Image Source: Salesforce

By Brian Nelson, CFA

On November 29, Salesforce (CRM) reported excellent fiscal third-quarter results and issued an outlook for its fiscal fourth quarter that came in better than expectations. The Dow Jones Industrial Average component’s results were welcome news as the bellwether revealed that spending on cloud-based CRM software remains robust. In the quarter ending October 31, revenue advanced 11% on a year-over-year basis, while non-GAAP diluted earnings per share came in at a solid $2.11. Its outlook was rosier than what the Street was expecting. For the fiscal fourth quarter, the company is targeting non-GAAP earnings per share in the range of $2.25-$2.26 per share, better than the consensus forecast of $2.18. The strong quarter only increases our confidence in Salesforce’s longer-term outlook, and we plan to raise our fair value estimate of the firm upon our next report update.

Here is what CEO Marc Benioff had to say about the quarter in the press release:

“We had another strong quarter of executing on our profitable growth plan we set in motion last year, delivering $8.7 billion in revenue and again raising our operating margin guidance for this fiscal year. We’re now the third largest enterprise software company by revenue, the number one AI CRM and the number one enterprise apps company. Most importantly, we’re bringing CRM, data, AI and trust together in a single, integrated platform, leading our customers into a new era of incredible productivity and growth.”

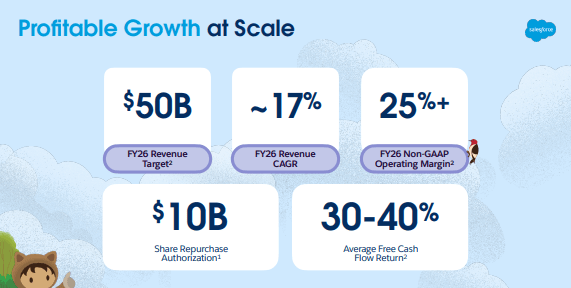

We think the growth runway at Salesforce continues to be a long one. Its total addressable market is targeted at $290 billion by calendar 2026 and is growing at a nice 13% compound annual growth rate. The company’s land-and-expand strategy generates incremental revenue across its existing customer base, while geographic expansion and multi-cloud adoption is helping performance. The company is targeting as much as $50 billion in revenue by fiscal 2026, up from expected fiscal 2024 revenue of $34.75-$34.8 billion, and as it scales its business, the firm’s operating margin should continue to expand. Salesforce ended the quarter with ~$11.9 billion in total cash and marketable securities and ~$9.4 billion in short- and long-term debt–good for a nice net cash position. For the first nine months of its fiscal year, free cash flow totaled $6.2 billion, up from $3.7 billion in the same period last year.

———-

Tickerized for CRM, ADBE, NOW, ADSK, ORCL

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.