Member LoginDividend CushionValue Trap |

Deere Runs! South America Not As Bad?

publication date: May 20, 2017

|

author/source: Brian Nelson, CFA

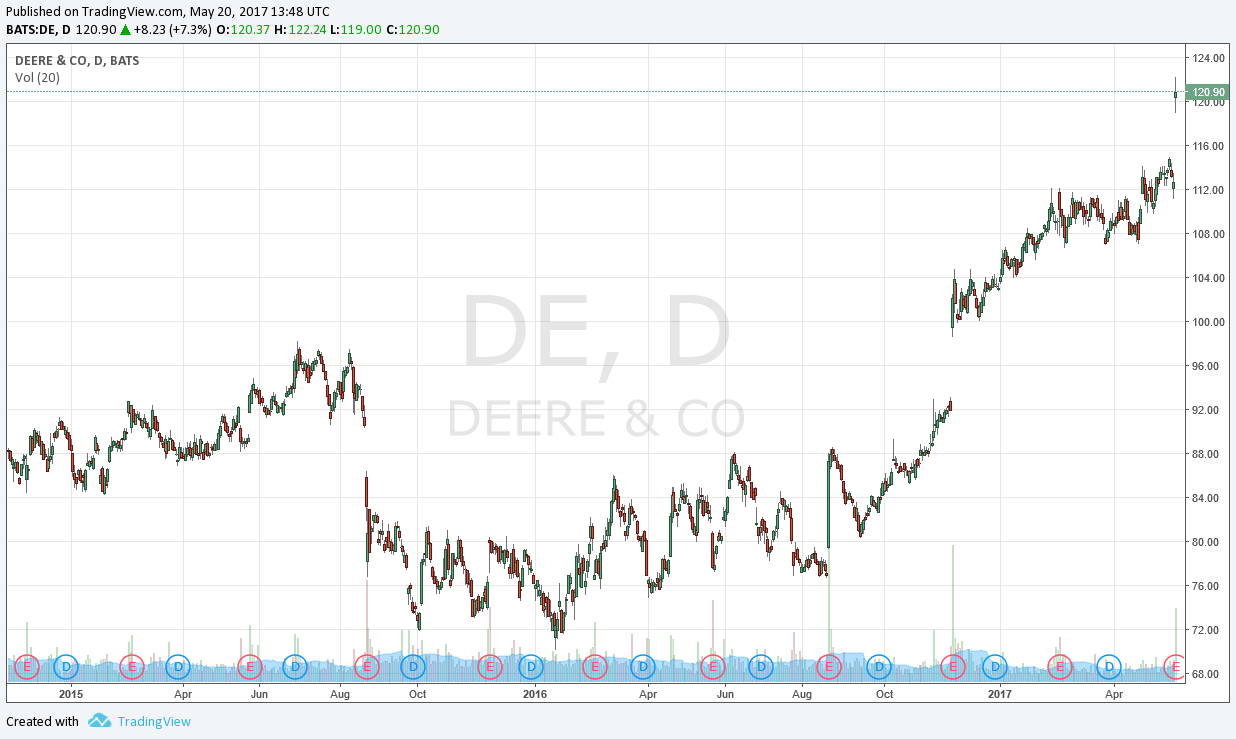

Deere’s equity is charging higher. Let’s look at the reasons why. Will Caterpillar follow? By Brian Nelson, CFA On May 19, agricultural equipment maker Deere (DE) reported solid quarterly results for the period ending April 30 that showed strong improvement in farm and construction equipment demand. Management noted that in its recently-completed second quarter “market conditions showed signs of further stabilization…(and) farm machinery sales in South America experience(ed) a strong recovery,” too. Deere increased its full-year earnings forecast to $2 billion, which it expects to be driven by 9% sales growth. Shares of Deere yield just north of 2% at the moment.

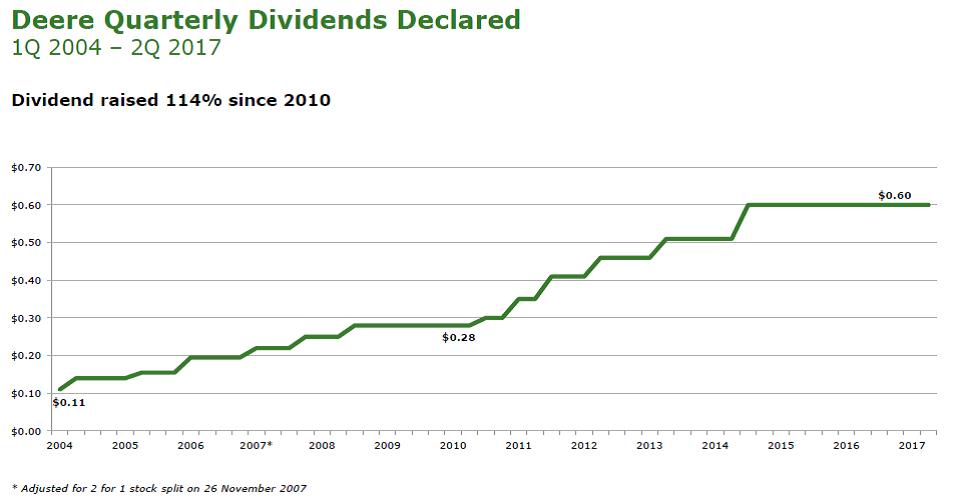

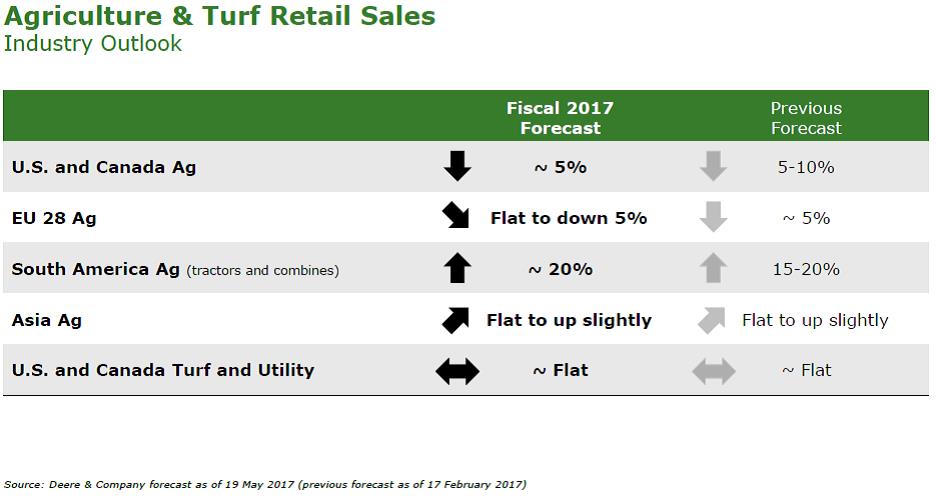

Image Source: Deere Investors were extremely pleased with Deere’s execution and even more enthused by the executive team’s increased guidance for “significantly higher earnings for the full year.” The high end of our fair value range for Deere rests just above $130 per share, but there may be some upside to that range if Deere continues to execute well and equipment pricing holds up. The company has been able to realize a 2% price increase across its worldwide equipment operations. We don’t think the commentary in the press release could have been more optimistic: “Deere is demonstrating a continuing ability to produce impressive results through all phases of the business cycle," Allen said. "This resilience illustrates our success driving improved operating efficiencies and developing a wider range of revenue sources. It also shows the impact of the company's consistent investments in advanced technology, new products and additional markets. These actions are leading to strong performance in 2017, and they reinforce our conviction that Deere is well-positioned to deliver significant value to customers and investors over the long term." The news from Deere has come as somewhat of a relief from renewed concerns about the conditions in Brazil (EWZ), as Deere expects “sales of tractors and combines (to be) up about 20% (thanks to) improving economic and political conditions” in the country and Argentina (ARGT). Agricultural equipment sales in the US and Canada are expected to be down roughly 5% for 2017, however, as weakness in the livestock sector and low crop prices weigh on farm incomes. Deere expects industry sales in the European Union to be flat-to-down 5%, while sales are projected to be flat-to-up modestly in Asia.

Image Source: Deere When Caterpillar (CAT) released first-quarter performance April 25, we noted upbeat commentary by Cat’s executive team in a recent write-up, and results by both equipment giants reflect enough evidence, in our view, that commodity end markets may be shaping up just a bit, even as we note ongoing weakness in iron ore prices, a key driver behind sales of earth moving equipment. Cat expects demand from ‘Resource Industries’ to be up 10%-15% from 2016 performance, however. Same quarter sales advanced for the first time in two years during Cat’s first-quarter report, and the equipment maker upped its 2017 revenue and adjusted earnings guidance to the range of $38-$41 billion (was $36-$39 billion) and $3.75 per share (was $2.90), excluding restructuring costs. Cat pointed to uncertainty as a result of the ongoing volatility of commodity prices, something that will never go away, but both Cat and Deere continue to benefit from expense control and improved execution. Cat yields ~3%. Agricultural Machinery: AGCO, CAT, CNHI, DE, HEES, JOY, MTW, RBA, TEX All in, we’re encouraged by what we’re seeing across the earth-moving equipment industry, and Cat and Deere have decent dividend yields, respectively. Cyclicality will always be a risk to fundamental performance, however.

Image Source: Caterpillar Related tickers: TTC, LNN |