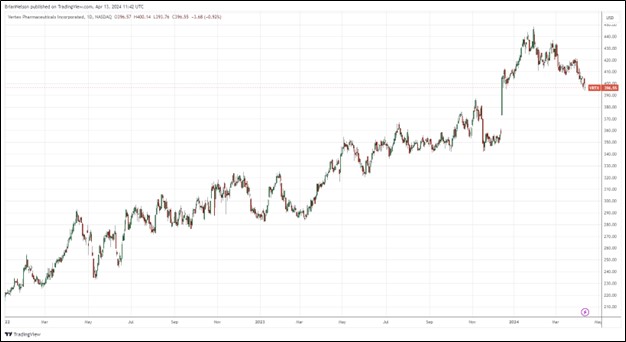

Image: Vertex Pharma’s shares have had a nice run the past couple years.

By Brian Nelson, CFA

On April 10, Vertex Pharma (VRTX) announced that it had entered into an agreement where Vertex will acquire Alpine Immune Services (ALPN) for $65 per share or ~$4.9 billion in cash. Alpine’s focus is on developing protein-based immunotherapies, and the company’s lead product, povetacicept, holds great promise in patients with IgA nephropathy, a life-threatening chronic kidney disease.

Here’s what Vertex management had to say about the proposed transaction:

Alpine is a compelling strategic fit for Vertex and furthers our ambition of using scientific innovation to create transformative medicines targeting serious diseases with high unmet need in specialty markets. We look forward to welcoming the talented Alpine team to Vertex and believe that together we can bring povetacicept, a potential best-in-class treatment for IgAN to patients faster. We also look forward to fully exploring povetacicept’s potential as a ‘pipeline-in-a-product’ and adding Alpine’s protein engineering and immunotherapy capabilities to Vertex’s toolbox.

We continue to be fans of Vertex Pharma’s cash-rich cystic fibrosis franchise, and its position in pain management, which may address the opioid crisis, as well as in further applications in gene-editing technology, of which it co-develops with CRISPR Therapeutics (CRSP). We have no qualms with the deal for Alpine, and we expect Vertex Pharma to continue to deliver for shareholders.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.