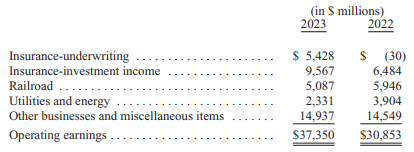

Image: Berkshire’s operating earnings experienced a strong advance during 2023 from last year’s levels.

By Brian Nelson, CFA

On February 24, Berkshire Hathaway (BRK) reported strong fourth-quarter results that capped off a year where operating earnings advanced 21% on a year-over-year basis. Warren Buffett tipped his hat to his long-time partner Charlie Munger, who passed away in November of last year, crediting him as the architect of Berkshire and himself merely in charge of the “construction crew.” There weren’t many surprises in the annual report, and Buffett made several references to areas that he has long talked about in the past, including pointing investors to operating earnings, as opposed to net income, which includes unrealized capital gains that can make reported results seem more volatile. All things considered, we liked Berkshire’s update, and we continue to like the firm as an idea in the Best Ideas Newsletter portfolio.

In the annual letter, Buffett made some popular references to the importance of buying great businesses at fair prices, as well how the stock market is a voting machine in the short run, but a weighing machine in the long run. The Oracle emphasized the importance of long-term investing, noting that when he purchased his first stock on March 11, 1942, the Dow Jones Industrial Average (DIA) was trading under 100, and how the index is now around 38,000. Though Buffett owns five Japanese (EWJ) trading houses [Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo], he reiterated how “America has been a terrific country for investors.” Similar to how we don’t make very many moves in the newsletter portfolios, Buffett emphasized that “all (investors) have needed to do is sit quietly, listening to no one.” Overtrading is not the path to riches, in our view, and Buffett tends to agree.

Buffett’s goals at Berkshire are the same as they have always been: “(They) want to own either all or a portion of businesses that enjoy good economics that are fundamental and enduring.” Entities that can grow free cash flow for long periods of time at robust rates are in a much better position than other firms that must plow considerable capital back into their businesses, resulting in rather low economic returns. As expected, Berkshire continues to “favor the rare enterprise that can deploy additional capital at high returns in the future.” For readers of Valuentum’s work, we measure the ability of companies to deploy additional capital at high returns via our Economic Castle rating, which measures the forward-looking difference between a company’s ROIC and WACC over the next five years. We continue to favor asset-light entities with strong free cash flow generation and attractive Economic Castle ratings.

Buffett continues to favor finding entities run by “able and trustworthy” managers, citing the words of the first Comptroller of the United States, Hugh McCulloch in 1863: “Never deal with a rascal under the expectation that you can prevent him from cheating you.” Buffett also set investor expectations, noting that because of Berkshire’s size, needle-moving opportunities at attractive prices have become few and far between. He also noted that “outside the U.S., there are essentially no candidates that are meaningful options for capital deployment,” and that the firm has “no possibility of eye-popping performance.” Still, Buffett explained that he expects Berkshire to “do a bit better than the average American corporation,” and that it “should also operate with materially less risk of permanent loss of capital. He goes on to say that “anything beyond ‘slightly better’ though is wishful thinking. We include Berkshire Hathaway in the Best Ideas Newsletter portfolio, more for its stability and diversification considerations than any expectation of shares to soar. Buffett’s mantra of “never risk permanent loss of capital” sits well with us.

In his annual letter, Buffett reiterated how he is poised to act in the event that panics happen once again in the markets, pointing to the view that “active participants are neither more emotionally stable nor better taught than when (he) was in school.” Buffett believes that today’s markets “exhibit far more casino-like behavior than they did when (he) was young.” With the proliferation of indexing, quantitative trading, as well as cryptocurrency, more and more investors are moving away from discretionary trading based on long-term fundamentals, and the impact of these trends continues to be one of our biggest long-term concerns with respect to market stability. If investors are trading on dynamics that aren’t tied to an intrinsic value estimate, how can stocks on the market best come to approximate intrinsic value? It’s a question that we will learn the answer to in time, but the seeds of price-agnostic trading have definitely been planted with young investors. The meme-stock craze and cryptocurrency hype may be a foretelling of the volatility that may eventually happen to equity markets, more broadly, in the future.

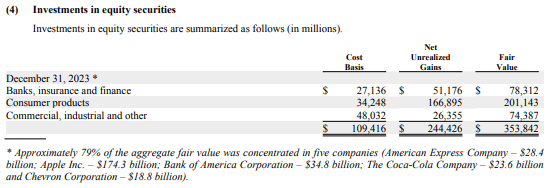

Image: A breakdown of Berkshire’s equity securities portfolio.

Buffett talked about some of the difficulties of its rail operator Burlington Northern Sante Fe, where capital requirements to maintain rail infrastructure are steep, and how earnings faced pressure more than he had expected. He mentioned that electric-utility operator Berkshire Hathaway Energy Company’s performance was also a disappointment in 2023, while noting that its insurance operations “performed exceptionally well last year, setting records in sales, float, and underwriting profits.” Berkshire ended the year with ~$167.6 billion in cash and U.S. Treasury bills, giving it an ample war chest to handle the ups and downs of the economic cycle. Free cash flow increased to ~$29.8 billion in 2023 from ~$21.9 billion in 2022, and the company’s top five securities holdings in American Express (AXP), Apple (AAPL), Bank of America (BAC), the Coca-Cola Company (KO), and Chevron (CVX) accounted for ~79% of its investment securities portfolio. Berkshire has also been buying back stock, and while the company, itself, does not pay a dividend, the firm benefits directly from the dividends of its underlying holdings. Berkshire remains a key holding in the Best Ideas Newsletter portfolio.

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

———-

Tickerized for BRK, BRKA, BRKB, AXP, AAPL, BAC, KO, CVX, EWJ, DIA, OXY, KHC, ITOCF, ITOCY, MARUY, MARUF, MSBHF, MITSY, MITSF, SSUMF, SSUMY, PGR, ALL, TRV, UNP, CNI, CSX, NSC.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges,