Image Shown: Albemarle Corporation’s lithium operations have posted stellar financial performance in recent quarters and underpin the firm’s bright long-term growth outlook. Image Source: Albemarle Corporation – Second Quarter of 2022 IR Earnings Presentation

By Callum Turcan

On August 3, Albemarle Corporation (ALB) reported second quarter 2022 earnings that matched consensus top-line estimates and beat consensus bottom-line estimates. Albemarle produces lithium derivatives such as lithium carbonate and lithium hydroxide that are used to produce lithium-ion batteries. The firm also produces bromine, which is used as a fire retardant in a wide variety of products, and catalysts for the refining industry.

The company once again raised its full-year guidance for 2022 during its second quarter earnings update. Albemarle also raised its full-year guidance during its first quarter earnings report and during a business update on May 23, which we have covered previously in our June 2022 article. Albemarle is a Dividend Aristocrat that has been firing on all cylinders of late.

Lithium Update

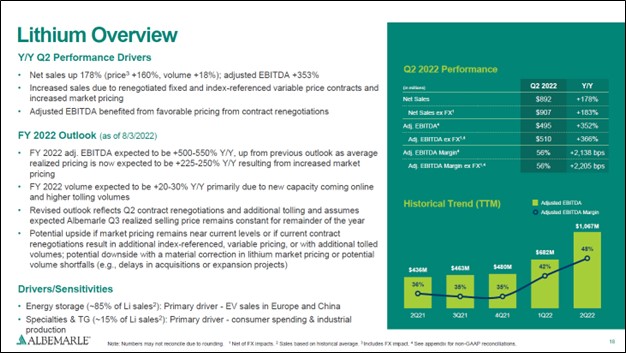

Net sales at Albemarle’s ‘Lithium’ segment were up 178% year-over-year last quarter, hitting $0.9 billion, with higher prices net of foreign currency movements for its lithium product sales driving the lion’s share of that growth. Albemarle renegotiated its lithium supply contracts in a favorable manner to enable the firm to realize pricing closer to market rates, which have been incredibly dear of late. Rising lithium sales volumes were also key due in large part to its recent expansion efforts in Chile (the Negra III/IV projects expanded Albemarle’s lithium carbonate production capacity when the third plant came online in June 2022).

Looking ahead, the recent completion of a growth development in Western Australia (the Kemerton I lithium hydroxide processing plant commenced commercial operations in July 2022), the aforementioned recently completed growth projects in Chile, and its other growth endeavors are expected to see Albemarle’s lithium production volumes swell higher over the coming years. Restarting an idled lithium mine in Australia and ramping up its lithium conversion capabilities by developing new assets and expanding existing facilities are key parts of Albemarle’s strategy here.

Image Shown: Albemarle is investing heavily in lithium conversion plants and to a lesser extent lithium mining operations. Image Source: Albemarle – Second Quarter of 2022 IR Earnings Presentation

This strong performance led to its Lithium segment’s non-GAAP adjusted EBITDA rising almost four-fold last quarter on a year-over-year basis. Within its second quarter earnings press release, Albemarle had this to say on its updated lithium outlook for 2022 (emphasis added):

Adjusted EBITDA for the full year 2022 is expected to grow approximately 500-550% year over year, up from the previous outlook of +300%. Average realized pricing is now expected to be up 225-250% year-over-year resulting from the renegotiated contracts and increased market pricing. Full-year 2022 volume is expected to be up 20-30% year over year primarily due to new capacity coming online as well as higher tolling volumes.

The revised outlook assumes the company’s expected third quarter realized selling price remains constant for the remainder of the year. There is potential upside if market pricing remains near current levels, if contract renegotiations result in additional price improvements, or with additional tolled volumes. There is potential downside in the event of a material correction in lithium market pricing or potential volume shortfalls (e.g., delays in acquisitions or expansion projects).

Albemarle’s lithium operations represent the bedrock of its business and its main long-term cash flow growth driver. Its Lithium segment is Albemarle’s largest by far in terms of its revenue and adjusted EBITDA generation. Success here will have an outsized impact on its company-wide operations, and so far, things have been progressing in the right direction.

Other Operations Update

The company’s ‘Bromine’ segment posted 35% year-over-year net sales growth last quarter, bringing its revenues up to $0.4 billion, due primarily to significant pricing increases (net of foreign currency movements) and modest volume growth. Adjusted EBITDA at Albemarle’s Bromine segment rose by 47% year-over-year last quarter. Here is what Albemarle had to say regarding the near term outlook of its Bromine segment within the firm’s latest earnings press release:

Adjusted EBITDA for the full year 2022 is expected to grow approximately 25-30% from 2021 based on higher pricing resulting from strong demand in diverse end-markets including fire safety solutions and clear completion fluids for offshore new well drilling. Successful execution of growth projects in 2021 is expected to contribute to a 5-10% volume increase in full-year 2022. Bromine’s ongoing cost savings initiatives and favorable pricing are expected to offset higher freight and raw material costs.

Pivoting to its ‘Catalysts’ segment, net sales were up 42% year-over-year to reach $0.2 billion last quarter as the global refining industry has largely recovered from the worst of the COVID-19 pandemic, which in turn has driven up demand for Albemarle’s refining catalyst offerings. Sharply higher sales volumes and moderately higher price realizations net of foreign currency movements were responsible for revenue growth at its Catalysts segment. However, this segment’s adjusted EBITDA tanked by 54% year-over-year last quarter due to onerous inflationary pressures from surging natural gas (a major input) and other raw materials pricing increases.

Albemarle is still contemplating whether to sell this part of its business and had this to say on its Catalyst segment within its latest earnings press release:

Albemarle expects full-year 2022 adjusted EBITDA to be down 25-65% year-over-year, down from the previous outlook due to continued volatility of raw materials costs and natural gas pricing in Europe related to the war in Ukraine, partially offset by higher pricing. The strategic review of the Catalysts business is ongoing. The company expects to provide an update as soon as circumstances warrant.

When market conditions “normalize” it would make sense for Albemarle to divest its refining catalysts business, in our view, as the company would benefit from greater operational focus on its remaining business segments. Diversified revenue streams can be quite useful when the broader strategy fits in well with the company’s business model. However, there is not a lot of overlap when it comes to Albemarle’s Lithium segment and its Catalysts segment. A lack of operational focus can ruin the parts of a firm’s business that are deemed to be non-core and selling off those types of assets instead of letting them flounder is the right call for all parties.

Financial Update

During the second quarter of 2022, Albemarle’s GAAP revenues skyrocketed higher 91% year-over-year to reach $1.5 billion, with sales strength seen across its three core business reporting segments. While its GAAP operating income declined during this period, please note that when removing a $0.4 billion gain on the disposition of a business in the second quarter of 2021, Albemarle’s operating income would have grown almost four-fold year-over-year last quarter due to strength at its Lithium and Bromine segments more than offsetting weakness at its Catalysts segment. The firm posted $0.4 billion in GAAP operating income in the second quarter of 2022.

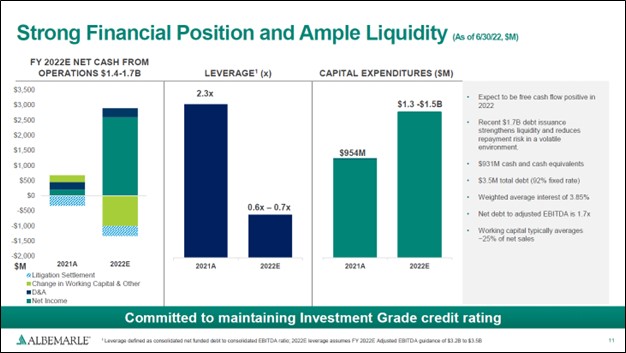

Albemarle exited June 2022 with $0.9 billion in cash and cash equivalents on hand (exclusive of long-term investments that are largely represented by strategic assets) versus $0.3 billion in short-term debt and $3.2 billion in long-term debt. In May 2022, Albemarle was able to issue long-term debt at attractive rates. We expect Albemarle will tap capital markets once again in the near to medium-term to raise funds for its lithium growth ambitions. Selling its refining catalysts business would help Albemarle raise significant amounts of cash as well.

Image Shown: Albemarle’s leverage ratios have been trending in the right direction of late and recent capital market activity indicates it should be able to tap debt and equity markets at attractive rates going forward. Image Source: Albemarle – Second Quarter of 2022 IR Earnings Presentation

While Albemarle generated negative free cash flows during the first half of 2022, the company now expects it will be free cash flow positive this year after its latest guidance increase. Please note Albemarle saw a major working capital build during the first half of 2022 which held down its net operating cash flows.

The upcoming graphic down below highlights Albemarle’s updated guidance for 2022. Again, we would like to stress that Albemarle previously expected it would generate negative free cash flows this year, and now expects to generate positive free cash flows, all while keeping its capital expenditure guidance the same.

Image Shown: Albemarle now expects to post positive free cash flows this year after its latest guidance revision. Image Source: Albemarle – Second Quarter of 2022 IR Earnings Presentation

Concluding Thoughts

We liked what we saw in Albemarle’s latest earnings report. Albemarle is betting the farm that the supply-demand dynamics will remain favorable for lithium producers. Volume growth and favorable pricing for lithium derivatives is a powerful combination that Albemarle has effectively capitalized on so far. Lithium is a major component in lithium-ion batteries which are used to power electric vehicles (‘EVs’), battery storage facilities, consumer electronics, and much more. Should EV sales continue to grow while utilities are increasingly turning to battery storage solutions to supplement their backup power options, demand for lithium should continue to grow at a robust pace as well.

Albemarle is well-positioned to capitalize on this upside, aided by its stellar operational execution. Shares of ALB yield ~0.7% as of this writing and the top end of our fair value estimate range for Albemarle sits at $309 per share.

—–

Mining & Chemicals Industry – APD, DD, EMN, ECL, LYB, PPG, BHP, FCX, NEM, RIO, VALE, WPM, AA, MLM, VMC, NUE, CSL, ALB, GGG, SHW

Tickerized for ALB, SGML, SQM, ALB, PILBF, LTHM, LAC, PLL, LIT, SLI

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on DIS, GOOG, META, MSFT, V, and VRTX and is long put options on RDFN and RKT. Newmont Corporation (NEM) is included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Albemarle Corporation (ALB) and South32 (SOUHY) are both included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.