By Callum Turcan

Consumer packaged goods and healthcare giant Johnson & Johnson (JNJ), a holding in both our simulated Best Ideas Newsletter and Dividend Growth Newsletter portfolios, reported second-quarter 2019 earnings July 16 that received mixed reviews from the market. Shares of JNJ initially sold off before recovering later in the trading day.

Quarterly Highlights

Revenue in the period dropped by a tad over 1% year-over-year to $20.6 billion on a GAAP basis, but adjusted operational sales (which exclude foreign currency movements, a headwind to Johnson & Johnson’s second quarter performance, and the net impact of A&D activity) rose by almost 4%. There’s underlying demand growth for Johnson & Johnson’s products, but as with all American companies with significant overseas sales, a strong US dollar is getting in the way.

We would also like to mention that Johnson & Johnson sold its Advanced Sterilization Products for $2.8 billion ($2.7 billion in cash, with the remainder coming from the company retaining $0.1 billion in net receivables) through a deal that closed April 1, resulting in a pretax gain of $2.0 billion last quarter. Fortive Corporation (FTV) was the acquirer.

Adjusting for that divestiture and other effects, Johnson & Johnson grew its non-GAAP net income and diluted EPS by 22% and 23%, respectively, versus the same quarter last year. Strong performance by Johnson & Johnson’s Darzalex (treats a blood cancer called multiple myeloma) and Stelara (treats moderate to severe plaque psoriasis in adults and children 12 years and older) therapies helped boost the company’s adjusted pharmaceutical operational sales by over 4% year-over-year. Considering this division generates roughly half of the company’s revenue, that growth went a long way in padding its bottom-line. GAAP revenue from this division was up almost 2% year-over-year in the second quarter.

The company’s adjusted operational sales from its consumer division climbed over 2% last quarter year-over-year, assisted by solid demand for its beauty products like Neutrogena (includes skin care, hair care, and cosmetic offerings) and over-the-counter medicine like Zyrtec (for allergy relief). Medical device revenue rose by over 3% year-over-year on an adjusted operational sales basis (excludes the impact from its ASP divestment), aided by its electrophysiology products selling well (which can be used to treat arrhythmia, irregular heartbeats).

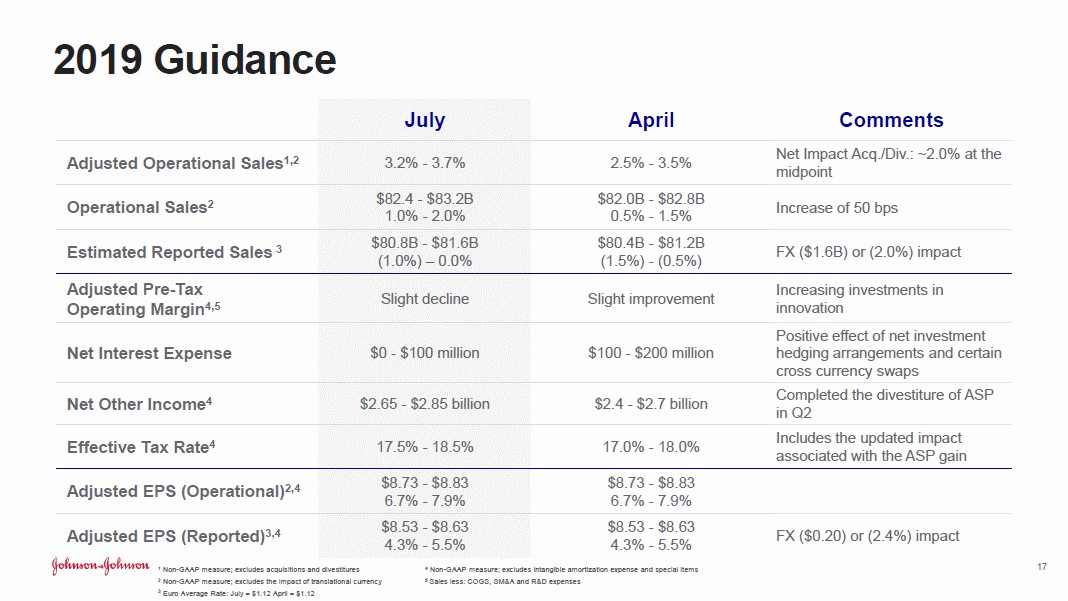

Another Guidance Raise

Management was confident enough in Johnson & Johnson’s performance to reiterate their forecast calling for $8.53 – $8.63 in adjusted EPS this year on a diluted basis, good for ~5% annual growth at the midpoint. Even better, Johnson & Johnson now sees its adjusted operational sales climbing by 3.2% – 3.7% this year, up from 2.5% – 3.0% growth previously. Its forecasted GAAP sales were revised up as well, with the company now expecting its 2019 revenue to either come in flat or post a marginal decline versus 2018 levels (instead of forecasting a modest decline in sales).

Please keep in mind that Johnson & Johnson had already revised both its earnings and sales guidance for 2019 upwards when it reported first quarter 2019 earnings. We covered that positive revision back on April 17, which can be viewed in this note here.

We caution that the company’s positive sales revision was offset by expectations for a slight decline in its adjusted pre-tax operating margin, which previously was expected to expand slightly, resulting in its adjusted EPS estimates for 2019 staying the same. That’s largely due to increased R&D investments, which we will cover in a moment. Foreign currency headwinds are expected to shave 200 basis points off Johnson & Johnson’s GAAP revenue growth rate this year.

Image Shown: Johnson & Johnson revised its expected sales growth rate for 2019 upwards, however, pressures on its operating margin forced management to keep adjusted EPS forecasts the same. Image Source: Johnson & Johnson – IR Presentation

While Johnson & Johnson is facing some major headwinds as it relates to foreign currency movements and ongoing legal troubles (stemming from its alleged role in the opioid crisis to the asbestos lawsuits relating to its talc powder offerings), we appreciate its positive sales guidance revision. We see Johnson & Johnson’s legal liabilities as being manageable (more on that here), but various legal challenges do pose a distraction from the company’s longer term goals.

Investing in the Future

Another space the company is performing well in relates to controlling its selling, marketing and administration expenses. As a percent of revenue, that line item fell by 50 basis points year-over-year last quarter, enabling Johnson & Johnson to allocate more towards R&D (which rose by 30 basis points as a percent of revenue) to better fund its drug pipeline and other potential future offerings. That includes pushing for greater use of Erleada to treat prostate cancer, which was approved by the US FDA back in February 2018.

Expanding on that, Johnson & Johnson’s Phase 3 TITAN study found that a combination of Erleada and androgen deprivation therapy (hormone therapy) was effective at treating metastatic castration-sensitive prostate cancer (“mCSPC”). That study’s results were announced in a May 31 press release, the same day the company presented the data to the American Society for Clinical Oncology. Now the company is seeking approval to use Erleada to treat patients with mCSPC from the FDA.

In order to fund these kinds of studies, Johnson & Johnson needs to invest heavily in R&D, and that’s just what the company is doing. We are very supportive of Johnson & Johnson’s focus on healthcare and pharmaceutical investments. R&D expenses were equal to 13% of the firm’s revenue during the second quarter of 2019.

What We Think

Here is a concise summary of our thoughts on Johnson & Johnson from our 16-page Stock Report (with minor adjustments);

“J&J has built one of the most comprehensive health care businesses, generating approximately 70% of revenue from top positions in its respective markets. The firm is focused on innovation while broadening its geographic presence. Consumer product sales are roughly 17% of its operations. The company was founded in 1885 and is headquartered in New Brunswick, New Jersey. J&J has 26 platforms/products that boast $1+ billion in annual sales as of the end of 2018. It plows ~10% of annual sales into R&D (that figure has more recently been closer to ~13%), a focus we like, but litigation risk continues to cast a shadow over shares. Management has been productive in reducing net debt of late.

J&J’s pharma portfolio is impressive. REMICADE has ~90% share of the US market for IV immunology products by volume, but the therapy’s US exclusivity expired in 2018. STELARA (exclusivity through 2023 in US) and SIMPONI (exclusivity through 2024 in US) are also key profit drivers. Biosimilars competition is accelerating, but J&J’s Oncology division is growing at a tremendous pace. Top-line growth at Johnson & Johnson will be driven by its impressive pharma portfolio pipeline, which will be supported by its steady consumer product business. The firm has at least 10 new molecular entities it believes have $1+ billion in individual annual sales potential that it expects to launch or file for approval from 2017-2021.

J&J’s has raised its dividend for 56 years consecutive years as of 2018. That streak continued in April 2019 as the company approved a 5.6% per share increase in its quarterly dividend. Its annual payout has advanced from just $0.43/share in 1997 to its current robust payout of $3.80/share on an annualized basis. J&J is a holding in both simulated newsletter portfolios, and we expect future dividend growth to be driven by robust free cash flow generation.”

We would like to highlight that Johnson & Johnson generated $18.5 billion in free cash flow last year, which easily covered $9.5 billion in dividend payments. Share buybacks totaled $5.9 billion in 2018.

Concluding Thoughts

Shares of JNJ yield 2.9% and remain at the lower end of our $121-$181 fair value estimate range for Johnson & Johnson. We see its legal troubles as representing the greatest hurdle to capital appreciation in the short term (again, we see those liabilities as manageable) but appreciate the apparently strong underlying demand for its products. When Johnson & Johnson publishes its 10-Q SEC filing for the second quarter, we will have more to say on the name.

Household Products Industry – CHD, CL, CLX, ENR, HELE, JNJ, KMB, PG

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Johnson & Johnson (JNJ) is included in Valuentum’s simulated Dividend Growth Newsletter and Best Ideas Newsletter portfolios. Contact Valuentum for more information about its editorial policies.