Member LoginDividend CushionValue Trap |

Canakinumab Posts Some Impressive Data For Novartis

publication date: Sep 11, 2017

|

author/source: Alexander J. Poulos

We remain impressed with the depth of the clinical pipeline that is currently being brought out to market by the Dividend Growth Newsletter portfolio idea Novartis. We closely follow the data delivered from clinical trials to gauge the potential for the pipeline; in the case of Novartis, we feel the strength of the emerging pipeline bodes very well for continued dividend growth over the next few years. In this piece, we will detail the clinical results for Canakinumab, as we feel the molecule will nicely complement Novartis’ burgeoning cardiovascular unit. By Alexander J. Poulos Canakinumab

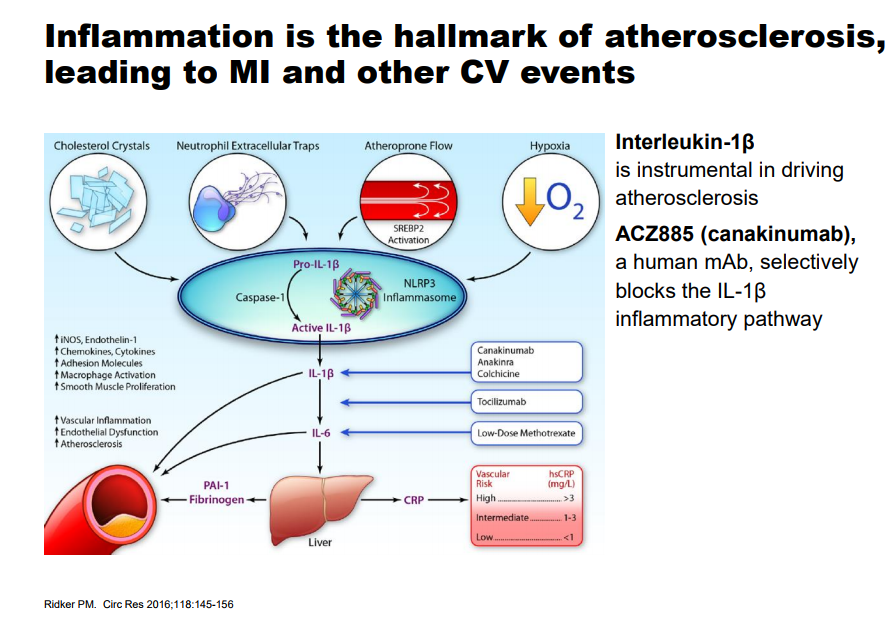

Image source: Novartis Cardiovascular Disease (CVD) remains one the largest areas of need based on the sheer number of patients afflicted with some form of the disease throughout the globe. The traditional therapy utilized to combat CVD is through the use of cholesterol-lowering agents such as statins with the express belief that a lower cholesterol level will reduce the risk of a cardiac event. A segment of the population that is afflicted with CVD, but cannot tolerate a statin or does not respond as expected, remains in dire need of alternative choices which has led to the development of the PCSK-9 inhibitor class headlined by Amgen’s (AMGN) Repatha. Repatha recently released outcomes data from the Fourier trial where it achieved a reduction in major adverse cardiovascular events (MACE) of 15, a disappointment which should in our view keep a lid on its commercial prospects, but the need for a viable alternative remains. Novartis (NVS) recently concluded the CANTOS trial which studied the use of Canakinumab over the course of six years, easily one of the largest clinical trials ever conducted. Canakinumab is a monoclonal antibody that is currently approved under the trade name Ilaris for the treatment of cryopyrin-associated periodic syndromes (CAPS) and systemic juvenile idiopathic arthritis (SJIA). Novartis is optimistic it can expand the prescribing label for Canakinumab into CVD—the initial data looks promising in a particular cohort.

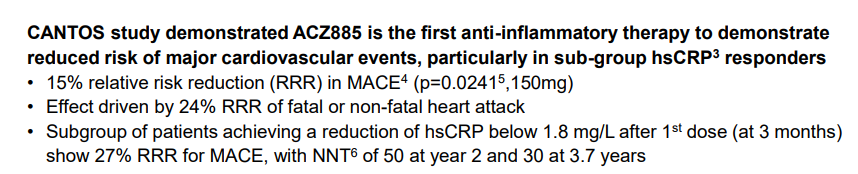

Image source: Novartis The primary endpoint of a 15% Relative Risk Reduction (RRR) matches the results of the Fourier trial posted by Repatha, a disappointment. The key difference is the results displayed by those patients that exhibited a sharp drop in High Sensitivity C-reactive protein (the test measures the level of inflammation in the body with a high number often indicating a long term illness) under 1.8mg/L three months after the first dose. This particular subgroup posted a very impressive 27% RRR which bodes well for the commercial prospects of the product. The more important metric from a payers perspective is the drop in Numer Needed to Treat (NNT) to receive a benefit which dropped from 50 at year 2 to 30 at the 3.7-year mark. The NNT metric allows the payers to model with a degree of precision the overall cost savings based on the number of lives covered by those afflicted with CVD. The therapy is widely-expected to carry a hefty price tag which heightens the need for a demonstrable benefit for widespread adoption. On the conference call, Novartis mentioned it might dose the overall patient population at no charge then seek reimbursement three months after the hs-CRP levels are drawn. We find this arrangement to be very innovative and wis; by seeking payment only on those who react to the therapy, Novartis has taken the risk for payers off the table. Canakinumab based on the stellar results posted by the lengthy CANTOS trial has generated a durable benefit, we feel the product will have an easier time capturing market share than the PCSK-9 class which continues to struggle. Side Effect Profile With Canakinumab belonging to the Monoclonal Antibody (mAb) class, the expected side effects of Leukopenia and an increased susceptibility to infections are evident. We do not believe this will come as a surprise to clinicians who have become well-versed in treating patients with the plethora of mAb such as Humira, Remicade, Xolair and Rituxan to name a few of the more popular products. We are more impressed with a few notable anomalies where the Canakinumab arm scored a markedly reduced level of side effects versus the control arm. With Canakinumab targeting inflammation throughout the body, we are not at all surprised to see a marked decrease in arthritis, osteoarthritis, and gout. With the average patient in the study well past the fourth decade of life, the reduction in the symptoms of arthritis is an added bonus. Canakinumab posted some remarkable data for the reduction of lung cancer—an indication that Novartis is actively seeking to have included in the prescribing label of Canakinumab.

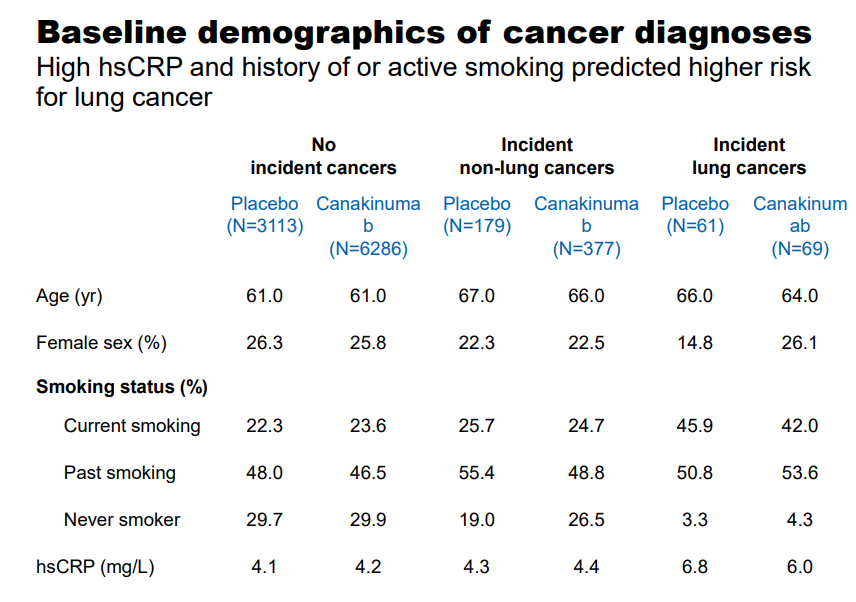

Image source: Novartis

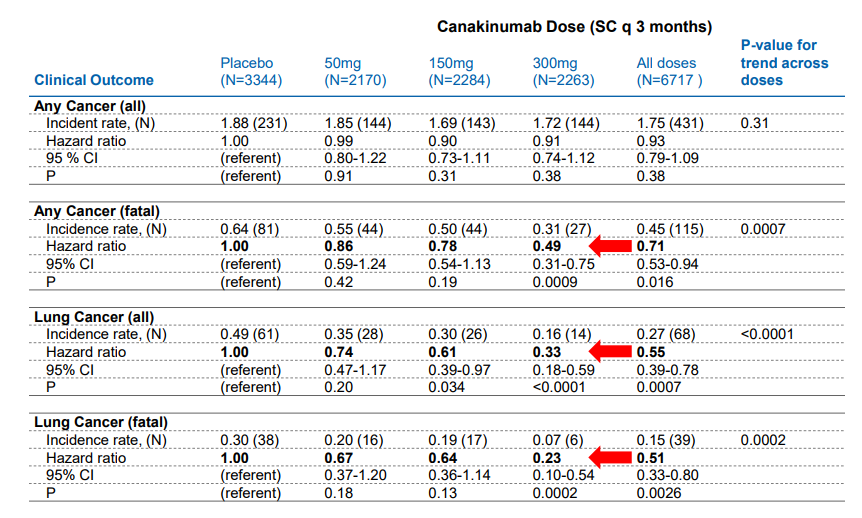

The age demographic utilized in the study falls squarely in the sixth decade of life, with a notable elevation in the C-reactive Protein score. The study arm treated with 300mg of Canakinumab posted a notable, statistically significant drop in the incidence of cancer with the more prominent drop occurring in the patient population afflicted with lung cancer.

Image source: Novartis

Novartis plans on conducting additional phase 3 trials with an expected commencement in the first quarter of 2018. We do not believe the product will be utilized as monotherapy; instead, it may become a valuable addition to the standard treatment paradigm. Patent Life and Royalty Rate Canakinumab is not an internally developed molecule. Novartis agreed to develop the molecule in agreement with Regeneron Pharmaceuticals (REGN) whereas Regeneron will receive a tiered royalty of worldwide sales. Regeneron Pharmaceuticals, Inc provided details of the royalty it receives on any sales of Canakinumab (ACZ885), an anti-IL1β antibody. Under a 2009 agreement with Novartis, Regeneron receives a royalty on worldwide net sales of Canakinumab; the royalty rate starts at 4 percent and reaches 15 percent when Canakinumab annual sales exceed $1.5 billion. The royalty applies to currently approved indications for Ilaris® , and any potential sales for future indications, including related to the positive Canakinumab Antiinflammatory Thrombosis Outcomes Study (CANTOS) results Source: Regeneron We believe Canakinumab has a promising future; based on the data presented we can envision a clear path towards blockbuster status (sales in excess of $1 billion per year). One of the challenges with Canakinumab is the length of the remaining patent life. The original patent is slated to expire in 2024, which offers a relatively short runway for commercial success for Novartis and by extension Regeneron Pharmaceuticals. Conclusion We are pleased to see our initial enthusiasm for the preliminary data as, detailed in an earlier piece ”Novartis is Building a Significant Cardiovascular Franchise,” is justified. Based on the impressive data posted, we feel Novartis now has a second product to pair with Entresto in the Cardiovascular Disease category. We feel the data pertaining to lung cancer is a pleasant surprise; we feel this may open a second avenue for revenue growth for the product. The continued string of hits recently posted by Novartis has given us the confidence to add the idea to the Dividend Growth Newsletter portfolio. We feel the constant innovation posted by Novartis bodes well for future dividend growth, and we’ll continue to provide updates.

Independent healthcare and biotech contributor Alexander J. Poulos is long Regeneron Pharmaceuticals. |