Source: Tesla

By Brian Nelson, CFA

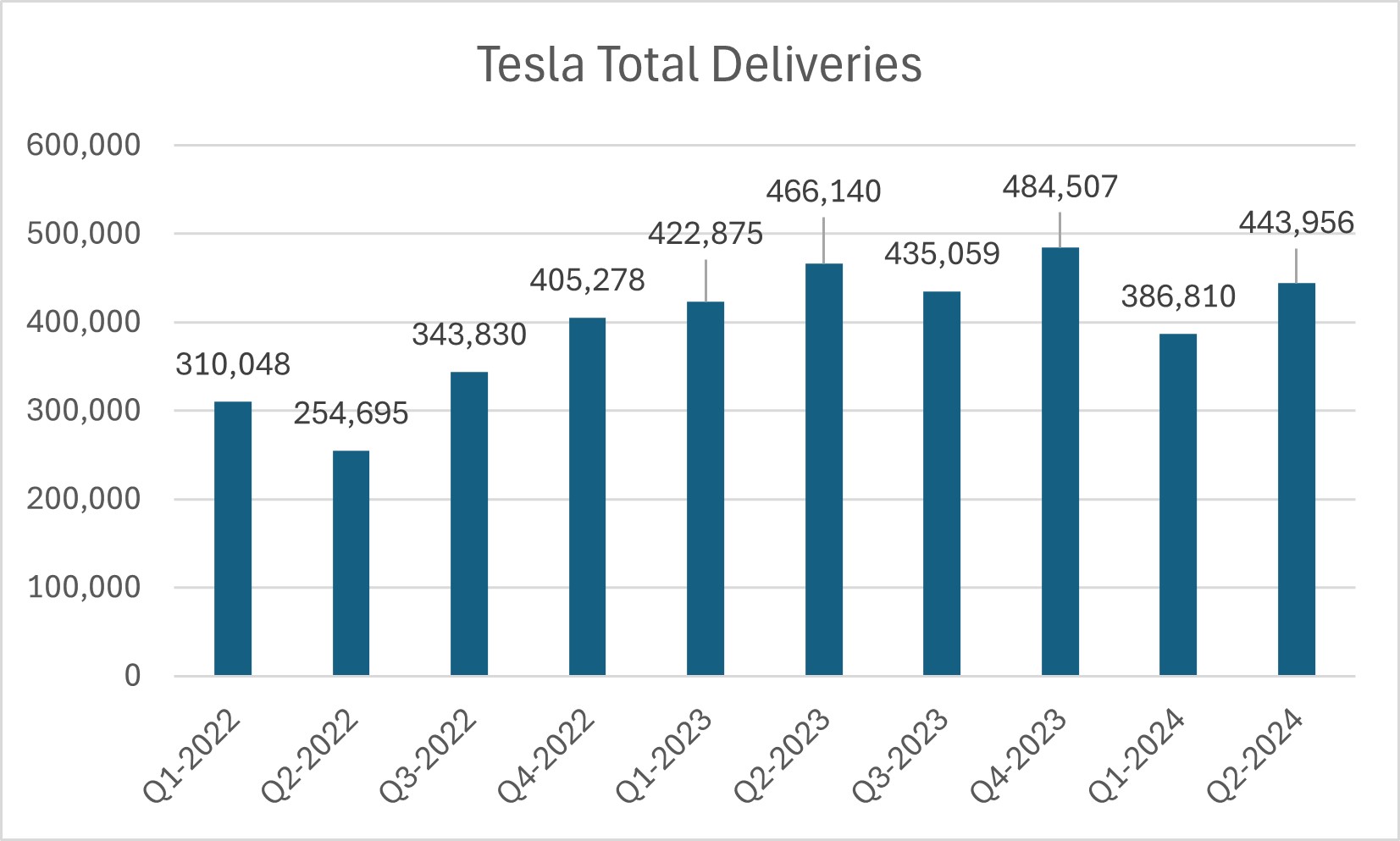

On July 2, Tesla (TSLA) released its production and delivery numbers for the second quarter of 2024. Production of Model 3/Y and other models totaled 410,831, while total deliveries came in at 443,956 units, consisting of 422,405 Model 3/Y and the balance coming from other models. The results were better than expected and helped to propel shares of the electric-vehicle maker higher. Tesla’s equity has shot up past the high end of our fair value estimate range, and while we liked the better-than-feared news regarding its deliveries, we continue to be on the sidelines with respect to Tesla’s shares. The next big catalysts for Tesla’s shares are its earnings release on July 23 and its robotaxi event on August 8. The high end of our fair value estimate range stands at $224, shy of where the company’s equity is trading ($250+).

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Tickerized for TSLA, RIVN, VLKAF, PSNY, LI, NIO, LCID, XPEV, CHPT, GOEV, LVWR, VFS, QS

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.