Image Source: Exact Sciences

By Brian Nelson, CFA

On January 9, diagnostic testing firm Exact Sciences (EXAS) issued promising preliminary guidance for its fourth quarter of 2022. The company expects fourth-quarter 2022 revenue, excluding COVID-19 testing, to advance 28% in the quarter on a year-over-year basis (considerably higher than the consensus forecast at the time), with screening revenue jumping 45% and precision oncology revenue advancing modestly, after excluding its divestiture of Oncotype DX Genomic Prostate Score test (completed in August 2022) and foreign exchange impacts.

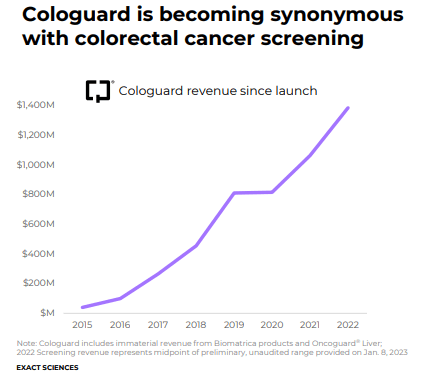

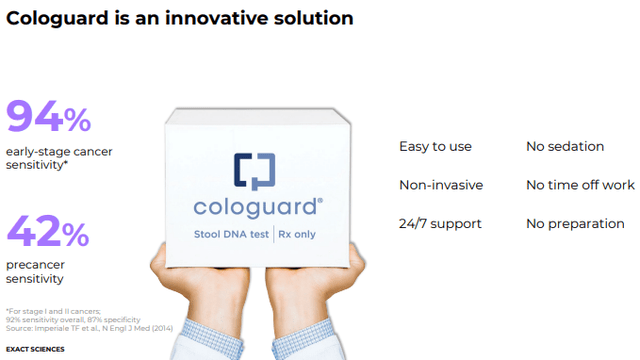

The company’s screening revenue consists of sales of its innovative Cologuard tests, which we’ll talk more about in this note, and its recently-acquired genetic testing firm PreventionGenetics, while its precision oncology division generates revenue from its Oncotype DX products as well as its therapy selection products. Exact Sciences’ flagship product is its Cologuard test, which is a stool-based DNA test that detects biomarkers that are associated with colorectal cancer and pre-cancer. Cologuard is indicated for average risk adults 45 years of age and older, a huge market of 110 million Americans.

Image Source: Exact Sciences

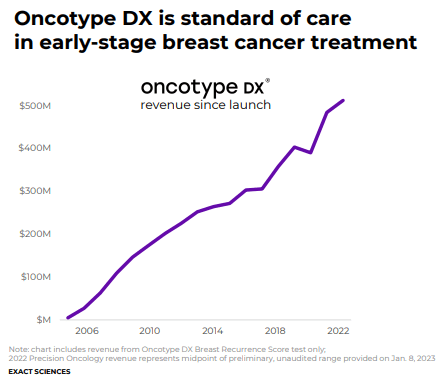

In the firm’s latest Form 10-K, Exact Sciences estimates that “at a three-year screening interval and an average revenue per test of approximately $500, (its Cologuard test) represents a potential $18 billion market.” For the twelve-month period ended December 31, 2022, the company’s total revenue is expected at ~$2.084 billion at the high end, so the firm has a long growth runway assuming competition remains at bay, which is something that cannot be guaranteed. Exact Sciences also has a suite of precision oncology tests including its main line of Oncotype DX gene expression tests for breast and colon cancers.

Image Source: Exact Sciences

Here are a couple descriptions of a two of its main tests, per its 10-K:

The Oncotype DX breast cancer test examines the activity of 21 genes in a patient’s breast tumor tissue to provide personalized information for tailoring treatment based on the biology of the patient’s individual disease. The test is supported by multiple rigorous clinical validation studies, including the landmarkTAILORx and RxPONDER studies, confirming the test’s ability to predict the likelihood of chemotherapy benefit as well as the chance of cancer recurrence in certain common types of early-stage breast cancer.

In patients with stage II and stage III colon cancer, the decision to treat with chemotherapy following surgery is based on an assessment of the likelihood of cancer recurrence and as a result, it is critical for clinicians to accurately assess a patient’s risk of recurrence. Our Oncotype DX Colon Recurrence Score test is a multi-gene test for predicting recurrence risk in patients with stage II and stage III A/B colon cancer to enable an individualized approach to treatment planning. By evaluating specific genes within a patient’s colon tumor, the test can determine the likelihood that the cancer cells will spread and cause the disease to return after surgery. Based on this information, healthcare providers and patients can make more informed treatment decisions. The Oncotype DX colon cancer test is supported by three rigorous clinical validation studies confirming the test’s ability to provide additional and independent value beyond the currently used measures for determining colon cancer recurrence risk.

When Exact Sciences released preliminary guidance January 9, the executive team noted that it now expects “adjusted EBITDA profitability (in) the fourth quarter (of) 2022 and full year 2023, ahead of (its) previous target of third quarter 2023.” The management team plans to publish full year 2022 results during its February 2023 earnings report, but net losses have been steep through the first nine months of 2022, coming in at $495.8 million versus net losses of $375 million during the same nine months a year-ago. At the end of September 2022, Exact Sciences held a massive net debt position, with long-term debt and convertible notes standing at $2.23 billion, and cash and marketable securities standing at $669.1 million.

Concluding Thoughts

Though Exact Sciences is experiencing strong top-line momentum in its business at the moment given its recent upward guidance revision for 2022, its net losses remain huge while its net debt position remains large. We also can’t forget that Exact Sciences recently lowered its full-year 2022 guidance in August, so visibility behind its operations is also somewhat limited, in our view.

That said, Exact Sciences’ stool-based Cologuard test has a massive long-term market opportunity, but competition from procedure-based detection technologies and other potential new entrants looking to develop their own stool-based colorectal cancer tests means its long-run outlook is just too murky for us to get excited about shares. Regardless, Exact Sciences’ equity has soared more than 20% to start 2023, and we’ve taken notice of the speculative pop.

Tickerized for EXAS, GH, NTRA, FLGT, DGX, MDXH, MYNZ, NVTA, ARKK, BDX, QDEL, ABT, RHHBY, RHHBF, QGEN, OSUR, LMDX, TMO, PKI, BIO, CODX, HOLX, HLTH, LH

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Be Careful With Celebrity Endorsement of Investment Products >>

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.