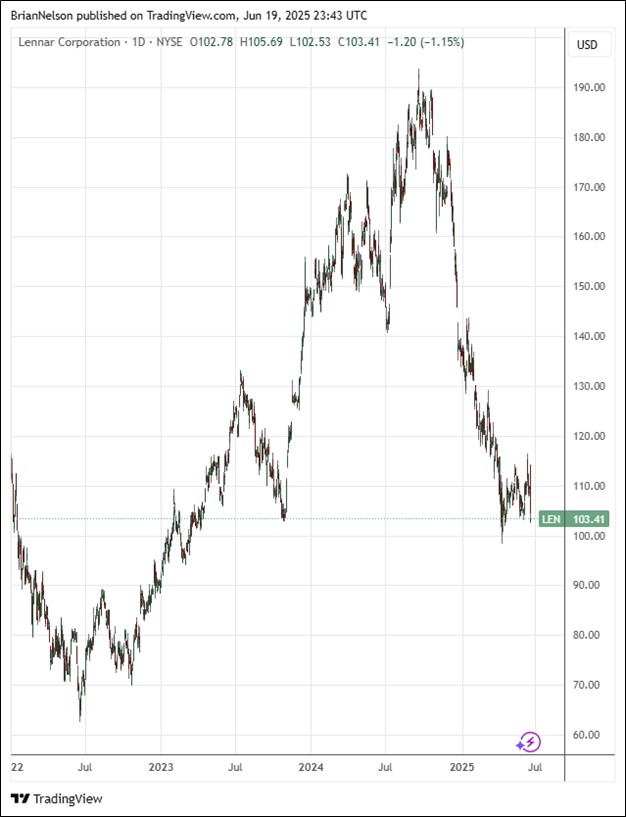

Image Source: TradingView

By Brian Nelson, CFA

On June 16, Lennar Corp. (LEN) reported mixed fiscal second quarter results with revenue beating the consensus forecast but non-GAAP earnings per share missing the consensus mark. Total revenues fell to $8.4 billion in the quarter from $8.8 billion in the year-ago period, while second quarter net earnings, excluding mark-to-market losses on technology investments were $499 million, or $1.90 per share, compared to $3.38 per share in the same period a year ago. Management had the following to say about the results:

While we continue to see softness in the housing market due to affordability challenges and a decline in consumer confidence, we adhered to our strategy of driving starts, sales, and closings in order to build long-term efficiencies in our business.

During the quarter, we drove new orders to 22,601 homes, within our guidance, and delivered 20,131 homes, also within our guidance, as we continued to focus on matching production pace with sales pace. Accordingly, we ended the quarter with limited inventory of 2,900 homes, which is fewer than two completed, unsold homes per community, and continues to be within our historical range.

Reflecting softer market conditions, our average sales price, net of incentives, declined to $389,000. As mortgage interest rates remained higher and consumer confidence continued to weaken, we drove volume with starts while incentivizing sales to enable affordability and help consumers to purchase homes. Additionally, our gross margin was 18.0% excluding purchase accounting, which met guidance, and our SG&A expenses ran higher at 8.8%, reflecting further investment and engagement in future efficiencies.

During the second quarter, Lennar’s new orders increased 6%, to 22,601 homes, while deliveries increased 2%, to 20,131 homes. Lennar ended the quarter with a backlog of 15,538 homes with a dollar value of $6.5 billion. For the third quarter of fiscal 2025, Lennar’s new orders are targeted in the range of 22,000-23,000, with deliveries expected in the same range. Lennar’s average sales price is expected in the range of $380,000-$385,000, with an approximate 18% gross margin on the percentage of home sales. SG&A as a percentage of home sales is targeted in the range of 8.0%-8.2% in the quarter, with financial services operating earnings expected to between $175-$180 million. Shares yield 1.9% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.