By Brian Nelson, CFA

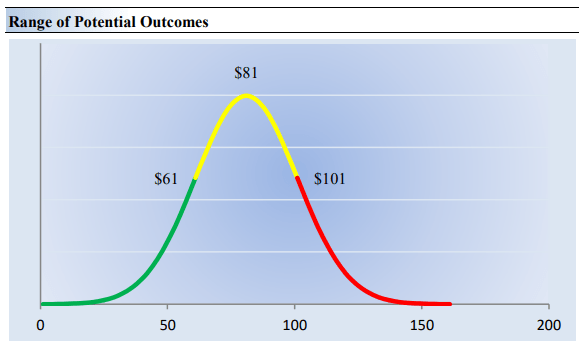

Cracker Barrel Old Country Store (CBRL) is a high-yielding restaurant idea with a unique concept that has fallen on more difficult times of late. Our recent channel checks indicate that Cracker Barrel has a lot of room to raise prices versus peers, but the firm is having a hard time executing on this front as overall traffic trends remain challenged. Right now, Cracker Barrel yields ~6.3%, and if the company can turn things around, it might make for one of the most interesting income ideas on the market. The high end of our fair value estimate range of Cracker Barrel stands north of $100 (its shares are trading at ~$80 each), but investors should remain cautious until we start to see more aggressive initiatives on the pricing front, of which management seems to be taking a cautious approach for the remainder of its current fiscal year. We’re watching and not pulling the trigger on this idea yet.

Image: The high end of our fair value estimate range of Cracker Barrel stands north of $100 per share.

When Cracker Barrel reported first-quarter fiscal 2024 results for the period ended October 27, the performance wasn’t great. Revenue fell almost 2% on a year-over-year basis, while the firm’s non-GAAP earnings per share came in lower than expectations. Comparable store restaurant sales dropped 0.5%, while comparable store retail sales fell 8.1% in the period. Management is focused on marketing and the guest experience, which is great, but we think the C-suite needs to turn up efforts with respect to pricing to offset headwinds. Total menu pricing increased 6.8% in the quarter (and management is targeting 4.5%-5% increases in fiscal 2024), but the executive team needs to be more aggressive on this front to catch up to peers that are charging much more for a much less desirable in-restaurant experience. Its average check, for example, is a meager ~$12-$13, which is only a few dollars more than value meals at fast-food restaurants these days.

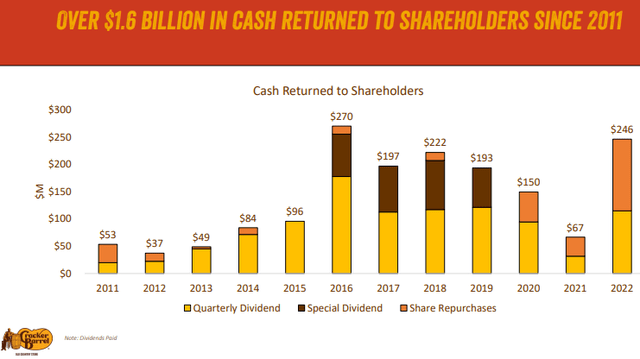

Image: Cracker Barrel remains focused on returning cash to shareholders.

In its latest quarter, GAAP operating income fell to $11.4 million, or 1.4% of total revenue, dropping by more than half from the year-ago period. Adjusted operating income fell to $19 million, or 2.3% of total revenue, from $30 million in last year’s quarter, or 3.6% of total revenue. We don’t think that the firm’s menu or retail store selections are any less desirable in a post-COVID-19 world, but the firm is having trouble retaining levels of operating income due to higher costs across the board from labor to general administrative and beyond. For fiscal 2024, the executive team is expecting commodity inflation in the low-single digits and hourly wage inflation in the mid-single digits, and these headwinds are being compounded by pressures on restaurant traffic and price-conscious guests reducing their retail purchases.

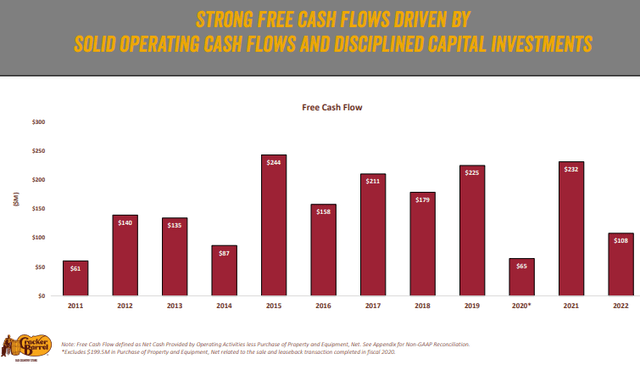

Image: Cracker Barrel has done a good job driving positive free cash flow, despite challenges in its business.

Where other restaurants may be charging an arm and a leg for a meal with a bare-bones restaurant experience, Cracker Barrel has been focused on messaging featuring an $8.99 price point for breakfast, while highlighting over 20 selections under $12 in its lunch and dinner marketing. We think Cracker Barrel has a lot of room to raise prices by as much as 30%-50% in the coming years, without losing a commensurate amount of traffic. From how we see it, unless it bites the bullet and raises prices materially, Cracker Barrel’s operations will likely continue to stagnate, and its dividend could be at incrementally greater risk. Cracker Barrel retains a net debt position with material operating lease liabilities, while free cash flow of ~$123.5 million for the twelve months ended July 28, 2023, was only marginally better than the $116 million in dividends it paid over the same period.

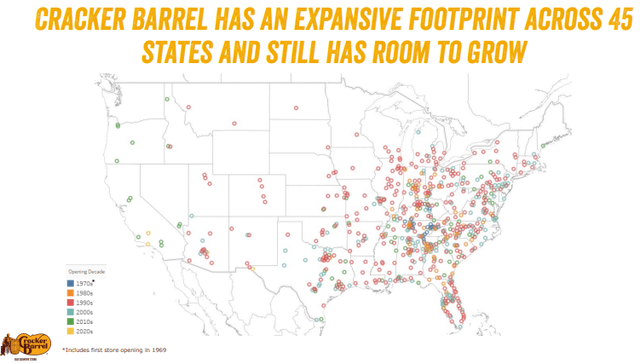

Image: Cracker Barrel’s established restaurant concept has a lot of room to grow.

We think performance at Cracker Barrel is fixable, but it has to be menu price-driven, in our view, as commodity price and hourly wage inflation continues to eat into operating income, and traffic remains troubled even with increased spend on marketing. Notwithstanding its long-term unit growth opportunities at its Cracker Barrel and Maple Street stores, Cracker Barrel’s unique concepts continue to resonate with consumers, but the firm is being left behind in a world where other restaurants are sacrificing price-conscious consumers for those less concerned about price increases. Its ~6.3% dividend yield at the time of this writing speaks of heightened risk, as does its 0.5 Dividend Cushion ratio, but if Cracker Barrel can turn things around by ratcheting up its pricing initiatives more aggressively in fiscal 2025 and beyond, the stock could end up being one of the most attractive income ideas on the market today. For now, however, we’re watching and waiting for a strategic shift.

———-

Also tickerized for holdings in the EATZ.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.