Image Source: Lockheed Martin Corporation – Second Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

Lockheed Martin Corporation (LMT) reported earnings for the second quarter of fiscal 2022 (period ended June 26, 2022) that missed consensus top- and bottom-line estimates, largely due to delays in securing another domestic F-35 contract and supply chain hurdles. In our view, these are near term headwinds that are resolvable. Reportedly, Lockheed Martin is nearing a deal worth ~$30 billion with the US Department of Defense (‘DoD’) covering orders for around 375 F-35 aircraft. As it concerns supply chain hurdles, the resumption of normal economic activities (as the worst of the COVID-19 pandemic is put behind the world economy) should steadily allow industrial supplies and global logistics networks to catch up.

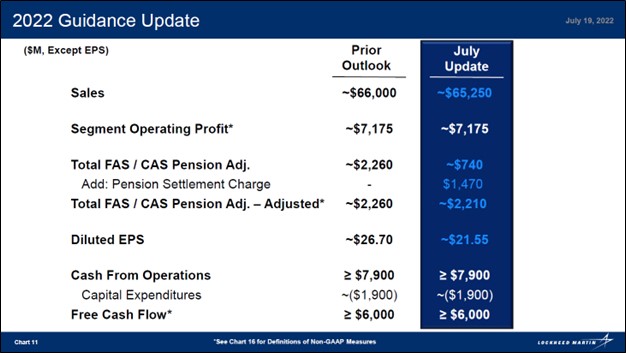

These headwinds forced Lockheed Martin to reduce its guidance for fiscal 2022 in conjunction with its latest earnings update, specifically as it concerns its revenue and diluted EPS forecasts, though the defense contractor maintained its free cash flow and ‘segment operating profit’ guidance.

We continue to like Lockheed Martin in the Dividend Growth Newsletter portfolio. The geopolitical backdrop (with an eye towards the Ukraine-Russia crisis, rising tensions between the US and China, and Western concerns with Iran and North Korea’s nuclear programs) is conducive for increased national defense spending in the U.S. and Western aligned nations across the globe. Lockheed Martin is well-positioned to meet those needs. Shares of LMT yield ~2.8% as of this writing.

Earnings Update and Guidance Revision

Lockheed Martin generated $15.4 billion in GAAP revenue (down 9% year-over-year) and $2.0 billion in GAAP operating income (down 10% year-over-year) in the fiscal second quarter. Sales declined at each of its core business reporting segments (‘Aeronautics,’ ‘Missiles and Fire Control,’ ‘Rotary and Mission Systems,’ and ‘Space’), which dragged down its operating income due to decreasing economies of scale.

In the fiscal second quarter, the firm delivered 35 F-35 aircraft (down two year-over-year), six C-130J aircraft (up six year-over-year), 25 government helicopters (up five year-over-year), and five international military helicopters (down two year-over-year). Lockheed Martin’s backlog stood at $134.6 billion at the end of the second quarter of fiscal 2022, down marginally on a sequential basis and moderately on a year-over-year basis as the company was still working on securing the aforementioned major order with the US DoD for its F-35 offerings. However, its backlog remains enormous.

During the first half of fiscal 2022, Lockheed Martin generated $2.2 billion in free cash flow and spent $1.5 billion covering its dividend obligations. We appreciate the firm’s ability to generate substantial “excess” free cash flows after covering its total payout obligations. Lockheed Martin also spent $2.4 billion buying back its stock during this period by leaning on its balance sheet to do so. At the end of the fiscal second quarter, Lockheed Martin had $1.8 billion in cash and cash equivalents on hand with no short-term debt and $11.6 billion in long-term debt on the books.

The upcoming graphic down below provides an overview of Lockheed Martin’s revised fiscal 2022 guidance versus its previous forecasts. Lockheed Martin maintained its guidance that calls for at least $6.0 billion in free cash flow in fiscal 2022 and ~$7.2 billion in segment operating profit guidance. Its diluted EPS guidance was reduced in large part due to one-time special events that we will cover in just a moment.

Image Shown: While Lockheed Martin reduced its revenue and diluted EPS guidance for fiscal 2022 during its latest earnings update, it mainlined its free cash flow and segment operating profit forecasts. Image Source: Lockheed Martin – Second Quarter of Fiscal 2022 IR Earnings Presentation

Lockheed Martin reduced its fiscal 2022 sales guidance for its Aeronautics, Missiles and Fire Control, and Rotary and Missile Systems segments while the sales guidance for its Space segment remained the same. Here is what Lockheed Martin’s management team had to say regarding its various guidance revisions during the firm’s fiscal second quarter earnings call (emphasis added, moderately edited for clarity):

“Our expectations for segment operating profit and free cash flow remain unchanged despite a lower sales outlook, reflecting solid year-to-date results and management’s focus on operating performance… The impact of lower anticipated sales volume [with management citing “supply chain impacts, award timing, and program schedule shifts” as the main culprits here] is expected to be offset by improved margins for the year, which is supported by our year-to-date margin performance.

We are lowering the earnings per share outlook by $5.15 to reflect the impact of one-time items, such as the pension transfer, debt refinancing and year-to-date mark-to-market adjustments… to the new estimate of approximately $21.55…

As I mentioned before, three of our four business areas have reduced sales outlooks, reflecting supply chain impact and award timing. But as noted, each business area is holding to the previous guidance for segment operating profit. We’re confident that we can deliver higher operating margins, offsetting the top line headwinds with our continued focus on cost reduction, program performance and leveraging the size and scale of the enterprise…

Now looking beyond 2022, the Lockheed Martin’s fundamentals remain strong. We continue to invest in support of our customers’ important security missions, leveraging the breadth of our platforms and solutions. Our broad portfolio as well as the current and projected backlog underpin our future growth expectations. In addition, the outlook for domestic and international defense spending has improved and we expect to incorporate these changes over the coming months as we gain clarity on the timing of global security spending commitments and industry fulfillment.” — Jay Malave, CFO of Lockheed Martin

Furthermore, Lockheed Martin has been playing a key role in supplying modern weapons to Ukraine via deals with the U.S. military in the wake of the Russian invasion of Ukraine in February 2022, including Javelin anti-tank missiles. Lockheed Martin’s longer term growth outlook is quite bright, in our view, and underpinned by rising geopolitical tensions. The firm’s vast portfolio caters to various national security needs, and Lockheed Martin has ample exposure to the burgeoning space economy which we covered in a September 2021 article that can be viewed here.

Concluding Thoughts

Lockheed Martin remains a stellar free cash flow generator with a manageable net debt load. Its vast backlog and the (reportedly) pending deal with the US DoD covering additional F-35 aircraft orders underpins its bright growth outlook. We continue to like Lockheed Martin in our Dividend Growth Newsletter portfolio.

—–

Industrial Leaders Industry – MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW

Tickerized for holdings in the ITA.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, META, GOOG, VRTX, and XLE and is long call options on DIS, GOOG, META, MSFT, and V. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT), and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Republic Services is included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.