WebMD Cuts Through Our Fair Value Estimate; Falls Almost 30% Today

publication date: Jan 10, 2012

WebMD surprised investors this morning. The company said it is no longer 'for sale', disclosed that its CEO had resigned, and warned that 2012 profits would disappoint. Our discounted cash-flow process had identified a buy-out premium in the shares, and we had been expecting a significant move lower into the high $20s based on our fair value estimate. We think WebMD's shares are fairly valued after the move.

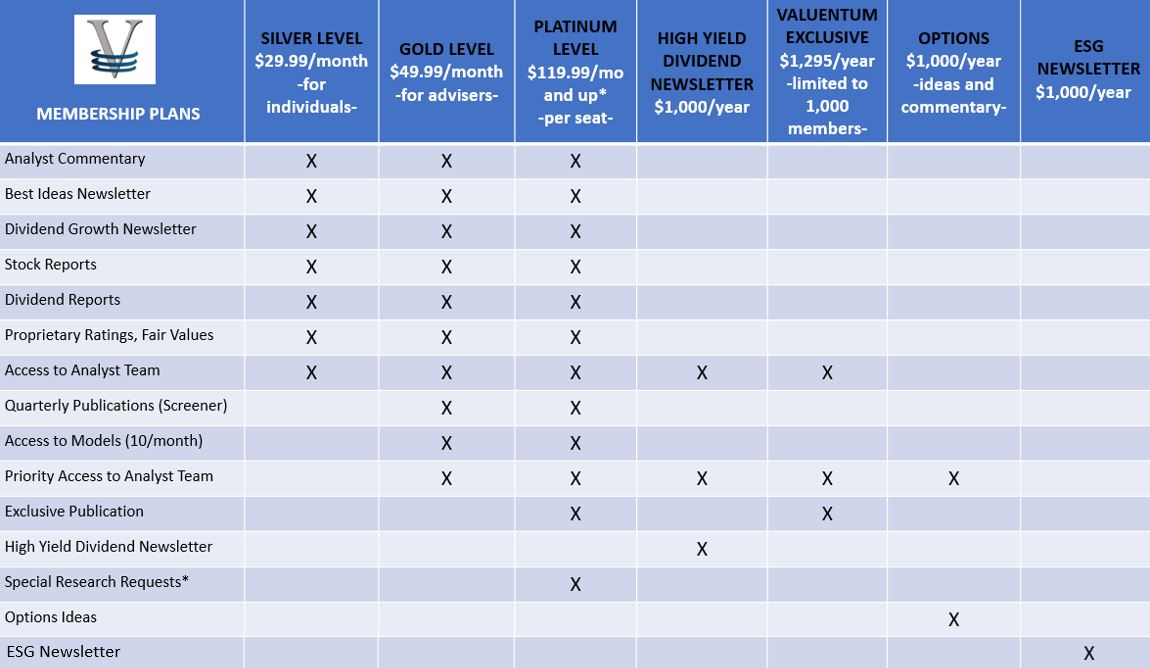

Subscribe Now to Gain Access!

This page is available to subscribers only. To gain access to members only content (including this research piece), click here to subscribe. With a subscription, you'll have access to all of our premium commentary, equity reports, dividend reports and Best Ideas Newsletter and Dividend Growth Newsletter, as well as receive discounts on all of our modeling tools and products. Financial advisers and institutional investors have even more to choose from!

Click to Learn More about Valuentum

If you are already a subscriber, please login.

If you believe you should be able to view this area then please contact us and we will try to rectify this issue as soon as possible.

To gain access to the members only content, click here to subscribe. You will be given immediate access to premium content on the site.