Image Source: Mylan NV – IR Presentation

By Callum Turcan

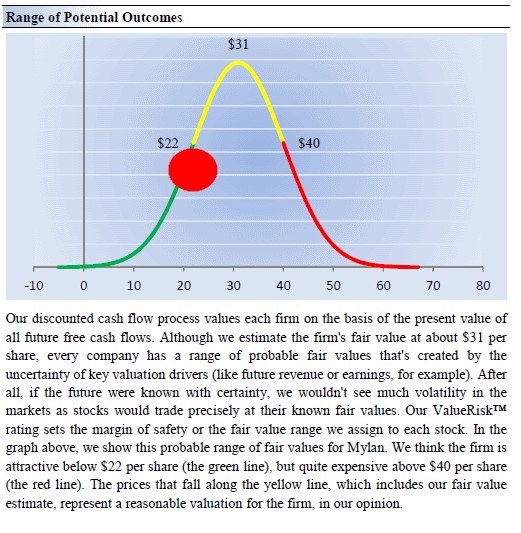

On July 29, Mylan NV (MYL) agreed to merge with Pfizer Inc’s (PFE) Upjohn unit to form a much larger and more diversified entity in the pharmaceutical industry, selling such products as Mylan’s EpiPen and Pfizer’s Viagra. Shares of MYL jumped by a double-digit percentage on the news, and we aren’t surprised given how Mylan has traded well below our $31 per share fair value estimate for some time now. What Mylan needed was a catalyst to get the market to take notice (of its estimated future free cash flows), and Pfizer seems to have offered it one by renewing investor interest in the name. Pro forma for this transaction, the new pharmaceutical company will be a big player in the generics, biosimilars, and off-patent branded space. Shares of MYL as still trading below the low end of our fair value range ($22/share) as of this writing, which is depicted in the graphic below (from our 16-page Stock Report that can be viewed here).

Image Shown: After the news with Pfizer broke, shares of Mylan shot up to just under the low end of our fair value estimate range as of this writing.

The name of the combined entity will be announced at a later date before closing. Shareholders of Mylan will own 43% of the pro forma company while shareholders of Pfizer will get the remaining 57%. While Mylan shareholders still need to approve of the deal, that appears likely given the positive MYL share price action witnessed after the news broke. This deal is expected to close by the middle of 2020, and no shareholder vote is required at Pfizer.

Evaluating the Pro Forma Company

On a pro forma basis, the company is expected to generate $19.0-$20.0 billion in net sales and $7.5-$8.0 billion in adjusted EBITDA next year. Pro forma free cash flows are estimated at $4.0 billion in 2020. Here’s some key commentary from the press release (emphasis added):

“The new company will be focused on returning capital to shareholders, while maintaining a solid investment grade credit rating. It expects to achieve a ratio of debt to adjusted EBITDA of 2.5x by the end of 2021. In addition, the new company intends to initiate a dividend of approximately 25% of free cash flow beginning the first full quarter after close and the potential for share repurchases once the debt to adjusted EBITDA target is sustained…

As important, the transaction we are announcing today will enhance the strength of our balance sheet by scaling and increasing our existing strong cash flows, providing the new company with the financial flexibility to support and accelerate deleveraging and the expected initiation of a meaningful dividend from the first full quarter after the transaction closes… This powerful new profile positions the new company for sustained success and long-term value creation.”

What’s interesting is that the pro forma company will allocate 25% of its free cash flows towards paying out a dividend, considering Mylan currently does not pay out a regular dividend and hasn’t since 2007. It’s possible some of the interest in this deal comes from Mylan effectively stating, on a pro forma basis, that it’s going to start paying out a dividend once again. Approximately $1.0 billion a year in common dividend payments should allow for a meaningful yield on a pro forma basis. The company noted that there’s plenty of room for share repurchases and dividend growth once long-term leverage ratio targets are obtained, sometime around 2021-2022.

Management is committed to maintaining an investment grade credit rating and expects to achieve a 2.5x debt to adjusted EBTIDA ratio by the end of 2021. Over the long-term, management is targeting a 2.5x leverage ratio. The company appears ready to use internally generated funds to repay debt maturing in 2020 and 2021, using the remaining free cash flow after dividends to delever. We are very supportive of this decision, as starting out on strong financial footing is the best call. At closing, the pro forma company is expected to have a ~$24.5 billion total debt load. Upjohn plans to issue out $12.0 billion in gross debt before the deal closes, with those proceeds going to Pfizer.

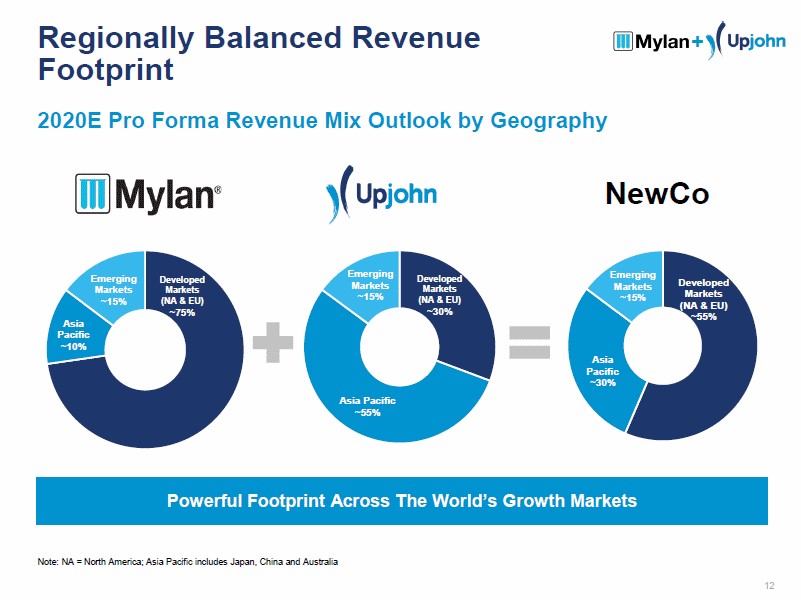

By 2023, $1.0 billion in annualized synergies are expected to be realized as Mylan and Upjohn leverage each other’s strengths. Mylan has a strong foothold in developed markets while Upjohn has an interesting presence in emerging markets. The goal is for Upjohn to utilize Mylan’s global manufacturing and supply chain operations to reduce costs while Mylan capitalizes on Upjohn’s marketing power to expand into new and existing markets where Mylan is less relevant.

Image Shown: The pro forma entity will have a far more diverse geographical footprint, with a sizeable presence in developed, developing, and emerging markets. Image Source: Mylan IR Presentation

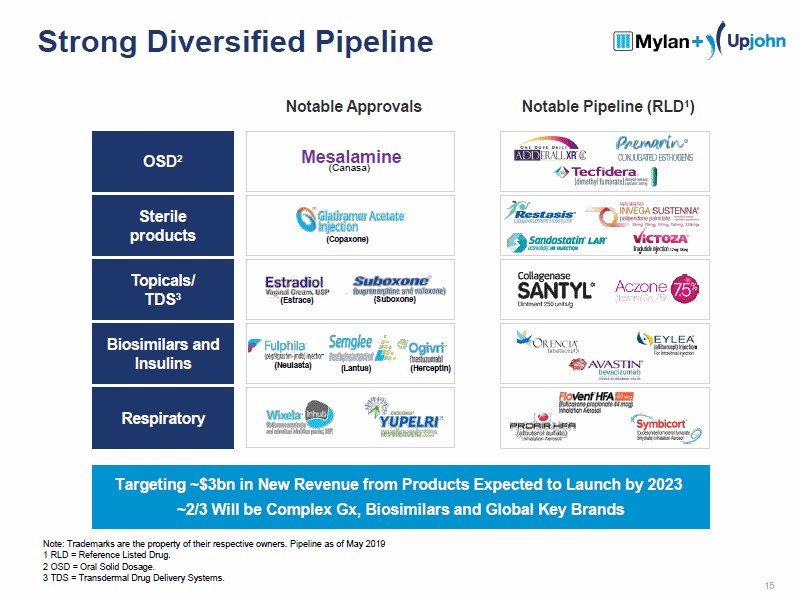

Going forward, the pro forma company expects to generate ~$3.0 billion in additional revenue from new product launches by 2023. The graphic below goes into more detail on where that upside will come from, with an eye on biosimilars and complex generics. On top of ~$1.0 billion in annualized synergies by 2023, there appears to be plenty of room for free cash flow expansion depending on how well the integration process goes.

Image Shown: The pro forma company is expecting to realize ~$3.0 billion in additional revenue from new products by 2023. Image Source: Mylan – IR Presentation

Concluding Thoughts

Having a Fair Value Estimate is one of the most important parts of the investing process, if not the most important. As investors begin to reassess Mylan in light of its deal with Pfizer’s Upjohn unit, they may begin to see a pharmaceutical company whose future free cash flows are stronger than previously expected. In the event that’s the case, that may see shares of MYL move higher still, especially if income growth oriented investors get interested in the name. We will be following this transaction going forward but are staying firmly on the sidelines for now.

Pharmaceuticals Industry (Biotech/Generic) – ALXN AGN BHC BIIB BMRN GILD MYL REGN TEVA VRTX ZTS

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.