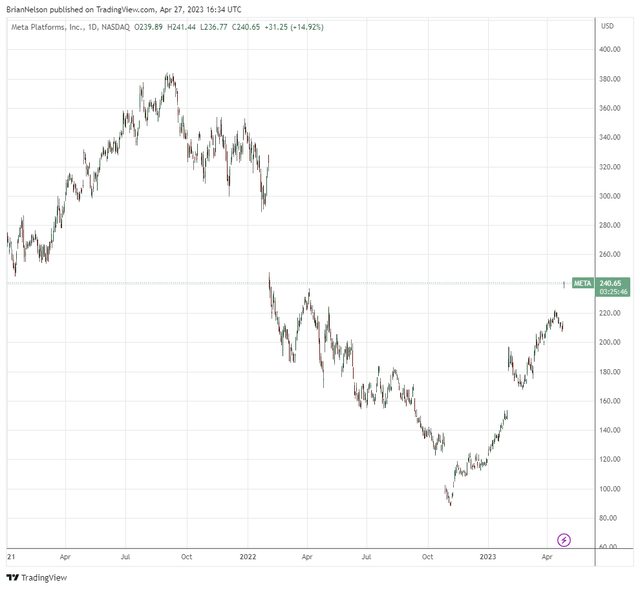

Image: Meta Platforms’ shares continue to recover from its massive fallout in 2022. We’re sticking with our $225 fair value estimate following the company’s first-quarter 2023 earnings report.

By Brian Nelson, CFA

Meta Platforms (META), formerly Facebook, has surged back to our discounted cash-flow-derived fair value estimate. Year-to-date in 2023, the social media behemoth’s shares have almost doubled, and while we are pleased with the company’s share-price comeback, we don’t envision making any material changes to our $225 per-share fair value estimate following the company’s first-quarter 2023 report, which we thought was just okay. Meta Platforms’ shares remain significantly below the $380+ highs that were reached in August 2021.

We’re happy to see the pop in Meta’s stock during the trading session April 27, but the pain of 2022 remains fresh. Meta can’t continue to cut costs forever, and while sentiment on the name has improved considerably of late (and ad revenue has ticked up), we can envision a scenario where Meta Platforms can easily get punished again. The threat of TikTok has not gone away, and most of our recent fair value increase of Meta was due to its cost-cutting initiatives, which represent low-quality earnings growth–which did not materialize during the first quarter of 2023. We also can’t rule out the view that the widely-publicized disruptions at Twitter may offer just a one-time ad revenue step-change at Meta, and this is what we’re witnessing so far during 2023.

Meta Platforms’ first-quarter 2023 results just weren’t that great either, all things considered. The social media giant’s revenue advanced only 3% on a year-over-year basis (6% on a constant-currency basis), while costs ballooned 10%, driving operating income 15% lower in the period. During the first quarter of 2023, Meta’s net income dropped 24% and diluted earnings per share fell 19% on a year-over-year basis. This was hardly a quarter to write home about in our view. The weak results, however, were better than consensus expectations, and this has investors optimistic about a sustained turnaround. After the fundamental shock of 2022 that was simply hard to explain, we remain skeptical of Meta’s business and won’t be adding it back to the newsletter portfolios.

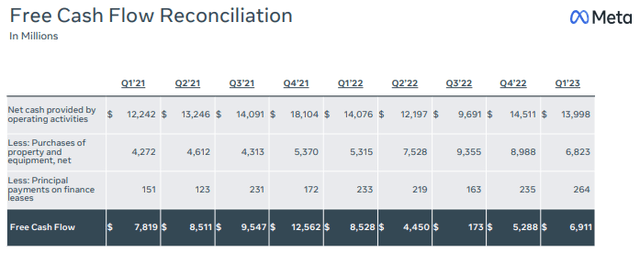

Image: Meta’s free cash flow fell on a year-over-year basis during the first quarter of 2023, but it has improved materially from the doldrums of the third quarter of 2022. Image Source: Meta Platforms

Free cash flow generation during the first quarter of 2023 at Meta, while robust, still faced some pressure as operating cash flow dropped on a year-over-year basis, while capital spending advanced. The $6.9 billion in free cash flow that Meta hauled in during the first quarter of 2023 was still notable, however. Meta’s balance sheet also remains strong. Cash and marketable securities stood at $37.44 billion at the end of March, while long-term debt was $9.92 billion. Meta continues to invest in the metaverse, but it is clear to us the executive suite is now prioritizing artificial intelligence [AI], which we believe is having a tangible, positive impact in driving higher view rates across its advertising suite, particularly Instagram. AI may help Meta better navigate Apple’s (AAPL) privacy changes, too.

Though Meta Platforms is no longer included in the newsletter portfolios, many readers know that we’ve been bullish on the areas of large cap growth and big cap tech for a long time now and that we include Alphabet (GOOG), Microsoft (MSFT), and Apple as core ideas in the newsletter portfolios. According to data from Morningstar, year-to-date and over the past year, an ETF that tracks the area of large cap growth (SCHG) has outperformed an ETF that tracks the area of small cap value (IWN) by roughly 9 percentage points. Over the past five years, the outperformance grows to more than 70 percentage points. Without a doubt, large cap growth has been the place to be, and we’ve had a courtside view of why thanks to our fundamental, cash-flow-driven analysis. We expect large cap growth to continue to lead markets, and while we’ve grown skeptical of Meta Platforms, we like that the market is viewing its first-quarter 2023 report positively.

———-

Tickerized for META, GOOG, GOOGL, SNAP, PINS, SOCL, QQQ, SCHG, IWN

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.