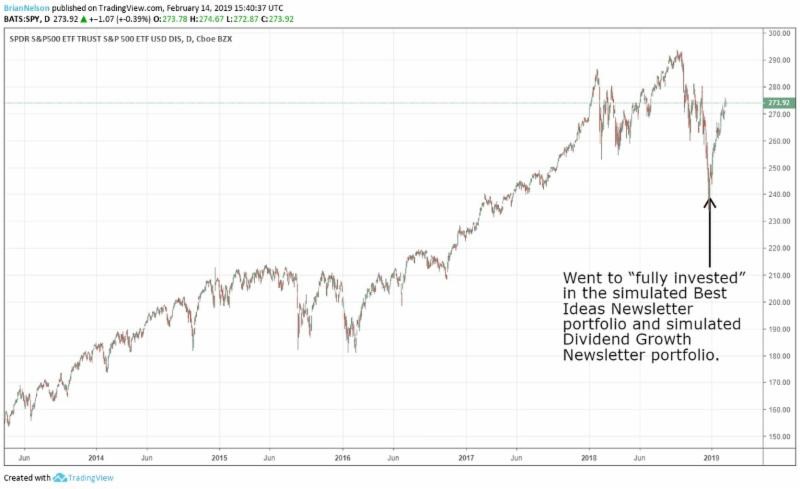

Image shown: In our December 26 note to members, we moved the simulated Best Ideas Newsletter and simulated Dividend Growth Newsletter portfolio to “fully invested” from a cash “allocation” of 30% and 20%, respectively at the high end of the range. It has worked out wonderfully as we keep our finger on the put option trigger in case price-agnostic trading and heightened volatility rears its ugly ahead again, as it did in December 2018.

Summary of Changes to Newsletter Portfolios

Best Ideas Newsletter:

Remove Gilead Sciences (GILD)

Add Financial Select Sector SPDR ETF (XLF) at 2.5%-4% weighting

Dividend Growth Newsletter:

Remove Xilinx (XLNX)

Remove Gilead Sciences

Add Financial Select Sector SPDR ETF at 2.5%-3.5% weighting

Add Health Care Select Sector SPDR ETF (XLV) at 2.5%-3.5% weighting

By Kris Rosemann and Brian Nelson, CFA

Good morning!

We wanted to get some news on your radar before we walk through the changes to the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. First, the Dividend Cushion ratio has done it again, highlighting the risk of a dividend cut at CenturyLink (CTL) before it disappointed income investors again. The company’s Dividend Cushion ratio was an ominous -3.3 (negative 3.3) before it slashed it. Remember — because the Dividend Cushion ratio maps future expected free cash flows with future expected dividends expected to be paid in the context of net balance sheet health, it highlights the overall risk of a dividend cut (ratios well below 0 = very risky), as much as the capacity for dividend growth (ratios significantly above 1 = less risky).

Also, just a heads up. Facebook (FB) and Alphabet (GOOG, GOOGL) no longer register 10s on the Valuentum Buying Index, but that is no cause for alarm. [Their new VBI ratings are reflected in their stock reports and will be updated in their respected stock tables with the website refresh this weekend.] We pay utmost attention to the price-versus-estimated fair value ratio, and we use the Valuentum Buying Index as a way to improve our “entry” and “exit” points on undervalued ideas. Since registering a 10 in January 2019, Facebook’s shares have advanced roughly 15%, while Alphabet’s shares increased a more-modest 4%. In any case, once an idea is added to the simulated newsletter portfolios, there is a significant amount of criteria we consider before adjusting its “weighting” or removing it. Here are some of the intricacies:

As it relates to the simulated Best Ideas Newsletter, for example, if a stock registers a 9 or 10 on the Valuentum Buying Index, we would consider adding it to the simulated newsletter portfolios. When the stock then/eventually registers a 1 or 2 on the Valuentum Buying Index in time, we might then consider removing it from the simulated newsletter portfolios. The changes in the “big middle” of the Valuentum Buying Index offer more tactical considerations, but we generally only consider the highest and lowest VBI ratings to be material. During times of market froth, however, as in arguably today’s environment, in the simulated Best Ideas Newsletter portfolio, we may relax some of the VBI criteria and consider undervalued stocks with neutral technical/momentum indicators, or fairly valued stocks with good relative valuation metrics and strong technical/momentum indicators. We may only consider removing ideas from the simulated newsletter portfolios when both their valuation and technical/momentum indicators point in the same direction (good/good or poor/poor), or if we’re making more strategic/tactical moves.

The criteria for the simulated Dividend Growth Newsletter is somewhat different. We’re looking for strong dividend growth stocks in this simulated Dividend Growth Newsletter portfolio (something that is not a part of the criteria in the simulated Best Ideas Newsletter portfolio), meaning that in addition to considering the VBI and fair value estimate range, the Dividend Cushion is also very important. We still look to add highly-rated stocks on the VBI and those that are undervalued to this simulated newsletter portfolio, but we may be more open to ideas that have strong dividend growth prospects, on the basis of the forward-looking Dividend Cushion ratio. After adding ideas to this simulated newsletter portfolio, we may continue to include them in the portfolio even if they have modest VBI ratings that are trading within our fair value estimate range, as long as they have strong dividend growth prospects. We’d only consider removing a stock from the simulated Dividend Growth Newsletter portfolio when we lose confidence in its intrinsic value support and its dividend growth prospects.

The way to think about our process is rather simple. In the simulated Best Ideas Newsletter portfolio, if a company registers a high rating in our coverage universe, we consider adding it (but we won’t consider adding all companies because of portfolio constraints). If we do decide to add the idea, then we watch its fair value estimate and technical/momentum indicators as it navigates the “big middle” of VBI ratings, and only consider removing the idea from the simulated Best Ideas Newsletter portfolio if it registers a 1 or 2 on the Valuentum Buying Index. In the simulated Dividend Growth Newsletter portfolio, we pay attention to the price-versus-fair value estimate range and the company’s Dividend Cushion ratio, as we’re looking for resilient equities with intrinsic-value support that have strong dividend growth prospects. Only when intrinsic-value support and dividend growth strength wane will we consider removing an idea from the simulated Dividend Growth Newsletter portfolio.

Let’s discuss the changes to the newsletter portfolios. First, let’s talk about one of our favorites, Xilinx. We love the free cash flow generating capacity of company, and its free cash flow margins are simply phenomenal, but we’re locking in significant profits in this short-term winner. Frankly, the market has rewarded us greatly. The idea was added to the simulated Dividend Growth Newsletter portfolio in the November edition, released November 1, when shares closed at $86.99, and its stock price has since surged to the $118 range as of intraday February 13. That’s good for a nearly 35% gain in just over three months. It’s hard to be disappointed with that “performance” under any strategy. But why are we dropping it?

Well, shares of Xilinx are trading near the upper bound of our fair value estimate range, which incorporates an optimistic discount rate, and appear to be technically extended after the significant rally following its fiscal 2019 third quarter report. Adding to our reasoning to pull the trigger on “locking in profits” on this idea are reports that the company has found itself in a bidding war over connectivity chipmaker Mellanox Technologies (MLNX) with the likes of Microsoft (MSFT), Intel (INTC), and Broadcom (AVGO). Management has been upfront about its desires for ongoing strategic M&A activity, but this has been coming in the form of relatively minor tuck-in acquisitions, which were easily supported by its free cash flow generation and balance sheet strength.

Though we still like the company a lot, we’re not particularly fond of the potential for Xilinx to overpay for an acquisition, and the aforementioned report has suggested that Mellanox has driven its asking price to the $6.7 billion range from $5.5-$6 billion previously, as the company is aware of its strategic fit with a number of suitors. We’re not sticking around to see Xilinx potentially eliminate its solid net cash position, especially after considering its current valuation and technical assessment. In any case, this idea was a huge winner for our members, even if it may never wholly fulfill its long-term dividend growth potential.

Now on to Gilead Sciences. This one has come back to bite us again. We’re removing Gilead from both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio. This idea was highlighted in July 2017 in the $76 range, but the story simply has not panned out as its strength in the HIV market has not offset significant weakness in HCV and its diversified pipeline has disappointed. The most recent disappointment came February 11 when a highly anticipated Phase 3 clinical trial of its NASH treatment solensertib failed to meet its primary endpoint. We’ve been counting on some big news in its pipeline.

The global NASH (nonalcoholic steatohepatitis) drug market is estimated at $35 billion, and the National Institutes of Health estimates that as high as 12% of US adults are afflicted by the fatty liver disease. There is currently no FDA-approved treatment available, and a number of pharma companies are racing to be first to market, which is what makes Gilead’s disappointing result all the more painful.

Gilead’s recent acquisition of Kite Pharma was targeted at expanding its product pipeline into the rapidly-growing area of oncology, and it has high hopes for recently-launched Yescarta. However, an impairment charge in the fourth quarter of 2018 related to a multiple myeloma drug being developed by Kite highlights the difficulties the company is having advancing other treatments acquired in the deal. We’re just not seeing too much upside potential given its recent pipeline disappointments.

To retain the equivalent amount of exposure to the healthcare space in the Dividend Growth Newsletter portfolio, we’re adding the Healthcare Select Sector SPDR ETF in Gilead’s place. Gilead is a ~2.5% weighting in this ETF, and it lists Johnson & Johnson (JNJ) as its top holding. Other top holdings include the likes of UnitedHealth Group (UNH), Pfizer (PFE), and Abbott Laboratories (ABT), among other healthcare heavy-hitters. The XLV carries a ~1.5% dividend yield as of this writing.

To retain “fully invested” status in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio, we’re adding exposure to the banking space, which was previously lacking, in both simulated newsletter portfolios at the lowest weighting range via the Financial Select Sector SPDR ETF. The Fed’s notably more dovish commentary (see our email to members here) adds to the attractiveness of adding exposure to the banking sector, and considering diversified exposure helps protect against the opaqueness of any one banking entity’s balance sheet. The XLF currently has a dividend yield of ~1.9%, which is suppressed in part by it listing Berkshire Hathaway (BRK.A, BRK.B) as its top holding at ~13%, but JPMorgan Chase (JPM), Bank of America (BAC), and Wells Fargo (WFC) are all 5%+ weightings in the ETF.

That’s all for now, but please be sure to stay tuned for any further updates. We’re expecting stock market volatility to increase in the coming years (read Value Trap), and our finger remains on the put-option trigger as the uncertainty of the political environment and Fed policy may only increase as we head into the back half of 2019. Price-agnostic trading may only further exacerbate the situation. The February edition of the Best Ideas Newsletter is due out tomorrow, February 15. We hope you enjoy. Thank you!

——————–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Brian Nelson and Kris Rosemann do not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.