Image Source: Tanger Inc.

By Brian Nelson, CFA

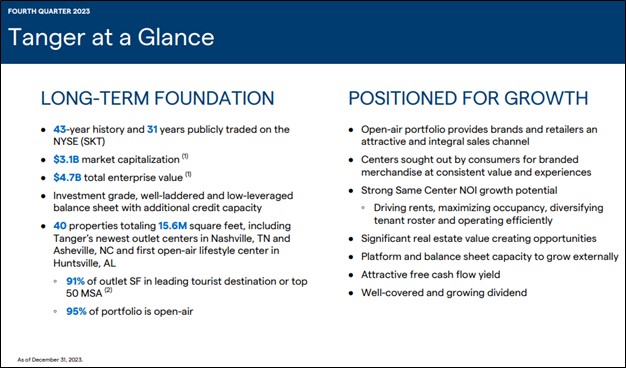

Tanger Inc. (SKT) is an owner and operator of outlet and open-air retail shopping destinations, and the REIT has done a great job of late, with shares advancing more than 50% during the past year. While traditional real estate equities have languished, Tanger has managed to keep moving in the right direction. The REIT reported better than expected fourth-quarter results February 15, and its ~3.6% dividend yield isn’t too shabby. For investors looking to take a leap into retail REITs, Tanger may be among the top considerations.

Tanger’s net income came in at $0.22 per share in the fourth quarter, up from $0.17 per share in the same period a year ago, while both core funds from operations and funds from operations advanced to $0.52, up from $0.47 per share in the year-ago period, both of which came in better than expectations. Occupancy rates have recovered nicely from the doldrums of the COVID-19 pandemic and were 97.3% as of December 31. Same center net operating income advanced 5.4% in the quarter, as Tanger experienced rent expansion and carved out expense efficiencies.

The company’s external growth activity looks encouraging:

Tanger Outlets Nashville, the Company’s newest development in Nashville, TN, opened on October 27, 2023. The center is approximately 291,000 square feet with a cost of approximately $145 million and a projected stabilized yield range of 7.5% to 8.0%. The open-air center offers shopping and dining across seven retail buildings and a unique, placemaking community space. Tanger Nashville reflects the Company’s commitment to diversify and enhance the shopping experience for its customers with nearly one quarter of the center’s dynamic assortment new to Tanger’s portfolio or first to the outlet channel.

Tanger Outlets Asheville, a 382,000-square-foot, open-air shopping center in Asheville, NC, was acquired on November 13, 2023 for $70 million. The established center is occupied by a diverse mix of brands that includes leading home furnishings providers as well as iconic apparel, footwear and accessories brands. Management expects the center to deliver a first-year return in the mid-eight percent range, with potential for additional growth over time.

Bridge Street Town Centre, an 825,000-square-foot, open-air lifestyle center in Huntsville, AL, was acquired on November 30, 2023 for $193.5 million. The center comprises over 80 retail stores, restaurants, and entertainment venues and serves as the dominant shopping destination in the market. Management expects the center to deliver a first-year return in the mid-eight percent range, with potential for additional growth over time.

Tanger ended the year with total outstanding debt of ~$1.6 billion and a net-debt-to-adjusted EBITDAre ratio of 5.8x, and the REIT issued guidance for diluted core funds from operations per share in the range of $2.02-$2.10 for 2024, the midpoint of which came in above consensus. Tanger used to be a Dividend Aristocrat before eliminating its payout during the COVID-19 pandemic, but the REIT has been steadily building its dividend back up in recent years. Its dividend has further room for expansion, too, with its funds from operations payout ratio standing at only 49% during 2023. We think Tanger is a strong consideration for investors looking to add REIT exposure to their portfolios.

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

———-

Tickerized for SKT, SPG, O, KIM, REG, FRT, NNN, BRX, ADC

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.