Image Source: Salesforce

By Brian Nelson, CFA

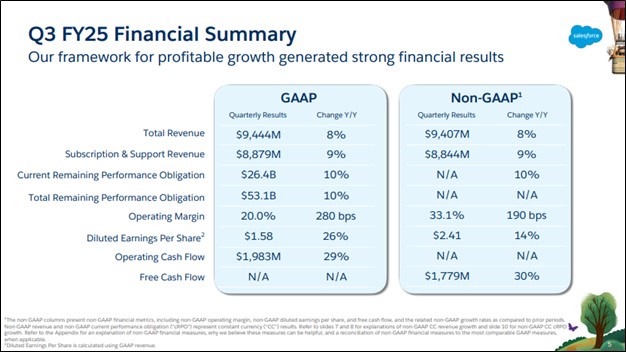

Salesforce, Inc. (CRM) reported mixed third quarter results on December 3 with revenue coming in ahead of the consensus forecast, but non-GAAP earnings per share coming in light versus what Wall Street had been looking for. Third quarter revenue grew 8% on a year-over-year basis with Subscription and Support revenue up 9%. Its third quarter GAAP operating margin was 20%, up 280 basis points year-over-year, while its non-GAAP operating margin came in at 33.1%, up 190 basis points year-over-year. In the quarter, non-GAAP diluted net income per share was $2.41, up 14% year-over-year.

Management had the following to say about the quarter:

We delivered another quarter of exceptional financial performance across revenue, margin, cash flow, and cRPO. Agentforce, our complete AI system for enterprises built into the Salesforce Platform, is at the heart of a groundbreaking transformation. The rise of autonomous AI agents is revolutionizing global labor, reshaping how industries operate and scale. With Agentforce, we’re not just witnessing the future—we’re leading it, unleashing a new era of digital labor for every business and every industry.

We continue to drive disciplined profitable growth with third quarter GAAP operating margin of 20.0%, up 280 basis points year-over-year, and non-GAAP operating margin of 33.1%, up 190 basis points year-over-year. To date, our total capital returns have surpassed $20 billion and we remain focused on driving shareholder value.

Salesforce’s current remaining performance obligations advanced 10% year-over-year in the quarter, to $26.4 billion. Third quarter operating cash flow was up an impressive 29% year-over-year, while free cash flow advanced 30% year-over-year, to $1.78 billion. During the quarter, Salesforce returned $1.6 billion to shareholders in the form of $1.2 billion in share buybacks and $0.4 billion in dividend payments. The company ended the quarter with $12.8 billion in cash and marketable securities and $8.4 billion in non-current debt.

Image Source: Salesforce

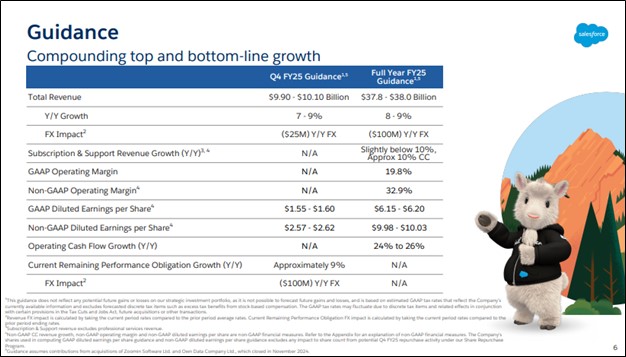

Looking to full year 2025 guidance, Salesforce raised the low end of its revenue expectations to $37.8-$38 billion, up 8%-9% year-over-year, while it maintained its Subscription & Support revenue growth guidance of approximately 10% in constant currency.

The company also raised its full-year GAAP operating margin guidance to 19.8% and its non-GAAP operating margin guidance to 32.9%. Salesforce raised its full year 2025 operating cash flow growth guidance to the range of 24%-26%. Non-GAAP diluted earnings per share is expected in the range of $9.98-$10.03 for the year (midpoint of $10.01), below the consensus estimate of $10.11. Salesforce is a net cash rich, free cash flow generating powerhouse, and the company continues to deliver for shareholders.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.