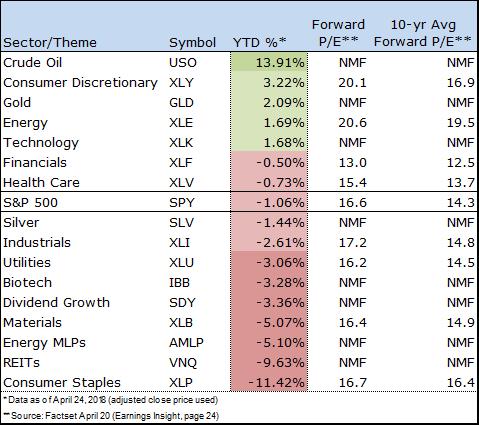

Image shown: Crude oil continues to lead gainers while consumer staples, REITs, and energy MLPs continue to get shellacked.

By Kris Rosemann

The stock market during the first few months of 2018 has been marked by a meaningful return to volatility. Commodity prices from crude oil (USO) to aluminum have had their moments in the sun as material supply/demand imbalances of years past continue to sort themselves out, with the help of a few key players, of course (OPEC member nations in the case of crude oil, and Chinese pollution regulations and US trade policy changes in the aluminum example). Geopolitical uncertainty is keeping both world leaders and investors on their toes as the world continues to navigate multiple denuclearization deals and potential looming trade wars, pushing some towards safe havens such as gold. Meanwhile, rising interest rates in the US continue to raise concerns over equity valuation and risk-reward trade-offs.

Though the S&P 500 (SPY) is down only slightly more than 1% year-to-date, it is off nearly 8% from its highest closing mark of the year, which came January 26, as rising Treasury yields, among other factors, have weighed heavy on investors’ minds since then. Rising interest rates have had a logical impact on the performance of REITs (VNQ), whose prices tend to be inversely-related to interest rates, at least in part as a result of a poorer risk-reward trade-off for income-minded investors that may be enticed by higher-yielding Treasuries. A similar case can be made for the utilities (XLU) and dividend growth (SDY) groups, but the biggest loser in the market thus far in 2018 has been consumer staples (XLP), which should come as no surprise to Valuentum readers, “We Said Consumer Staples Would Underperform.”

Energy MLPs (AMLP) continue to lag the broader energy sector, too, as they have been plagued by a variety of issues, not the least of which is also related to rising rate fears (higher borrowing costs) and structural problems within the MLP business model itself, a notion that has become increasingly evident as more and more MLPs pursue simplification transactions. While the MLP space has yet to realize the benefit of rising commodity prices, many players in the basic materials sector (XLB) are facing the challenges that come with higher input costs in the form of raw materials. Others in the sector are seeing a challenging outlook as many agricultural commodities have faced meaningful pressure as a result of a potential trade war with China, a key buyer of US agricultural goods.

The industrial sector (XLI) has also been impacted by rising input costs, and President Trump’s steel and aluminum tariffs, while less intense than initially indicated, will continue to have an impact on companies that are dependent on those raw materials. Strong performer Boeing (BA) is a top position in the Industrial Select Sector SPDR ETF, but General Electric (GE) is, too, and the latter’s shares have been under tremendous pressure. The US healthcare space (XLV) has been stuck in rut more recently as policy uncertainty persists and payors work to reign in the rising cost of treatment. We may be witnessing the end of the pharmacy benefit manager as we know it, and a greater emphasis on generics and biosimilars may likely pressure growth and margin performance for some key players.

The financial space (XLF) has been on a bit of a roller coaster ride thus far in 2018, but it finds itself back near its starting point despite the yield curve striking less optimistic sentiment. Strong fundamentals in the US economy have helped, but US consumer debt is at record highs above $1 trillion, which may eventually come home to roost. The tech sector (XLK) has also had a bumpy start to 2018, with some key names such as Intel (INTC) and Facebook (FB) getting into hot water with the public, and concerns related to the impact of tax reform on the long-term strategies of some of the most cash rich entities in the space, as exemplified by Apple’s (AAPL) recent decision to move from a $163 billion net cash position to a cash-neutral balance sheet, potentially impacting investor decision making.

The energy sector’s (XLE) performance thus far in 2018 has been largely understandable given the ongoing recovery in energy resource pricing, but geopolitical concerns and ongoing unrest in the Middle East have the potential to change market dynamics at the drop of a hat. Uncertainty related to the Iran nuclear deal could drastically alter the delicate supply/demand profile of the global oil market, and tensions between Russia and the US are not being eased in the slightest by the ongoing possibility of confrontation in or over Syria. Meanwhile, US independent producers continue to grow rig counts and pump increasing levels of oil, and many estimates suggest the country will surpass Russia as the world’s leading oil producer by 2019 at the latest.

The consumer discretionary (XLY) space, the top-performing sector thus far in 2018, has been a key beneficiary of solid consumer confidence in the US, which rose in the month of April (according to preliminary estimates) despite ongoing concerns regarding the implications of a trade war at the consumer level. Increased transportation costs via rising fuel prices have the potential to impact levels of discretionary spending in the near term, but the US economy continues to power ahead, giving consumers adequate confidence in current and future levels of disposable income to continue spending. Amazon (AMZN) and Netflix (NFLX) continue to be the bellwether in the consumer discretionary space.

The volatility of early 2018 is likely here to stay for some time, so be careful, but not fearful, out there. As always, be sure to regularly check in on the stock landing pages of portfolio holdings for the most recent updates to fair value estimates, Dividend Cushion ratios, and a number of Valuentum’s other proprietary metrics.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.