Image Source: UnitedHealth Group

By Brian Nelson, CFA

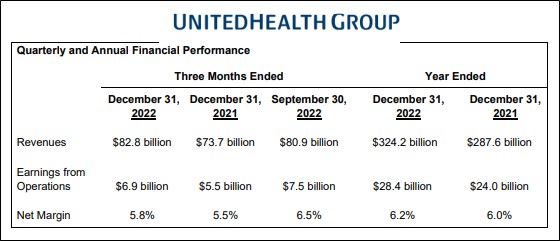

UnitedHealth Group (UNH) is a holding in the Dividend Growth Newsletter portfolio, and it completed a fantastic 2022 when it reported its fourth-quarter results, released January 13. UnitedHealth Group is a free cash flow generating powerhouse. During 2022, the company hauled in $26.2 billion in cash flow from operations and spent just $2.8 billion on property, equipment, and capitalized software, good enough for $23.4 billion in free cash flow, materially higher than the $5.99 billion it paid in cash dividends over the same time. The Dividend Cushion ratio of UnitedHealth Group is a very healthy 3.5, and our valuation puts the high end of a fair value estimate range for shares of $618 each.

During 2022, UnitedHealth Group’s revenue advanced 13%, as it experienced strong double-digit expansion at both its divisions, UnitedHealthcare and Optum. As noted previously, the firm’s cash flow generation is simply amazing, with operating cash flow coming in at 1.3x net income for the year, translating into an impressive free cash flow conversation rate. The company’s fourth quarter adjusted net earnings of $5.34 per share beat the consensus estimate by $0.17. Looking to 2023, UnitedHealth Group reaffirmed its guidance calling for revenues in the range of $357-$360 billion, adjusted net earnings of $24.40-$24.90 per share, and cash flow from operations of $27-$28 billion. 2023 is looking like another strong year for UnitedHealth Group.

At its UnitedHealthcare division, which provides health benefits to individuals and employers as well as Medicare and Medicaid beneficiaries, revenue advanced 12% during the year, as earnings from operations expanded to $14.4 billion from $12 billion in 2021, as the segment’s operating margin advanced ~0.4 percentage points, to 5.8%. At its Optum division, which is the company’s care management, pharmacy services and information and analytics segment, revenue grew 17% in 2022, while earnings from operations advanced to $14.1 billion from $12 billion last year, as its operating margin held relatively steady at 7.7%. On a consolidated basis cash and short- and long-term investments were $71.6 billion at the end of 2022, while long-term debt and short-term borrowings came in at $57.6 billion.

Very few firms have the type of free cash flow conversion as that of UnitedHealth Group, and the company’s free cash flow coverage of its cash dividends remains phenomenal, all the while its balance sheet remains as strong as ever. We expect the firm to continue to raise its 2023 guidance throughout the year as momentum behind its UnitedHealthcare and Optum divisions accelerate. The executive team remains confident that it will achieve its long-term goal of growing earnings per share in the range of 13%-16% per annum, and while that may seem aggressive, it is achievable, in our view. Healthcare spending remains a large part of U.S. GDP, and we expect overall spending on healthcare to continue to expand at a rapid clip in coming years. We continue to like UnitedHealth Group as a dividend growth idea, and its financials speak to tremendous payout support.

Tickerized for UNH, LHCG, CI, CVS, ELV, HUM, ABBV, AMGN, LLY, NVO, PFE, MRK, BIIB, XLV

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Be Careful With Celebrity Endorsement of Investment Products >>

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.