Consumer Staples Stocks Underperform — We think investors are wising up to the risks of consumer staples stocks, and increasing risk-free rates seem to already be complicating the investment decision-making process for many investors. Consumer staples equities in the S&P 500 are currently trading at ~19.4 times forward 12-month earnings, well above their sub-17 times 10-year trailing average. We believe investors will continue to swap out of these steady-eddy, but overpriced, gems in the near term, in favor of higher-beta commodity and energy-oriented companies as the market sets up to surge in 2017. We have been warning about the tipping point in Treasury yields and implications on dividend-paying consumer staples equities for some time. – Brian Nelson CFA, December 2016, “5 Shocking Stock Market Predictions for 2017”

By Brian Nelson, CFA

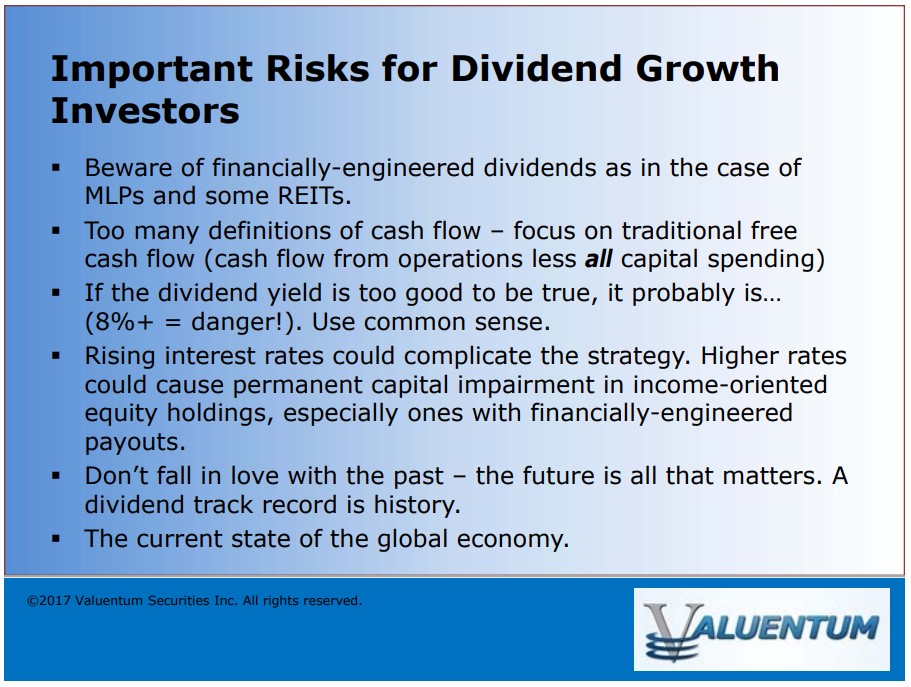

When I visited Houston, Texas, for a CFA Society chapter talk in March 2017, I highlighted how I thought consumer staples stocks would underperform. Those accessing Valuentum’s Learning Center probably came across those slides. You can download the slide deck that focused on the master-limited-partnership space but also warned about the consumer-staples space here (pdf). A proxy for the consumer staples sector, the Consumer Staples Select Sector SPDR ETF (XLP), has fallen nearly 12% so far in 2018 alone versus roughly flat performance from the S&P 500 (SPY).

During the past few days, the consumer staples sector has been getting pounded by the big disappointment at Philip Morris (PM), which has also impacted Altria (MO) in sympathy, “Philip Morris Shocks the Tobacco Space But Why?” Procter & Gamble (PG) reported calendar first-quarter (fiscal third-quarter) results that showed gross-margin pressure and weakness with respect to product pricing, which has had an impact on other household-product, consumer-staple entities across the sector, too “Procter & Gamble Pressured By Pricing,” including Colgate-Palmolive (CL). None of this should be surprising to our readership. We started picking up on the product pricing pressures in early 2017, “Consumer Staples: Product Pricing Gains To Wane in 2017?” Another consumer staples giant, Coca-Cola (KO), whose results were decent but continued to show deteriorating free cash flow trends relative to just a couple years ago, also caught some selling during the past few days, “Coca-Cola’s Free Cash Flow Generation Could Be Better.” Pepsi (PEP) has also traded off in sympathy.

Procter & Gamble, Coca-Cola, Pepsi, Philip Morris account for four of the top 5 heavily-weighted companies in the consumer staples sector, as measured by the Consumer Staples Select Sector SPDR ETF, while Altria and Colgate-Palmolive are a part of the top 10 holdings. These hefty dividend payers still have fantastic business models and generate tremendous amounts of cash, and we still like their competitive advantages and staying power. However, when it comes to share-price performance and dividend strength, free cash flow and balance-sheet health matters, and we haven’t liked this at a great many of consumer-staples stocks for some time, “Coca-Cola, Pepsi, Kimberly-Clark: Great Businesses But Lofty Earnings Multiples and Net Debt Positions,” from August 2017.

We don’t think you can find a better second (or third) opinion than Valuentum’s.

Household Products: CHD, CL, CLX, ENR, HELE, KMB, JNJ, PG

Related: VDC, IYC, RHS, FXG, XRT, FSTA, PEJ, PBJ, PBS, PSL, RTH, PSCC, RETL, UCC, PMR, SCC

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.