By Brian Nelson, CFA

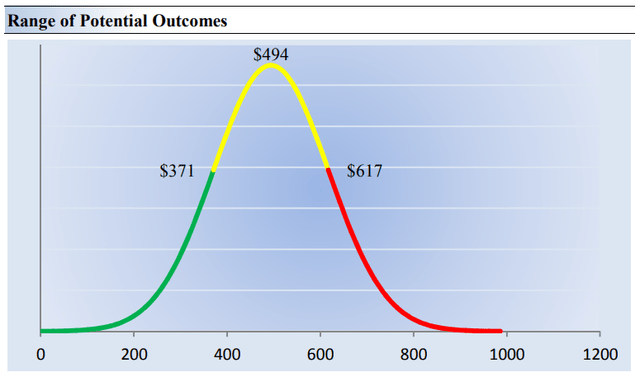

On April 14, UnitedHealth Group (UNH) reported first-quarter 2023 that beat the consensus estimates on both the top and bottom lines. Revenue advanced 14.7% in the quarter, while non-GAAP earnings per share of $6.26 beat the consensus number by $0.18, increasing from $5.49 per share in the prior-year period. The high end of the fair value estimate range of UnitedHealthGroup stands north of $600 per share, implying considerable valuation upside potential compared to where shares are trading at the time of this writing.

Image: We view valuation as a range of probable fair value outcomes. The high end of the fair value estimate range for UnitedHealth Group stands north of $600. Shares are currently trading at ~$520 each at the time of this writing.

UnitedHealth Group remains a veritable cash machine, with adjusted operating cash flow coming in at $5.13 billion in the quarter and adjusted free cash flow reaching $4.37 billion, after deducting for $760 million in capital spending during the quarter. We wrote in our January 2023 note that “we expect the firm to continue to raise its 2023 guidance through the year as momentum behind its UnitedHealthcare and Optum divisions accelerate,” and that’s just what the firm did during the first quarter of 2023.

Both its UnitedHealthcare and Optum groups experienced double-digit expansion in the first quarter of the year, and UnitedHealth Group raised its full-year 2023 outlook for net earnings to the range of $23.25-$23.75 per share and adjusted net earnings to the range of $24.50-$25 per share, the latter up from its prior target of $24.40-$24.90 per share. UnitedHealth Group continues to increase the number of people to which it offers health care services, as it expands its ability to care for them in a more holistic manner. We expect more guidance raises as the year progresses.

UnitedHealth Group continues to exhibit strong earnings quality, with adjusted operating cash flow roughly 0.9x net income in the period. Inclusive of the April Centers for Medicare and Medicaid Services (CMS) payments that it booked at the end of last month, operating cash flow was a whopping $16.3 billion in the quarter, nearly 3x net income. Looking at the balance sheet, cash and long-term investments stood at $93.4 billion, while short-term borrowings and long-term debt stood at $70.6 billion — good for a strong net cash position.

We’re huge fans of entities that generate strong free cash flow and boast a healthy net cash position on the books, and that includes UnitedHealth Group. During the first quarter of 2023, the company returned $3.5 billion to shareholders via dividends and buybacks. UnitedHealth remains one of our top dividend growth ideas, and while the company yields just ~1.3% at this time, we expect its future pace of dividend growth to be robust, especially in light of its strong potential earnings expansion that is backed by robust free cash flow generation and a net-cash-rich balance sheet. It’s simply hard not to like UnitedHealth Group.

UnitedHealth Group 16-page Stock Report (pdf) >>

UnitedHealth Group Dividend Report (pdf) >>

Tickerized for UNH, LHCG, CI, CVS, ELV, HUM, ABBV, AMGN, LLY, NVO, PFE, MRK, BIIB, XLV

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.