Apple is a top-weighted idea in the Best Ideas Newsletter portfolio and is also a mid-weighted idea in the Dividend Growth Newsletter portfolio. We added to Apple in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio in December 2018, and we added to it yet again in April 2019. We continue to like shares and value them at ~$220 each. We expect a modest upward revision following the report.

—

By Brian Nelson, CFA

—

Before we get started talking about Apple (AAPL), its fiscal third-quarter report released after the close, I wanted to alert you to our views on McDonald’s (MCD) and point to some of the great calls we’ve been making in the restaurant space. Please have a read of that piece here, and then jump back to this article.

—

I’d also like to remind you to

lock in the current pricing for the Exclusive publication here. It’s official: The pricing of the Exclusive will be going up to new members to $1,295/year on August 5, so please don’t miss the savings. If you have any questions about the Exclusive publication, please just let me know. Now, on to Apple.

—

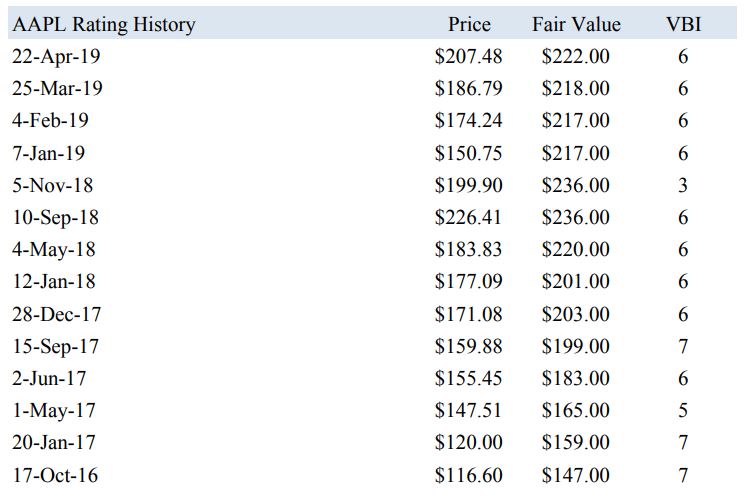

Image Source: Rating history of Apple, Valuentum’s 16-page stock report.

—

We’ve had an above-market fair value estimate for Apple for as long as we can remember, and at least from mid-2016. When the markets swooned in December 2018/January 2019, we stuck by our guns in this, yet another, great call. Not only did we nail the fair value estimate, as Apple is indicated up to ~$220 in after-hours trading, but the VBI offered some great signals along the way. The worst performance of Apple followed a rating of 3 (1= worst), while some of the best performance of Apple came multiple periods after it registered a 7 (10= best). We continue to work to optimize the signal-to-noise ratio in our work, and we are evaluating expanding our update cycle to half-year periods to better bolster the signaling aspects of the Valuentum Buying Index (VBI).

—

In our widely-read case study, the VBI showed its ability to rank equity returns over a forward 12-month period, and we think a migration to less-frequent updating may make the most sense to better capture the forward-looking dynamics of the system. We think this will help weed out false breakouts and other noise that could be harmful. Remember, if you are only paying attention to the update cycle, you are missing the forest for the trees. Our goals are to do extremely well in using the tools and metrics we create, the fair value estimate, the VBI, the Dividend Cushion ratio, among others, and to highlight the best ideas for consideration in the newsletter portfolios.

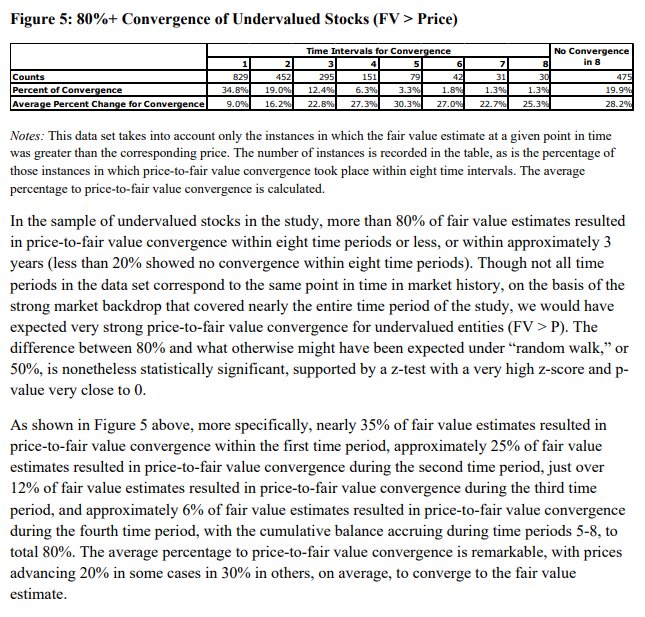

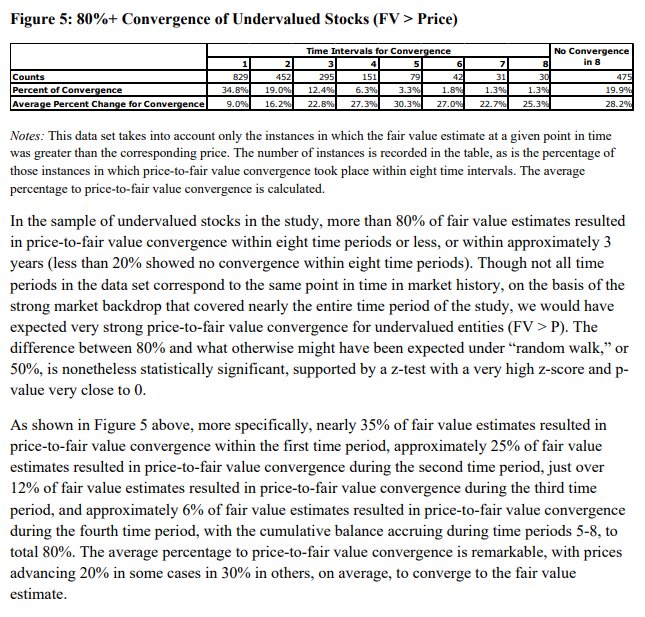

That said, the price-to-fair value gaps are very important, too. For example, in our recent study that measured the instances of price-to-fair value convergence from 2012 through mid-June 2017, the efficacy of fair value estimates in predicting stock prices was impressive. If you haven’t already, please take a read of the performance of undervalued stocks in the image above. We talk about this in Value Trap. We think using the price-to-fair value consideration coupled with a strong technical/momentum overlay is a great way to capture strong expected returns (i.e. price-to-fair value convergence), as this is the framework behind the VBI. Pay attention to large price-to-fair value gaps and building convergence momentum, or value…..ntum.

—

—

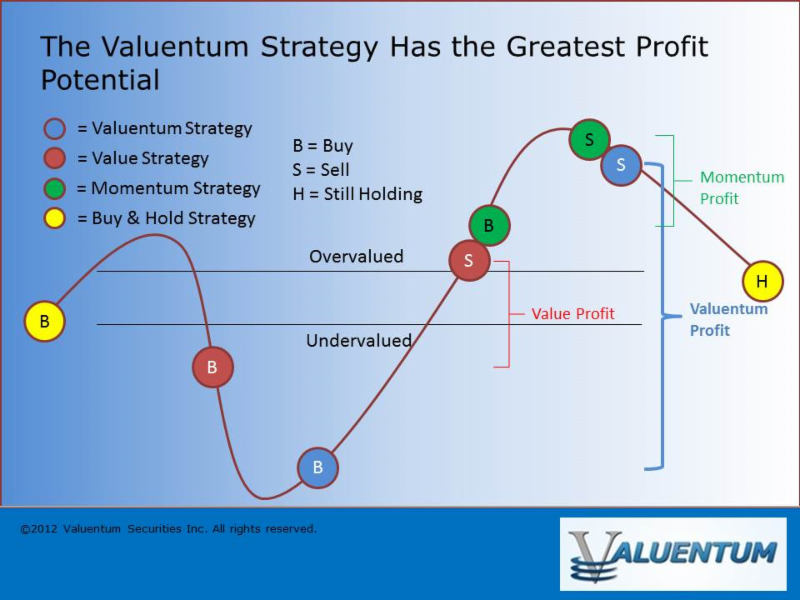

Apple was a stock that we highlighted in the book, Value Trap, and one that we added to during the past few months, further bolstering its weighting in the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. The stock has now experienced rapid price-to-fair value convergence since the doldrums of December 2018, and now we’re letting it run higher. It just recently broke out from what many technicians call a cup-and-handle, and now we watch as technical and momentum investors pile into the stock. Read more about these dynamics in the Dollar General (DG) note here, a stock in a relatively similar situation. We explain the illustration above in the Dollar General piece, too.

—

We may look to remove shares of Apple, but we may only do so as they approach the higher end of the fair value estimate range, and only after they start to roll over. As with Dollar General, that may happen sooner than later, and that’s why at these price levels of Apple shares, we’re paying much closer attention to its technical/momentum indicators than we would any “rounding errors” in the price-to-fair value ratio. What do we mean by “rounding errors?” Well, it was easy to say Apple was severely mispriced when it was trading in the mid-$140s earlier this year (it had a huge margin of safety relative to the fair value estimate), but at ~$220, it’s a much more difficult question. In any case, we expect a modest upward revision to the fair value estimate as a result of the news. Our team will also have a more dedicated note on Apple’s fiscal third-quarter report on the website soon.

—

In other news, we’re getting more and more confirmation that Mylan (MYL) may not be a value trap, but the company is not out of the woods yet. Its technicals are still very ugly. Nontheless, our fair value estimate stands well above where shares are trading–but we’re still not adding it to any newsletter portfolio. There are so many other “easier” ideas out there (see the newsletter portfolios or the Exclusive), but our valuation work on Mylan speaks to the considerable benefits of using price-to-fair value outliers as a screen of new ideas. You can read our latest work on Mylan here.

—

Thank you, and don’t forget to lock in the Exclusive pricing here. What a fantastic second-quarter earnings season thus far!

—

Valuentum Securities, Inc.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum‘s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.