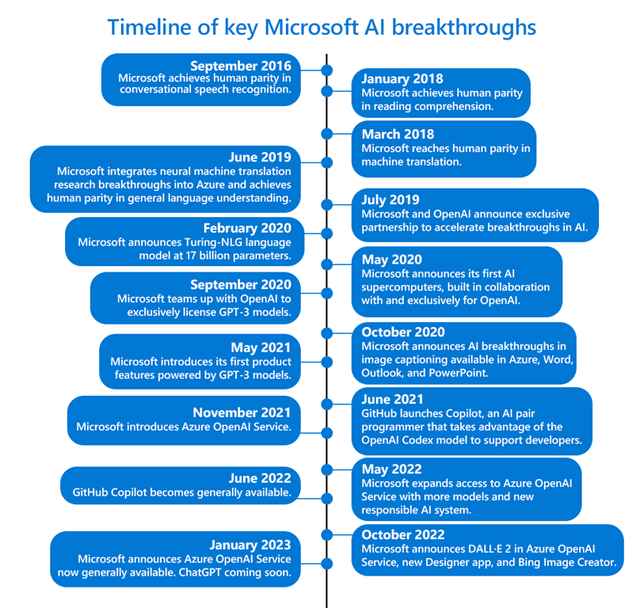

Image: Microsoft believes artificial intelligence (AI) will be the next platform wave, and the company is going full steam ahead to incorporate AI across its business systems. Image Source: Microsoft

“The age of AI is upon us and Microsoft is powering it. We are witnessing non-linear improvements in capability of foundation models, which we are making available as platforms. And as customers select their cloud providers and invest in new workloads, we are well positioned to capture that opportunity as a leader in AI. We have the most powerful AI supercomputing infrastructure in the cloud. It’s being used by customers and partners like OpenAI to train state-of-the-art models and services, including ChatGPT.” – Microsoft CEO Satya Nadella (January 24, 2023)

By Brian Nelson, CFA

On January 24, Microsoft Corp. (MSFT) reported second-quarter results for fiscal 2023 (calendar fourth quarter 2022 results) that weren’t as good as we would have liked. Revenue nudged up only 1.9% on a year-over-year basis, while second-quarter non-GAAP earnings per share was slightly better than the consensus estimate. Microsoft is trading at ~22x fiscal 2024 earnings estimates, and we think shares will be choppy for some time before the software giant regains its footing. Our fair value estimate stands at $262, and we continue to be huge fans of its dividend growth potential.

As noted, Microsoft’s fiscal second-quarter 2023 results could have been better. Non-GAAP operating income dropped 3% on a year-over-year basis, while non-GAAP net income fell 7%. Non-GAAP diluted earnings per share dropped 6% from the same period last year. On a constant-currency basis, sales in its ‘Productivity and Business Processes’ division advanced 13%, while revenue increased 24% in its ‘Intelligent Cloud’ segment. These areas experienced robust sales expansion, especially Azure and other cloud services, but its ‘More Personal Computing’ division, which includes Windows OEM and Xbox content, experienced a revenue decline of 16%.

Going forward, Microsoft will have to look to its cloud business, artificial intelligence and gaming to continue to satisfy shareholders. The software giant is investing big bucks in ChatGPT’s parent OpenAI, and we like the move, “We’re Glad Microsoft Sees Promise in ChatGPT,” as the technology may fit well within its Windows operating system, augment its search engine operations (Bing), and integrate nicely into its Azure cloud service. We were mighty impressed with ChatGPT, and we’re super excited that Microsoft has catapulted itself to become a leader in AI. Recent reports indicate that ChatGPT could charge as much as $42/month for professional access.

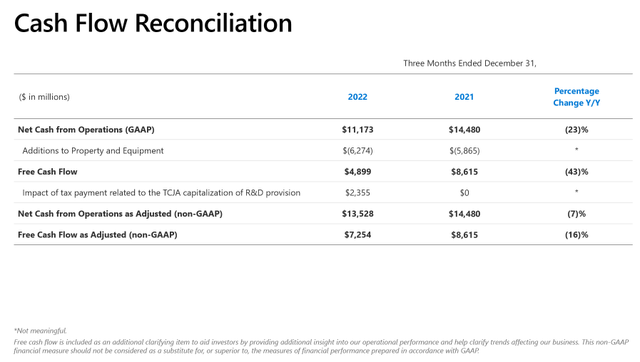

Microsoft’s free cash flow generation wasn’t as strong during the second quarter of its fiscal 2023, falling to $7.25 billion on a non-GAAP basis versus $8.62 billion in the same period a year ago. Adjusted net cash flow from operations dropped 7% in the quarter, to $13.5 billion, as lower net income, unfavorable changes in deferred income taxes and accounts payable, as well as higher capital spending weighed on the measure. Though the firm’s GAAP cash generation in the period faced pressure as a result of a one-time $2.36 billion impact related to a tax payment (TCIA capitalization of R&D provision), Microsoft remains a veritable cash-generating machine.

Image: Microsoft faced a one-time item that impacted its cash flow generation during the quarter ended December 31, 2022. Image Source: Microsoft

The software giant ended 2022 with nearly $100 billion in total cash, cash equivalents, and short-term investments versus short- and long-term debt of $48.2 billion on the balance sheet, good for a robust net cash position. Its adjusted free cash flow measure covered cash dividends 1.43x during the calendar fourth quarter, and on a GAAP basis during the first half of its fiscal 2023 (the six months ended December 31), Microsoft hauled in $21.8 billion in free cash flow, which handily covered the $9.7 billion in cash dividends paid over the same time period.

With the DOJ cracking down on Alphabet’s (GOOG) (GOOGL) search business, uncertainty regarding Microsoft’s proposed deal to buy Activision (ATVI) has never been higher, in our view. Regardless of whether that deal is consummated, however, we continue to like shares of Microsoft, even as we expect them to face some selling pressure in light of the disappointing cash flow performance during its fiscal second-quarter 2023 results and more cautious economic outlook, altogether–particularly in light of recent job cuts. Microsoft, nonetheless, remains a core idea in the simulated newsletter portfolios, and we remain big fans of its dividend health and growth prospects.

Learn More about Azure’s OpenAI Service >>

Tickerized for MSFT, ATVI, EA, CRM, ORCL, GOOG, GOOG, SNOW, MDB, NTDOY, SONY, GAMR, NERD, META, AI, SOUN, BBAI

———-

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.