Image: Pricing growth remains the story at McCormick, but for how long? Image Source: McCormick

By Brian Nelson, CFA

Those that know McCormick & Company (MKC) are aware of its dominance in spices and seasonings, but just how much more can the consumer pay for its products? So far so good it seems, but we have doubts consumers are going to keep paying up and up ad infinitum for its flavors. Something’s got to give eventually, and that could result in a big quarterly miss, in our view.

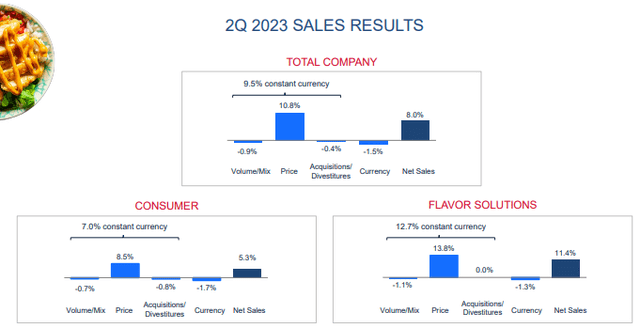

When McCormick reported second-quarter fiscal 2023 results on June 29 for the period ending May 31, 2023, all its sales growth came from pricing actions, with McCormick experiencing a 0.9% decline in volume and mix in the period. The company’s adjusted operating income surged an amazing 35% during the period thanks to the substantial pricing growth, but we think McCormick is likely pushing the limit with respect to its pricing programs, which could have implications on the long-term health of the company.

For all of fiscal 2023, McCormick reaffirmed its sales growth expectations, and the spice and seasonings maker raised its operating income and adjusted earnings per share assessment. It’s obvious almost all of McCormick’s strength and upside is being driven by pricing actions, and we’re just not sure how much more the consumer can take given competing consumer budget priorities, and especially with growing private-label competition and consumers already pushing back as evidenced by the 0.9% decline in volume and mix during the most recently reported quarter.

The current reality, however, is that price elasticities remain positive for McCormick as pricing growth continues to drive considerable operating income and adjusted earnings per share expansion. The company’s free cash flow is booming, too, with McCormick’s operating cash flow expanding to $394.2 million during the first six months of fiscal 2023 from $154.4 million during the same period a year ago. Capital spending is only up modestly over the same time period, resulting in considerable free cash flow growth. Management may be doing the right thing at the moment, but at some point, price will reach a tipping point.

Just how much further McCormick will push pricing initiatives remains to be seen, but we think investor caution is in order. The stock is already trading at 33x current fiscal year adjusted earnings, and its shares have yet to return to the peak levels reached during 2020. We wonder if there may be troubling times ahead. Our fair value estimate stands at $73 per share, well below where shares are currently trading.

Tickerized for MKC, MDLZ, GIS, HSY, BYND, HAIN, HRL, TSN, DANOY, DOLE, CAG, AVO, UTZ, LW, NAPA, COTY, OLPX, SJM, KHC, POST

NOW READ — ALERT: Big Yield Additions to Dividend Growth Newsletter Portfolio and High Yield Dividend Newsletter Portfolio

NOW READ — ALERT: Going to “Fully Invested” in the Best Ideas Newsletter Portfolio

NOW READ — Expect Huge Equity Returns This Decade, Much More Volatility However

NOW READ — There Are No Free ‘Income’ Lunches

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.