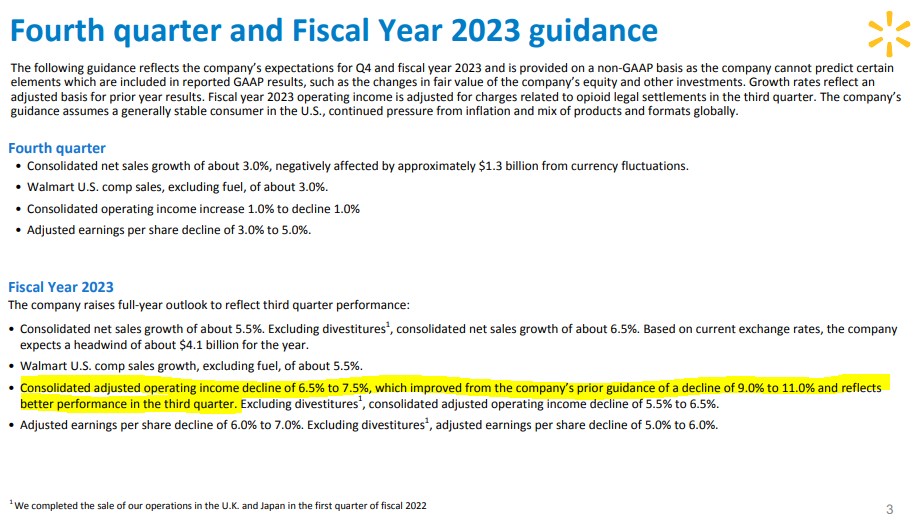

Image: Walmart’s operating income performance, while still under pressure, improved considerably during the third quarter. Image Source: Walmart

By Brian Nelson, CFA

Walmart Inc. (WMT) was the canary in the coal mine earlier this year when the company reported its first-quarter 2022 results in May that showed spending on food staples and energy (gas) was cutting into discretionary general merchandise (hardline) spending. However, market sentiment seems to be improving these days, and the firm’s third-quarter results released November 15 showed the huge big box retailer is getting back on track. Though we’re not going to be adding Walmart to any newsletter portfolio, we like what we saw in the quarterly report.

During the third quarter, Walmart’s total sales growth advanced 9.8% in constant currency as its U.S. comp sales grew 8.2%. Comps in the U.S. registered a strong two-year stack of 17.4%, impressive for a retailer of Walmart’s size. The two-year stack comp is derived by adding the percentages of the third quarter of 2022 with that of the third quarter of 2021. Walmart continues to gain share in the grocery segment, and e-commerce expansion was 16% in the period. On a two-year stack basis, e-commerce growth was 24%, a solid showing.

Comparable store sales growth at its membership warehouse Sam’s Club advanced 10% and 23.9% on a two-year stack basis, and the firm noted that Sam’s Club membership count and income reached an “all-time high.” We would expect similarly strong results to come from Costco (COST) and Target (TGT) when these firms release their quarterly reports. Walmart International also did well in the third period, with net sales advancing 7.1%, despite headwinds from the stronger dollar (UUP), which will likely continue to be a stiff headwind for most multi-nationals in the coming quarters.

From what we can tell by quarterly results, Walmart seems to have sorted out most inventory issues, and demand seems more resilient than what we might have thought earlier this year. On an adjusted basis, Walmart’s cost structure also improved. The firm noted that “adjusted operating expenses as a percentage of net sales decreased 75 basis points, primarily due to strong sales growth and lower COVID-related costs.” Adjusted operating income didn’t match the pace of the firm’s top-line expansion in the period, but it still grew 3.9%, which is great considering inflationary pressures (namely wage costs). Adjusted EPS of $1.50 per share in the quarter beat the consensus estimate by $0.18.

During the third quarter, Walmart returned $4.5 billion to shareholders, with $1.5 billion going to dividends and $3 billion going to share buybacks. The company recently announced that it has approved a new share repurchase authorization to the tune of $20 billion, a move that we’re roughly neutral on as shares trade roughly in line with our fair value estimate at the time of this writing. Year-to-date free cash flow was $3.6 billion, and Walmart raised its fiscal year 2023 guidance. The firm now only expects an operating income decline of 6.5%-7.5%, a marked improvement from prior guidance calling for a decline of 9%-11%.

The competitive environment in the grocery arena continues to ebb and flow these days, with Kroger (KR) recently announcing that it will purchase rival Albertsons (ACI) for about $25 billion. The deal would combine the second- and fourth-largest grocers in the U.S. after Walmart, so there remains questions whether anti-trust regulators will allow the deal to happen. Walmart continues to pack an effective punch with respect to its e-commerce initiatives as it continues to hold Amazon (AMZN) at bay, but we would not be surprised to see some consumers continue to trade down to Aldi, Dollar General (DG) and Dollar Tree (DLTR) in this hot inflationary environment. Walmart’s top line is holding up very well, however.

Concluding Thoughts

We had been concerned about the third-quarter performance of retail heavyweights, including Walmart, which disappointed earlier this year. However, the firm’s third-quarter results, released November 15, revealed a strong showing in comp growth across the board, an all-time high membership count in Sam’s Club, and what looks to be a management team that has gotten inventory issues under control. We’re reiterating the high end of our fair value estimate range for Walmart of $169 per share and believe its massive new $20 billion share buyback authorization will provide continued support to the stock. Market sentiment is improving.

Tickerized for WMT, COST, TGT, DG, DLTR, FIVE, OLLI, BJ, SFM, WBA, CVS, NGVC, IMKTA, MMRTF, GO, USFD, SYY, KR, ACI, MKC, CAG, CL, PG, TJX, ROST, XRT, RTH, ONLN, IBUY, XLP, UUP

———————————————

About Our Name

But how, you will ask, does one decide what [stocks are] “attractive”? Most analysts feel they must choose between two approaches customarily thought to be in opposition: “value” and “growth,”…We view that as fuzzy thinking…Growth is always a component of value [and] the very term “value investing” is redundant.

— Warren Buffett, Berkshire Hathaway annual report, 1992

At Valuentum, we take Buffett’s thoughts one step further. We think the best opportunities arise from an understanding of a variety of investing disciplines in order to identify the most attractive stocks at any given time. Valuentum therefore analyzes each stock across a wide spectrum of philosophies, from deep value through momentum investing. And a combination of the two approaches found on each side of the spectrum (value/momentum) in a name couldn’t be more representative of what our analysts do here; hence, we’re called Valuentum.

———————————————

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, BITO, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, and RSP. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.