The Puzzling Attack on Alibaba

publication date: Sep 14, 2015

Alibaba is not a “dot-bomb” like the infamous blow-ups in the US in the late 1990s/early 2000s. The Chinese e-commerce giant is significantly profitable and free cash flow positive, and growth prospects are tremendous. Calling for a ~15 times multiple on next year’s earnings, as a large publisher has done, where next year’s earnings are but a fraction of the company’s earnings power 5-10 years from now is an attempt, in our view, to punish the stock at a vulnerable time when global economies are shuddering and the Chinese equity markets continue to face immense pressure. Our estimate of the firm’s long-term intrinsic value is significantly higher than its current market price, but the mounting proliferation of fear may very well hurt shares in the near term.

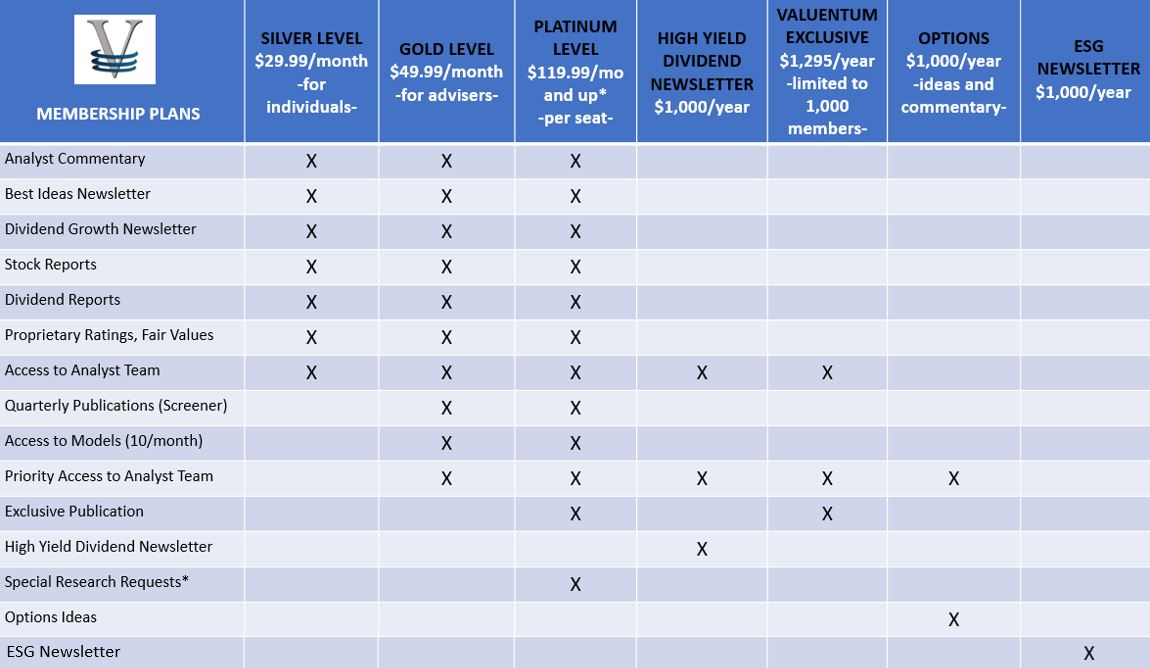

Subscribe Now to Gain Access!

This page is available to subscribers only. To gain access to members only content (including this research piece), click here to subscribe. With a subscription, you'll have access to all of our premium commentary, equity reports, dividend reports and Best Ideas Newsletter and Dividend Growth Newsletter, as well as receive discounts on all of our modeling tools and products. Financial advisers and institutional investors have even more to choose from!

Click to Learn More about Valuentum

If you are already a subscriber, please login.

If you believe you should be able to view this area then please contact us and we will try to rectify this issue as soon as possible.

To gain access to the members only content, click here to subscribe. You will be given immediate access to premium content on the site.