Image Shown: Dividend growth idea Lockheed Martin Corporation is very shareholder friendly. The defense contractor is doing its best to arm Ukraine and other Western allies during these difficult times. Image Source: Lockheed Martin Corporation – First Quarter of Fiscal 2022 IR Earnings Presentation

By Callum Turcan

The Russian invasion of Ukraine in February 2022 and simmering geopolitical tensions in East Asia between Western aligned nations and China over Taiwan and other issues have created a backdrop that is conducive to significant increases in national defense spending. Though we hope peace prevails soon, the realities on the ground in Ukraine and elsewhere call for North Atlantic Treaty Organization (‘NATO’) member nations and other Western aligned nations to ramp up their military budgets to deter future threats and to prepare for worst case scenarios.

Geopolitical Backdrop

For example, Germany’s new administration intends to significantly increase the country’s defense budget by ramping up spending levels north of 2% of GDP after keeping such spending levels subdued over the past two decades (Germany spent an estimated ~1.5% of its GDP on its military in 2021). This represents a sea change in Germany’s national and foreign policy priorities, and the country is far from alone.

Poland is also ramping up its military expenditures. After keeping its defense budget north of 2% of its GDP in recent years, Poland aims to push that figure closer to 3% by 2023 and is working with the European Union (‘EU’) to potentially adjust budgetary rules to allow for such a move. Other Western nations that are ramping up their military budgets or intend to do so includes Belgium, France, Italy, Sweden, and Norway. This is by no means an exhaustive list.

In 2021, global military expenditures topped $2.1 trillion according to the Stockholm International Peace Research Institute (‘SIPRI’), with the five largest spenders being the US, China, India, the UK, and Russia. Defense spending by the US, UK, Japan, India, and Australia remains robust, in large part due to growing geopolitical tensions in East Asia, as military spending in China and Russia has been rising rapidly in recent years.

Lockheed Martin

Lockheed Martin Corporation (LMT) is one of our favorite defense plays, and we include shares of LMT as an idea in the Dividend Growth Newsletter portfolio. The company is the prime contractor on the F-35 jet fighter and Thermal High Altitude Area Defense (‘THAAD’) programs, with the F-35 program representing a major modernization of the Western alliance’s air capabilities and the THAAD program representing how Western allies can counter ballistic missile threats (the US government ordered another THAAD battery system in April 2022). Lockheed Martin is also a big player in the space industry across military, governmental, and commercial activities. We covered Lockheed Martin’s space upside in this article here.

The shoulder-fired anti-armor Javelin weapons system was developed by Lockheed Martin, which has been a key part of the West’s strategy of arming Ukraine to fend off the Russian invasion. Lockheed Martin is also working with Raytheon Technologies Corporation (RTX) on the shoulder-fired anti-air Stinger weapons system, another key part of the West’s strategy in arming Ukraine. Though we do not expect incremental sales of these weapons systems to be needle-moving as it concerns Lockheed Martin’s intrinsic value, we appreciate that the company is doing all it can to arm and defend Western allies.

At the end of Lockheed Martin’s first quarter of fiscal 2022 (period ended March 27, 2022), the company had a total backlog of $134.2 billion. We appreciate the significant visibility Lockheed Martin has on its future cash flow performance which underpins its high-quality cash flow profile. Additionally, Lockheed Martin’s capital expenditure expectations to maintain a given level of revenues is relatively modest, especially for a major industrial firm, better allowing the company to generate substantial free cash flows.

In the wake of the Russian invasion of Ukraine, Germany opted to order 35 F-35 jet fighters from Lockheed Martin in March 2022 as part of its €100 billion modernization program for its military. Though the US plans to order less F-35s in its fiscal 2023 budget than previously expected, various officials across multiple military branches have pushed for Congress to fund the purchase of additional F-35 jet fighters than what was officially requested. Given the geopolitical backdrop, in our view it is likely that the US will continue to invest heavily in the F-35 program to ensure that NATO member nations and other Western aligned nations have air superiority.

The US Government Accountability Office (‘GAO’) noted in a recent annual report that the F-35 program is facing hurdles due to the need to complete certain combat simulation tests and other factors. As these issues are resolved, ramping up annual production of the F-35 jet fighter will become an easier task which should result in meaningful economies of scale for Lockheed Martin along with providing the firm’s revenue performance with a powerful tailwind. The company delivered 26 F-35 aircraft last fiscal quarter.

When Lockheed Martin reported fiscal first quarter earnings on April 19, the defense giant missed consensus top-line estimates and beat consensus bottom-line estimates. Its GAAP revenues declined by 8% year-over-year and its GAAP diluted EPS dropped by 2% year-over-year as supply chain hurdles took their toll. Management noted during the company’s latest earnings call that Lockheed Martin’s revenue performance last fiscal quarter faced headwinds from supply chain hurdles arising from the Omicron variant of the coronavirus (‘COVID-19’) pandemic. However, these are expected to be short-term issues that the firm can overcome, and Lockheed Martin reaffirmed its full year guidance for fiscal 2022.

Here is what management had to say on the state of the F-35 program during the company’s latest earnings call (emphasis added):

“Turning to the F-35 program. Germany recently announced their intent to procure 35 aircraft. Lockheed Martin will support our U.S. government Joint Program Office in this process, as we look to partner with Germany to provide this unique capacity and capability for its national defense.

The government of Canada has also announced it will enter into the finalization phase of their procurement process with the United States government and Lockheed Martin to purchase 88 F-35 fighter jets for the Royal Canadian Air Force. Canada is one of the original eight partner countries on the F-35 program, and we’re very pleased to have the opportunity to provide this unrivaled plane to strengthen Canada’s national defense.

The German and Canadian announcements followed similar award decisions last year from Switzerland and Finland. And these four competitive wins have the potential to add 223 F-35s to our backlog when all are finalized. All four of these recent announcements underscore that the F-35 fighter jet remains the most capable, survivable and highly connected platform in production as well as the best value available today for our war fighters.” — Jim Taiclet, President, Chairman, and CEO of Lockheed Martin

Furthermore, on the subject of F-35 orders to the US coming in below expectations for fiscal 2023, Lockheed Martin remained optimistic that a combination of incremental orders from the unfunded priority list from US military branches along with increased international demand would keep the firm’s growth runway intact. Demand for Lockheed Martin’s other offerings including Black Hawk helicopters, C-130J transport aircraft, Sikorsky CH-53K helicopters, and various satellite and missile systems remains strong (particularly from the US government).

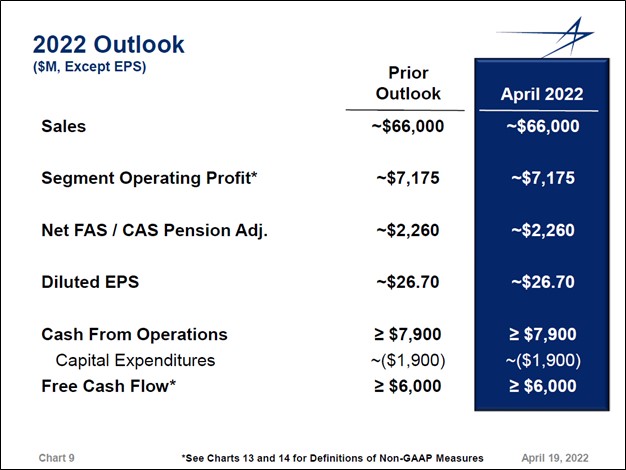

In fiscal 2022, Lockheed Martin aims to generate at least $6.0 billion in free cash flow, which we appreciate (its run-rate dividend obligations stood at $2.9 billion in fiscal 2021). The company’s sales are expected to decline by less than 2% this fiscal year versus fiscal 2021 levels, though its diluted EPS is expected to grow over 17% year-over-year during this period. Though supply chain hurdles are posing significant headwinds, its operations stand to benefit as most of the world puts the worst of the COVID-19 pandemic behind it. Additionally, Lockheed Martin is somewhat insulated from inflationary pressures due to the nature of its contracts with government entities across the Western world.

Image Shown: Lockheed Martin expects to remain a free cash flow cow in fiscal 2022. Image Source: Lockheed Martin – First Quarter of Fiscal 2022 IR Earnings Presentation

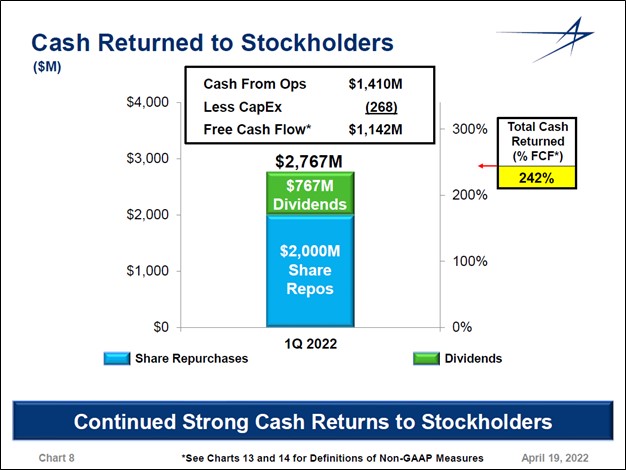

During the fiscal first quarter, Lockheed Martin generated $1.1 billion in free cash flow and spent $0.8 billion covering its dividend obligations along with another $2.0 billion buying back its stock. Its share repurchases were largely funded by its balance sheet. Lockheed Martin exited the fiscal first quarter with a net debt load of $9.8 billion (inclusive of short-term debt), with $1.8 billion in cash and cash equivalents at the end of this period offering the firm ample liquidity to meet its near term funding needs. We appreciate Lockheed Martin’s ability to generate substantial free cash flows in almost any environment, though we would like to see its net debt load get pared down over time.

As an aside, Lockheed Martin terminated its agreement to acquire Aerojet Rocketdyne Holdings Inc (AJRD) in February 2022 after the US Federal Trade Commission (‘FTC’) moved to block the acquisition. The ~$4.4 billion all-cash deal was first announced back in December 2020, and while there were plenty of potential synergies that could have been generated by joining forces, Lockheed Martin is not looking back and neither are we.

Concluding Thoughts

In light of simmering geopolitical tensions around the world, which have boiled over to a full-blown conflict in Eastern Europe, we think it is prudent for investors to have a meaningful amount of exposure to defense contractors. Lockheed Martin is a rock-solid enterprise that is incredibly free cash flow positive and shareholder friendly. Its portfolio includes some of the most cutting edge military hardware around, equipment that is essential to safeguarding national sovereignty in the 21st Century.

We are big fans of Lockheed Martin and appreciate the company’s efforts during these difficult times. Shares of LMT yield ~2.5% as of this writing and there is ample room for Lockheed Martin to push through sizable dividend increases going forward. Shares of LMT on a price-only basis are up ~24% year-to-date as of this writing. We hope peace prevails in Ukraine soon, and to quote a former US president, one of the ways to accomplish that goal is peace through strength.

—–

Industrial Leaders Industry – MMM, DHR, GE, HON, BA, GD, LMT, NOC, RTX, WM, RSG, CAT, CNHI, DE, CNI, CSX, UNP, FDX, UPS, FAST, APH, GLW, TEL, ETN, DOV, ITW, SWK, EMR, ROP, PNR, PH, AOS, EXPD, GWW

Tickerized for holdings in the ITA. Also EWG, EWGS, EPOL, RSX, ERUS, SPY, DIA, QQQ, TQQQ, IWM, IWN.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan owns shares of DIS, FB, GOOG, VRTX, and XLE and is long call options on DIS and FB. Honeywell International Inc (HON), Lockheed Martin Corporation (LMT) and Republic Services Inc (RSG) are all included in Valuentum’s simulated Dividend Growth Newsletter portfolio. Republic Services is included in Valuentum’s simulated ESG Newsletter portfolio. Some of the other companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.