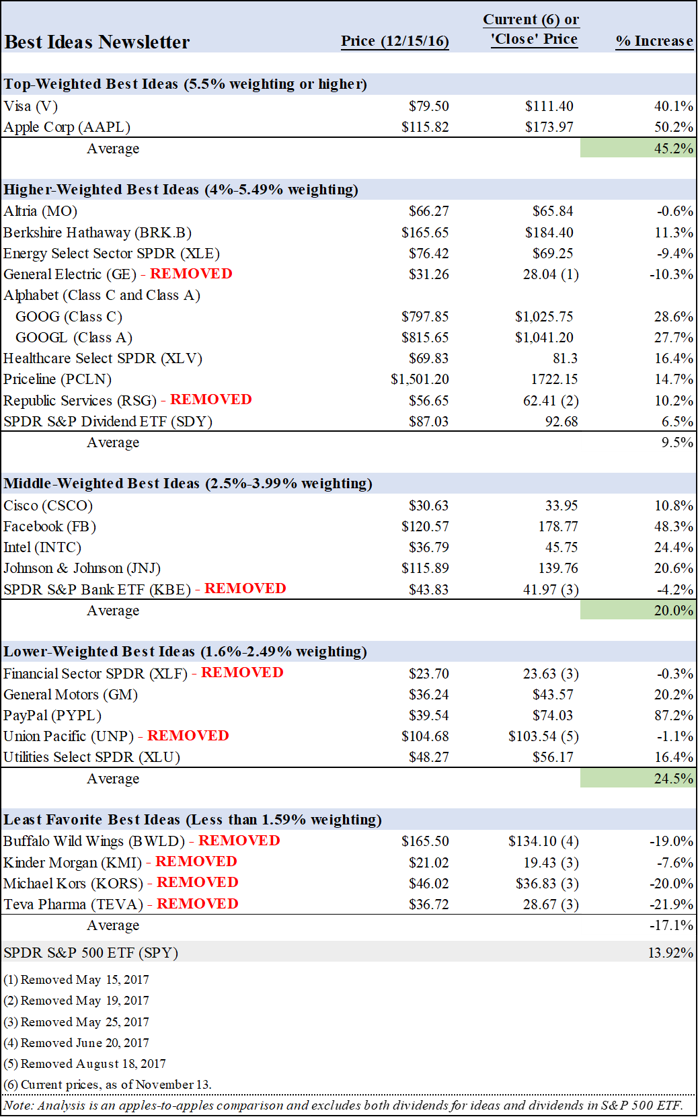

The top-weighted ideas are getting the job done, while we avoided one of the biggest missteps in all of 2017. We’ve had better years, but 2017 was still a great one. Key takeaways: 1) "The top-weighted ideas in the Best Ideas Newsletter portfolio, Apple and Visa, performed wonderfully from the release of the December 2016 newsletter through November 13, 2017, averaging more than an increase of 45%, excluding dividends, versus a mid-teens percentage advance for the S&P 500, excluding dividends." 2) "The weighting concept within a portfolio context is an important one because, as a portfolio manager adds more and more ideas to the portfolio, the next best idea is just that--the next best one--so the probability of diluting portfolio returns may increase with the addition of each next best idea, even as diversification benefits are added. As I often say, absent diversification reasons, the next best idea may be, or rather should be, the first best idea, and that was the case in 2017 given Apple’s and Visa’s performance." 3) "...we’re viewing the decision to “exit” (General Electric) at nearly $30 per share as a huge win (it is now trading in the high-teens per share)." 4) "Facebook, up nearly 50%, Intel, up nearly 25%, and Johnson & Johnson, up more than 20%, were the key advancers in the middle-weighted ideas group of the Best Ideas Newsletter portfolio, or those with weightings of 2.5%-3.99%. The lower-weighted ideas, or those with 1.6%-2.49% weightings, were led by strength in PayPal, which jumped nearly 90%, and General Motors, which also performed quite well, up more than 20%." 5) "Our least-favorite ideas in the newsletter portfolio, meaning those of a more-speculative variety, and ones we don’t like nearly as much as the others, didn’t do that great, unfortunately. Buffalo Wild Wings, Kinder Morgan, Michael Kors and Teva Pharma all declined. One might say that’s why we had them weighted so low though." 6) "We show each and every day that hard work and a systematic cash-flow-based process can add value across the board, not only in highlighting and ranking top performers such as Visa and Apple, but also in avoiding what could have been a disaster in General Electric." 7) "Beginning in 2018, we plan to present the newsletter portfolios in the Best Ideas Newsletter and Dividend Growth Newsletter in a manner that better emphasizes how much we like each idea. We want to make sure that readers are finding our very best ideas easily, ones, for example, with high weightings such as Visa or Apple, and not focusing too much on our lower-conviction, speculative considerations that are but a very small part of any well-diversified portfolio (some even included solely for diversification reasons). We think the list-and-weighting format does a much better job communicating our sentiment toward ideas, and we hope you will, too." 8) "We’re bound to get a top-weighted idea wrong every now and again, especially as we stare down a rather overheated stock market, in general. We're always available for any questions." Please continue reading below... -------------------- By Brian Nelson, CFA As 2017 is nearing a close, it’s probably a good time to start reflecting on the year past -- some things we got right, and some things we got wrong during the year. I think, without a doubt, the highlighting of the tremendous risk of General Electric’s (GE) dividend cut, months before it happened, and more than 30% ago, may be one of the most valuable pieces of research we produced this year, right up there with our work on Kinder Morgan (KMI) in June 2015 before its collapse. We can thank the focus on free cash flow generation for continuing to help dividend growth investors, the Dividend Cushion ratio, in particular. But what about our “best ideas,” the ones on the Best Ideas Newsletter portfolio? How have they stacked up? We’ve talked a lot about the astounding success rates in the Nelson Exclusive publication and exciting developments with respect to the new High Yield Dividend Newsletter, but what about the workhorse ideas in the Best Ideas Newsletter? Right? Well, I think they’re doing fantastic. For example, here’s how I might envision the sentiment of someone joining our service in December 2016, right before the release of the December edition of the Best Ideas Newsletter. The December 2016 edition can be downloaded here (pdf), page 8. First, the person might have scoured the Best Ideas Newsletter newsletter portfolio for ideas, and uncover that our two top favorite ideas are Apple (AAPL) and Visa (V) because they are the top-weighted in the newsletter portfolio, both comfortably above 5% weightings and nearly 7% in Visa’s case. The reader might come to interpret these weightings in the view that we like these two ideas 4-5 times as much as a lower weighted idea. The top-weighted ideas in the Best Ideas Newsletter portfolio, Apple and Visa, performed wonderfully from the release of the December 2016 newsletter through November 13, 2017, averaging more than an increase of 45%, excluding dividends, versus a mid-teens percentage advance for the S&P 500, excluding dividends. The weighting concept within a portfolio context is an important one because, as a portfolio manager adds more and more ideas to the portfolio, the next best idea is just that--the next best one--so the probability of diluting portfolio returns may increase with the addition of each next best idea, even as diversification benefits are added. As I often say, absent diversification reasons, the next best idea may be, or rather should be, the first best idea, and that was the case in 2017 given Apple’s and Visa’s performance. We couldn’t be more pleased getting these two top ideas in front of our readership. They were home runs in 2017! But what about those with lower weightings between 4%-5.49%? Well, General Electric was once a part of this group (it feels like a long time ago now, after its share-price-plunge), and we’re viewing the decision to “exit” the idea at nearly $30 per share as a huge win (it is now trading in the high-teens per share). Overall, this weighting bucket did “okay,” with an average advance of ~10%, just shy of the market return, mostly because of the more conservative ideas, the SPDR S&P Dividend ETF (SDY) and Berkshire Hathaway (BRK.B). Alphabet (GOOG, GOOGL) was a very, very strong performer in this weighting segment, with its share classes up nearly 30%, and there were some other solid ideas, too, including the Healthcare Select SPDR (XLV), for example. Facebook (FB), up nearly 50%, Intel (INTC), up nearly 25%, and Johnson & Johnson (JNJ), up more than 20%, were the key advancers in the middle-weighted ideas group of the Best Ideas Newsletter portfolio, or those with weightings of 2.5%-3.99%. The lower-weighted ideas, or those with 1.6%-2.49% weightings, were led by strength in PayPal (PYPL), which jumped nearly 90%, and General Motors (GM), which also performed quite well, up more than 20%. We can’t be too disappointed with the 15%+ advance by the Utilities Select SPDR (XLU). Our least-favorite ideas in the newsletter portfolio, meaning those of a more-speculative variety, and ones we don’t like nearly as much as the others, didn’t do that great, unfortunately. Buffalo Wild Wings (BWLD), Kinder Morgan (KMI), Michael Kors (KORS) and Teva Pharma (TEVA) all declined. One might say that’s why we had them weighted so low though. Our confidence level wasn’t nearly as high as that of a Visa or Apple, for example. The 40% gain in near-7% weighted Visa, for example, contributes about 280 basis points of portfolio strength, while a 1.3% weighting in Teva provides only a 30-basis point headwind, a net of about +250 basis points. We got Visa right, and Teva wrong, but weightings and levels of conviction matter. How awesome it is for the top-weighted ideas to be doing this well, and for us to stay on our toes to get ahead of the developments at General Electric. We’re not taking it easy. We’re not resting on our solid past. We show each and every day that hard work and a systematic cash-flow-based process can add value across the board, not only in highlighting and ranking top performers such as Visa and Apple, but also in avoiding what could have been a disaster in General Electric. Importantly though, we can’t possibly get everything right, and I cannot stress this enough, but when the top ideas are jumping at a pace that is a multiple of the market, it’s really hard not to be pleased. Beginning in 2018, we plan to present the newsletter portfolios in the Best Ideas Newsletter and Dividend Growth Newsletter in a manner that better emphasizes how much we like each idea. We want to make sure that readers are finding our very best ideas easily, ones, for example, with high weightings such as Visa or Apple, and not focusing too much on our lower-conviction, speculative considerations that are but a very small part of any well-diversified portfolio (some even held solely for diversification reasons). We think the list-and-weighting format does a much better job communicating our sentiment toward ideas, and we hope you will, too. But even so, we’re bound to get a top-weighted idea wrong every now and again, especially as we stare down a rather overheated stock market, in general. Perhaps put bluntly, if it wasn’t for our independent cash-flow based analysis on GE more recently, for example, the portfolio would have suffered immensely from the company’s share-price collapse. Since its inception, the Best Ideas Newsletter portfolio has created more return for the level of risk (volatility), and while we expect to stop measuring the performance on a portfolio level at the end of 2017 due to the migration to list-and-weighting format, we plan to publish a deep analysis of its history soon. We trust you find tremendous value in the Best Ideas Newsletter publication, and we’re always available for any questions. Thank you! The image below shows the “performance” of ideas that were in the Best Ideas Newsletter portfolio at the time of the release of the December 2016 edition of the Best Ideas Newsletter. The portfolio has changed quite a bit since then, so please be sure to read each edition as it becomes available on the 15th of each month. The November edition will be released tomorrow, November 15.

|