Bank of America can be bought for a valuation that reflects the bank as if it were to stand still, even though it is steadily going after the competition and improving its own efficiency and return on capital metrics.

By Matthew Warren

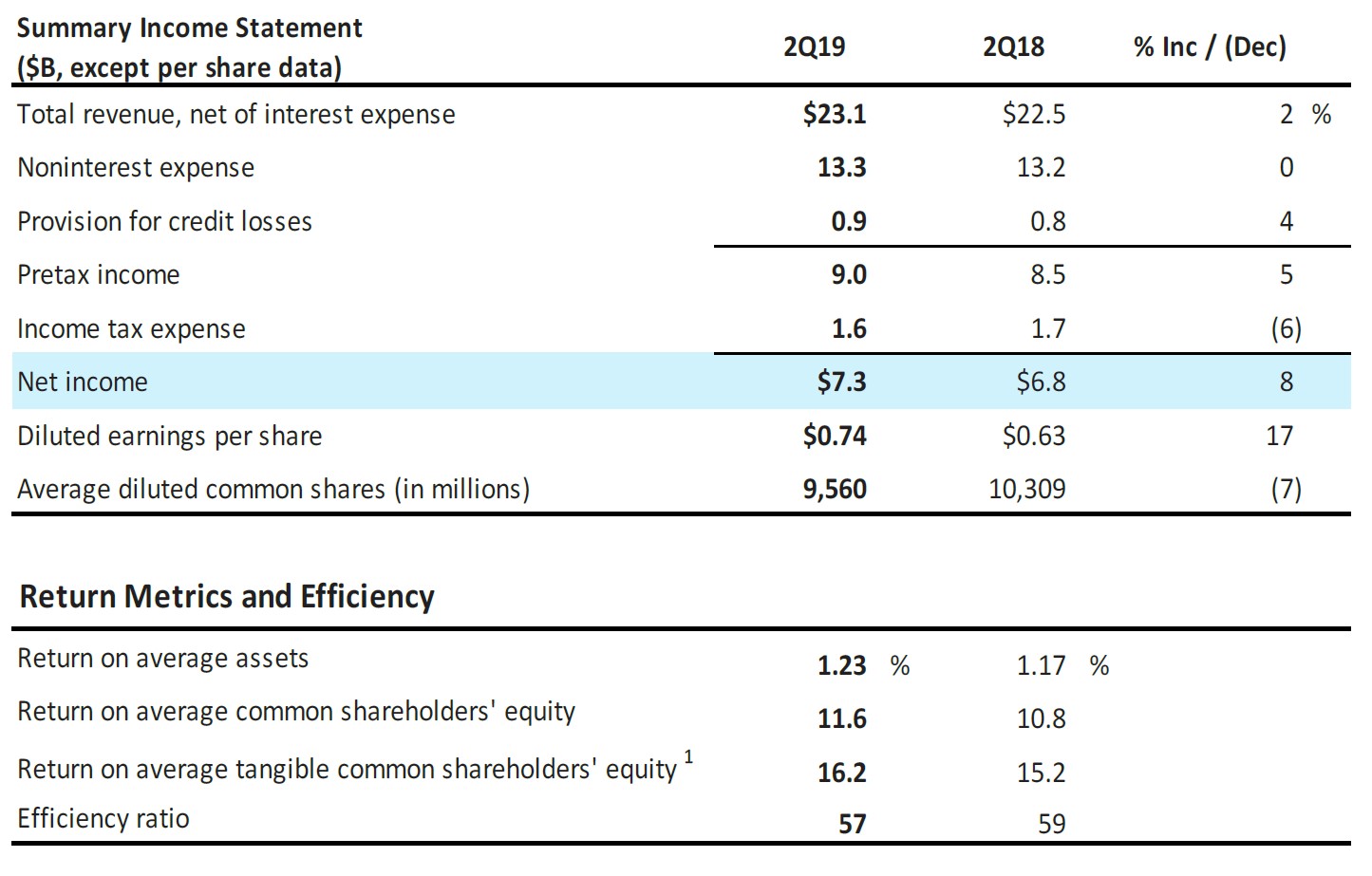

Powered ahead by its Consumer Banking segment, but held back by Global Banking and Global Markets, Bank of America (BAC) reported decent second-quarter results July 17. Total revenue was up only 2%, but ongoing tremendous cost control helped translate this into 8% net income growth, and ongoing sizable share buybacks meant diluted earnings per share were up a whopping 17%.

Image Source: Bank of America 2Q19 Earnings Presentation

Quite simply, if market related revenues weren’t moving backwards from last year’s high levels, this would have been a monster quarter for Bank of America. But you simply can’t run a universal bank without offering corporate and commercial customers investment banking and trading services. Compared to peers, Bank of America appears to have gained share at its investment bank and securities operations.

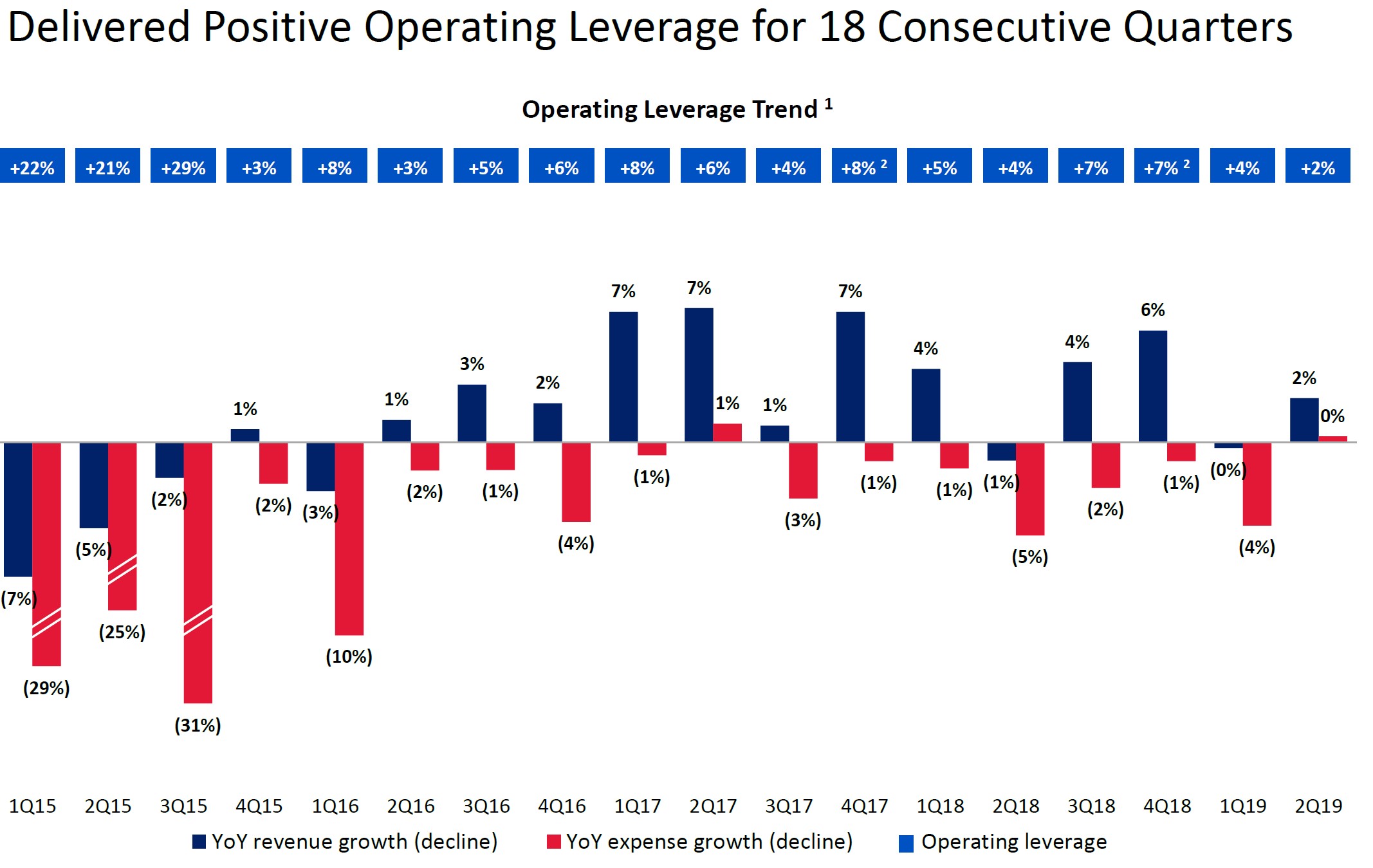

In fact, it appears the large US universal banks in general are gaining share at the expense of their European competitors. This will only serve to exacerbate the problems those institutions, which are faced with weaker local economies and negative rates on key on-balance-sheet securities everywhere they look. Bank of America has now delivered positive operating leverage for an astonishing 18 quarters in a row, as you can see below:

Image Source: Bank of America 2Q19 Earnings Presentation

While the early work was the result of getting rid of bloat compared to more-efficient peers, the more-recent progress reflects an institution that is nipping at JPMorgan’s (JPM) heels to be considered the best-in-class global universal bank. Bank of America’s management has been investing in improving the franchise and taking market share in areas like deposits, all this while that it has also been focused on improving its efficiency ratio.

Bank of America is on the cutting edge of digitalization efforts which allows millennials (MILN) and other like-minded folks to do business the way they want (at the click of a button on a mobile app), while also streamlining the back office and overall cost structure. The branch footprint has been and continues to be streamlined, with a lot of selling activity replacing simple transactions like depositing a check. Corporate clients are also doing routine transactions on mobile phones, as management highlighted in this quarter’s presentation deck.

All in all, Bank of America can be bought for a valuation that reflects the bank as if it were to stand still, even though it is steadily going after the competition and improving its own efficiency and return on capital metrics. While a recession could dent results for a spell, we like the idea of betting on this management team and this bank. We may look to add Bank of America to the newsletter portfolios.

Related: XLF

—–

Matthew Warren does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.